The National Bank of Rwanda (BNR) has officially advanced its Central Bank Digital Currency (CBDC) initiative from the research phase to a proof-of-concept (PoC) stage, signaling a major step toward the possible launch of a digital Rwandan Franc.

This is coming after Rwanda’s Central Bank Admits Crypto Is Here to Stay, Plans for 2025 Regulations

This development coincides with the launch of a national retail CBDC ideathon, inviting fintechs, startups, developers, and citizens to contribute ideas and use cases for a potential e-Franc-Rwandais.

CBDC Proof-of-Concept Begins: Real-World Testing Underway

BNR has initiated a closed-loop PoC involving a controlled group of participants including commercial bank staff, merchants, and select institutions. Over a five-month period (August–October 2025), this phase will test core features such as:

- Offline transaction capabilities

- USSD access for feature phones

- Cybersecurity resilience

- Legal and regulatory compliance

According to the central bank, this phase is essential to evaluate technical feasibility and user experience before advancing to live pilots or broader public deployment.

“The PoC aims to test foundational design features suggested by the research phase , including legal, cybersecurity, and payment system implications. It will inform our decision for future pilots or a differentiated rollout strategy,” stated BNR in its official release.

BDC Ideathon: Open Call for Innovation

In tandem with the PoC, BNR has launched a Retail CBDC Ideathon, encouraging collaboration from the private sector, developers, and the general public. This initiative aims to identify high-impact use cases tailored to Rwanda’s economic realities, from rural financial inclusion to modern remittance flows.

“CBDC isn’t just a digital currency. It’s an innovation platform,” BNR emphasized via its official Twitter page.

Interested participants can register and submit proposals via the central bank’s official portal.

4 Strategic Objectives of Rwanda’s CBDC

From its feasibility studies and ongoing consultations, BNR has identified four “sweet spots” for a retail CBDC:

- Resilience During Outages

Offline payment support ensures access during power or network disruptions, crucial for rural areas. - Stimulating Innovation & Competition

A CBDC could lower transaction costs and break the duopoly of mobile money, creating room for new entrants. - Reducing Cash Handling Costs

Digitizing payments could reduce costs related to printing, storage, and transport of physical currency. - Enhancing Remittance Systems

Cross-border corridors such as Rwanda–Tanzania stand to benefit from faster, cheaper, and more transparent remittance flows.

How Rwanda Got Here: From Research to Real-World Testing

BNR began exploring a CBDC in early 2022, conducting detailed assessments on:

- Economic impact

- Functional use cases

- Legal and regulatory fit

- Public sentiment and readiness

In mid-2024, the bank invited the public to provide feedback via surveys, reflecting a consultative approach that prioritized transparency and inclusion.

Since then, the momentum has only grown, aligning with Rwanda’s broader goal of building a modern, cash-lite financial ecosystem.

“As digital transformation accelerates across Africa, a CBDC offers a safe, accessible, and inclusive alternative,” BNR noted.

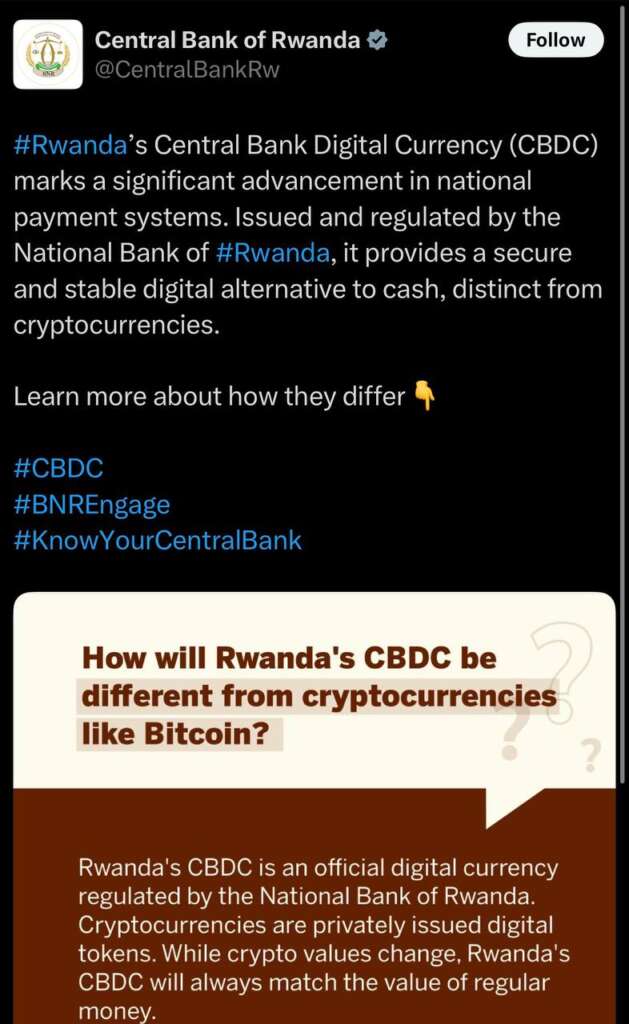

CBDC vs. Cryptocurrency: What’s the Difference?

BNR continues to emphasize that its digital currency project is not a cryptocurrency. Unlike Bitcoin or Ethereum, a CBDC is legal tender, backed by the central bank, non-speculative, and designed for stability and mass adoption.

It will complement, not replace, existing payment methods like cash, cards, or mobile money.

What’s Next?

With PoC results expected in October 2025, Rwanda is positioning itself to become one of the leading African nations in the CBDC race, joining the likes of Nigeria (eNaira) and Ghana (eCedi).

If successful, a broader pilot or phased rollout could follow in 2026, firmly embedding the e-Franc into Rwanda’s digital financial landscape.

Stay Updated

Subscribe to TawkCrypto’s Weekly Roundup to get the latest African crypto news, regulatory updates, and innovation stories delivered straight to your inbox.