OTC trading and stablecoins emerge as Africa’s quiet FX revolution

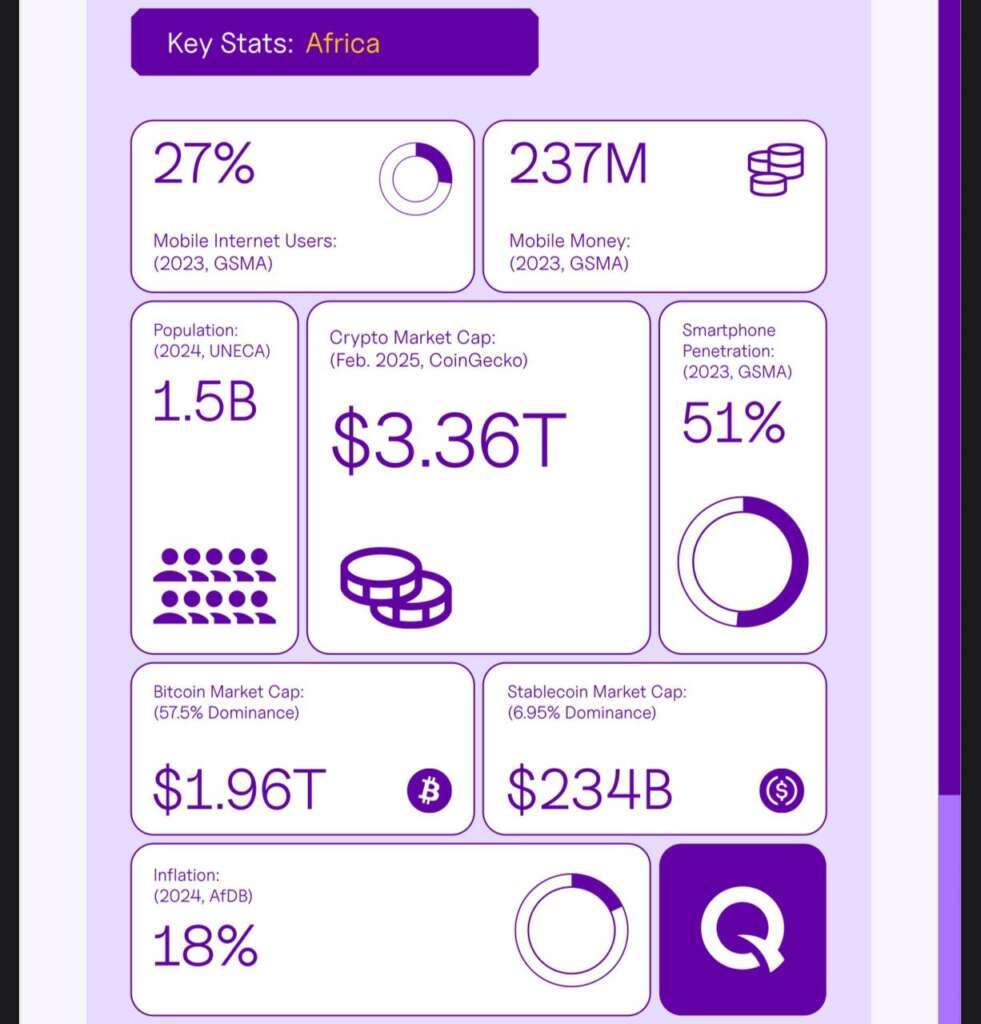

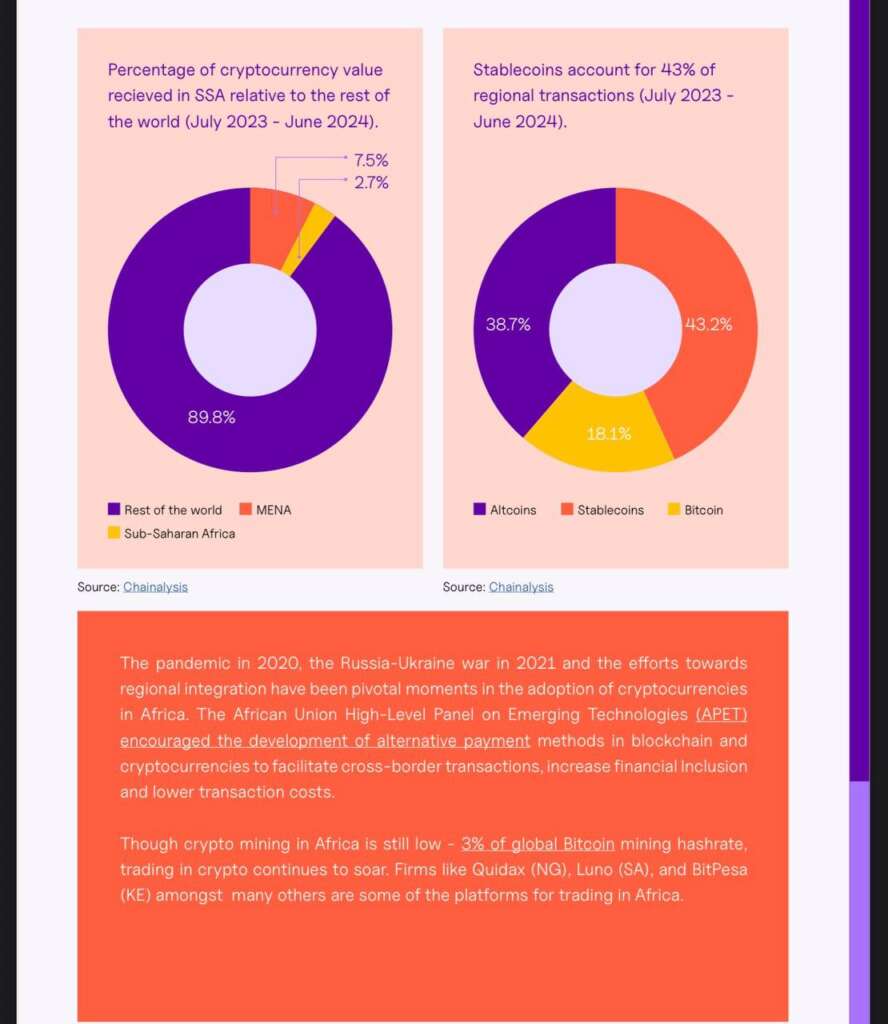

Sub-Saharan Africa’s cryptocurrency economy is undergoing a structural shift. According to a new report by Quidax, stablecoins now account for 43% of all crypto transactions in the region, transforming from a niche hedging tool into the backbone of African cross-border trade.

