Sub-Saharan Africa has secured its position as the world’s third-fastest growing cryptocurrency market, surpassed only by Asia-Pacific and Latin America, according to comprehensive research from blockchain analytics firm Chainalysis.

The region’s remarkable growth trajectory highlights the increasing role of digital assets in addressing financial inclusion challenges across the continent.

Despite maintaining its status as the globally smallest crypto economy by volume, Sub-Saharan Africa’s unique adoption patterns and grassroots cryptocurrency usage provide compelling insights into how digital assets are becoming integral to everyday financial activities in emerging markets.

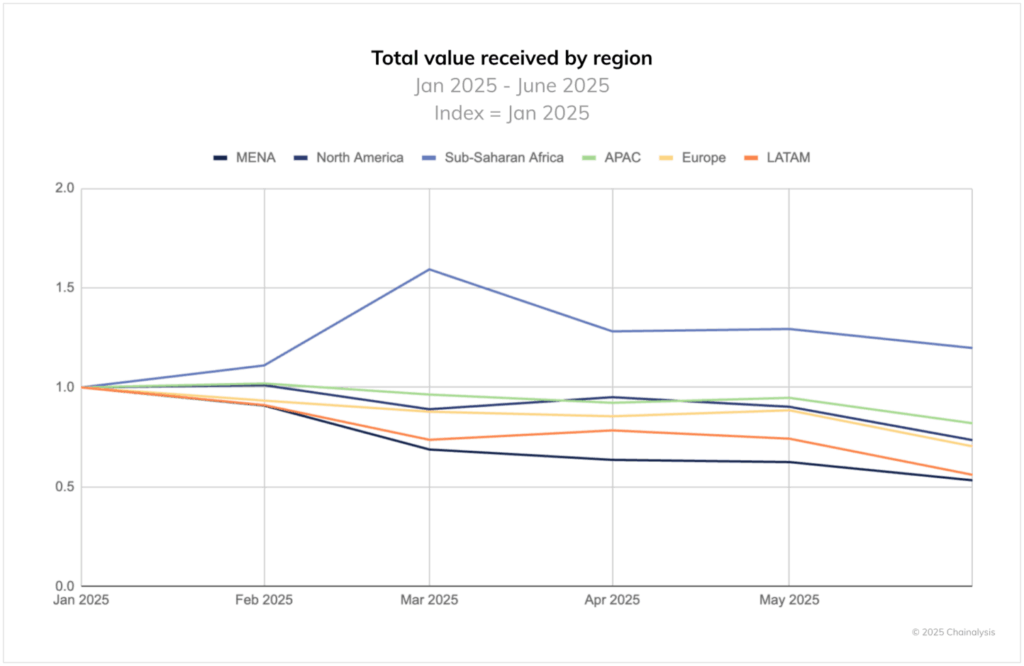

Dramatic Volume Surge Defies Global Trends

The region experienced an unprecedented surge in cryptocurrency activity during March 2025, with monthly on-chain volume skyrocketing to nearly $25 billion. This dramatic increase occurred while most other global regions witnessed declining activity, positioning Sub-Saharan Africa as a standout performer in the global cryptocurrency landscape.

The surge was primarily attributed to intensified centralized exchange activity in Nigeria, triggered by sudden currency devaluation pressures that drove investors toward cryptocurrency alternatives. This pattern demonstrates how macroeconomic instability continues to fuel cryptocurrency adoption across African markets.

Between July 2024 and June 2025, Sub-Saharan Africa received over $205 billion in total on-chain value, representing a substantial 52% increase from the previous year. This growth rate significantly outpaces many developed markets and underscores the region’s emerging importance in the global cryptocurrency ecosystem.

Retail Adoption Drives Regional Growth

Analysis of transaction patterns reveals Sub-Saharan Africa’s emergence as a critical retail cryptocurrency market, with distinctive characteristics that differentiate it from other global regions. The region demonstrates a notably higher proportion of smaller-value transactions, indicating widespread grassroots adoption among individual users rather than institutional players.

More than 8% of all cryptocurrency value transferred within Sub-Saharan Africa during the analyzed period involved transactions under $10,000, compared to just 6% globally. This trend strongly indicates cryptocurrency’s growing role in addressing financial inclusion challenges, particularly in communities where traditional banking infrastructure remains limited or inaccessible.

The prevalence of smaller transactions reflects cryptocurrency’s practical utility for everyday financial needs, including remittances, savings, and local commerce. This usage pattern suggests that digital assets are filling genuine gaps in the regional financial ecosystem rather than serving purely speculative purposes.

Financial Inclusion Through Digital Assets

Despite significant progress in mobile money adoption across Sub-Saharan Africa, substantial portions of the adult population remain unbanked, creating ideal conditions for alternative financial technologies like cryptocurrencies to flourish. Traditional banking limitations, including high fees, limited geographic reach, and complex requirements, have opened opportunities for cryptocurrency solutions.

Nigeria and South Africa, the region’s two largest cryptocurrency markets, have demonstrated substantial institutional activity driven by growing business-to-business sectors focused on facilitating cross-border payments. These developments suggest maturation beyond retail adoption toward more sophisticated commercial applications.

The institutional engagement in these markets reflects growing recognition of cryptocurrency’s utility for business operations, particularly in international trade and cross-border transactions where traditional banking systems often prove inadequate or expensive.

Stablecoins Enable Cross-Border Trade

Detailed analysis of on-chain transaction flows reveals the pivotal role of stablecoins in facilitating high-value transactions connected to trade flows between Africa, the Middle East, and Asia. Regular multi-million-dollar stablecoin transfers have been observed, supporting critical sectors including energy and merchant payments.