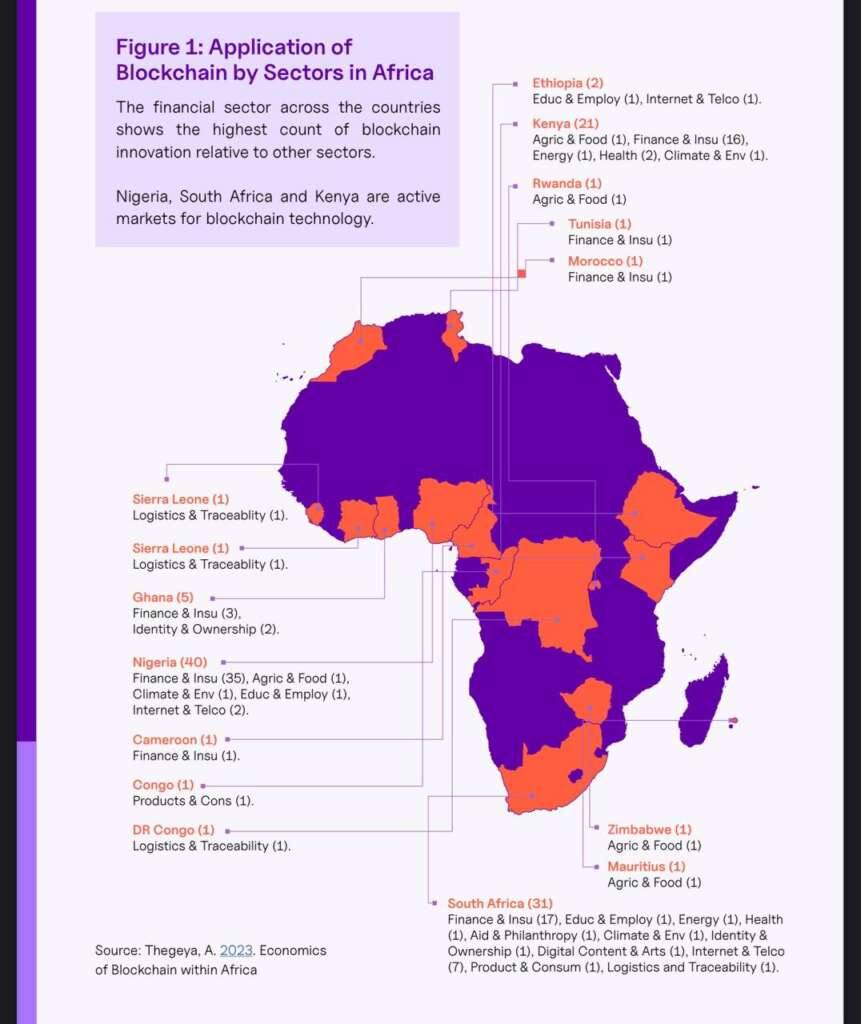

With Nigeria, South Africa, and Ethiopia leading the charge, this surge reflects a maturing digital finance ecosystem where over-the-counter (OTC) crypto trading and stablecoins are making transactions faster, cheaper, and more compliant than traditional banking.

From Speculation to Settlement

Africa’s early crypto adoption was driven largely by retail investors seeking to protect savings against inflation, currency devaluation, and capital controls. But today, the continent’s blockchain use cases extend far beyond speculation.

The Quidax report, The Rise of OTC and Stablecoins, Africa’s Quiet FX Revolution, reveals:

- Global OTC volumes rose 106% year-on-year in 2024

- Stablecoin activity grew 147% during the same period

- Nigeria alone accounted for over 40% of all SSA stablecoin inflows last year

OTC trading, where deals happen directly between parties rather than on public exchanges, offers African businesses crucial advantages:

- FX Stability: Locking in exchange rates using USDT/USDC

- Lower Slippage: Preventing large trades from moving market prices

- Faster Cross-Border Payments: Converting from sender’s fiat to recipient’s fiat in minutes

- Compliance: Licensed OTC desks meet KYC/AML standards under Nigeria SEC, South Africa FSCA, and other regulators

Some African corporates have reportedly cut settlement times from five days to minutes while reducing FX transaction costs by up to 2%.

Why Stablecoins Are Winning in Africa

Stablecoins, pegged to stable assets like the US dollar, now dominate crypto transaction volume in much of Sub-Saharan Africa, even surpassing Bitcoin in some countries.

Their appeal is straightforward:

- Price stability in volatile FX markets

- Instant settlement across borders

- Blockchain transparency for auditing and compliance

In Ethiopia, retail stablecoin transfers have more than doubled in the past year, while Zambia’s market is also growing at over 100% annually.

Businesses are using stablecoins to:

- Pay suppliers abroad without costly wire transfers

- Hedge against currency depreciation

- Avoid delays and fees from correspondent banking networks

Regulators Move from Ban to Engagement

The policy environment is also shifting.

- Nigeria introduced a crypto licensing regime in 2024, enabling exchanges like Quidax to operate under SEC oversight.

- South Africa’s FSCA issued dozens of crypto licenses, allowing compliant OTC services.

- Kenya is finalizing a Virtual Asset Service Provider (VASP) bill.

Quidax’s dual licensing in Canada and Nigeria positions it as a bridge for global corporates seeking regulatory clarity when settling into African markets.

The Road Ahead: Programmable Finance

Quidax predicts that within a few years:

- Stablecoin and OTC rails will integrate seamlessly into ERP systems, fintech apps, and AfCFTA trade platforms

- Programmable stablecoins will automate corporate payments

- CBDCs and stablecoin-pegged local currencies could reduce Africa’s reliance on USD for trade

Buchi Okoro, CEO of Quidax, summed it up:

“OTC desks in Africa will soon adopt more standardized practices, better risk management, and stronger compliance, while powering faster, cheaper trade flows across the continent.”

Africa’s FX revolution is already here. Stablecoins and OTC trading aren’t just fintech buzzwords, they’re becoming the invisible financial rails for trade, investment, and financial inclusion across the continent.