This usage pattern demonstrates cryptocurrency’s practical utility as a settlement infrastructure, particularly valuable in regions where traditional financial systems operate slowly or remain inaccessible for international transactions. Stablecoins provide the price stability necessary for commercial applications while maintaining the speed and accessibility advantages of blockchain technology.

The prevalence of stablecoin usage for trade finance indicates sophisticated understanding of different cryptocurrency applications, with businesses strategically selecting appropriate digital assets for specific use cases rather than adopting cryptocurrency indiscriminately.

Nigeria Maintains Market Leadership

At the country level, Nigeria continues to dominate Sub-Saharan Africa’s cryptocurrency landscape, receiving over $92.1 billion in cryptocurrency value during the 12-month analysis period. This volume represents nearly three times the amount received by South Africa, which secured second place in regional rankings.

Ethiopia, Kenya, and Ghana completed the top five cryptocurrency markets by volume, demonstrating the breadth of adoption across the continent. Nigeria’s continued dominance stems from its large, technology-savvy youth population combined with persistent economic challenges including high inflation rates and restricted foreign currency access.

These macroeconomic pressures have made stablecoins increasingly attractive as financial alternatives, providing Nigerians with access to stable value storage and international transaction capabilities that traditional banking systems struggle to provide effectively.

South Africa Leads Regulatory Development

South Africa has distinguished itself through advanced regulatory frameworks that have fostered a more institutionalized cryptocurrency market environment. The country currently hosts hundreds of licensed virtual asset service providers, demonstrating the positive impact of regulatory clarity on market development.

This regulatory maturity has provided the legal certainty necessary for institutional players to engage confidently in cryptocurrency markets, resulting in substantial large-scale transaction volumes often connected to sophisticated trading strategies including arbitrage opportunities.

Financial institutions in South Africa are progressing beyond exploratory phases into active cryptocurrency product development, including crypto custody solutions and stablecoin issuance services. Major banks like Absa are reportedly in advanced stages of creating institutional cryptocurrency products.

This institutional engagement positions South Africa as a regional leader in cryptocurrency infrastructure development and regulatory compliance maturity, potentially serving as a model for other African markets seeking to develop their own cryptocurrency frameworks.

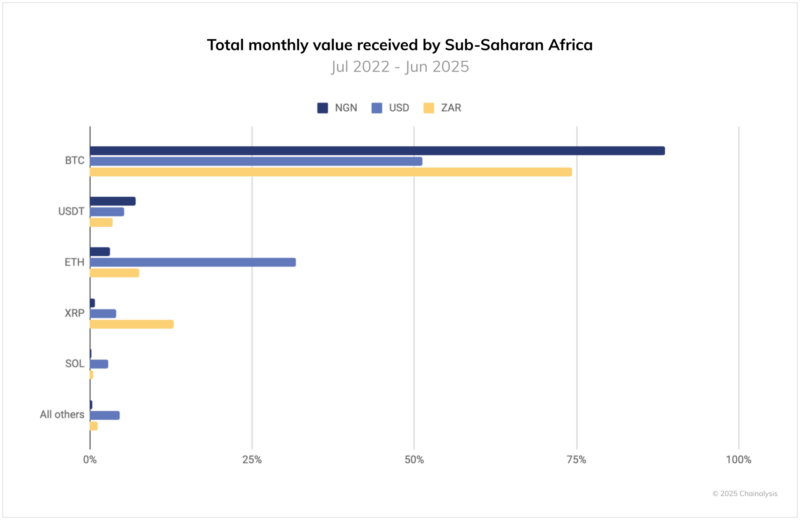

Bitcoin Dominates Fiat Purchases

Among cryptocurrency purchases using fiat currencies in Sub-Saharan Africa, Bitcoin maintains overwhelming dominance, accounting for 89% of purchases in Nigeria and 74% in South Africa. These percentages significantly exceed the 51% Bitcoin share observed in USD-denominated markets globally.

These statistics suggest that Bitcoin is perceived not only as a store of value but also as the default entry point for cryptocurrency exposure in Sub-Saharan Africa, particularly in economies experiencing fiat currency volatility and limited access to traditional investment options.

In Nigeria specifically, where USD access remains tightly controlled by government policies and inflation rates continue climbing, Bitcoin has become widely recognized as an effective hedge against inflation and an alternative savings mechanism for preserving purchasing power.

Market Outlook and Future Implications

Sub-Saharan Africa’s cryptocurrency ecosystem continues evolving rapidly, driven by a combination of grassroots retail adoption, increasing institutional engagement, and persistent macroeconomic pressures that make digital assets attractive alternatives to traditional financial systems.

The region’s growth trajectory suggests cryptocurrency adoption will likely accelerate as infrastructure develops, regulatory frameworks mature, and economic pressures continue driving demand for alternative financial solutions. Nigeria’s volume leadership combined with South Africa’s regulatory advancement creates a strong foundation for continued regional growth.

With stablecoins playing increasingly important roles in trade and cross-border payments, and Bitcoin maintaining its status as a trusted hedge against inflation, Sub-Saharan Africa’s cryptocurrency landscape appears positioned to play an even more significant role in shaping the future of finance across the continent.

The combination of practical utility, regulatory progress, and growing institutional adoption suggests that Sub-Saharan Africa’s cryptocurrency market may continue outpacing global growth rates as digital assets become increasingly integrated into the region’s financial infrastructure.

Read also Lisk Executive: African Web3 Startups are Solving Real Problems