If you’ve been watching Bitcoin’s price action over the past few weeks and wondering why it feels more like holding a Nasdaq-listed software startup than a safe-haven asset, you’re not imagining things. Bitcoin has been moving almost in lockstep with high-growth tech equities, and the latest sell-off has forced a serious conversation about what Bitcoin actually is as an investment.

Let’s break it all down.

Bitcoin Hit $60,000, And the Culprit Might Surprise You

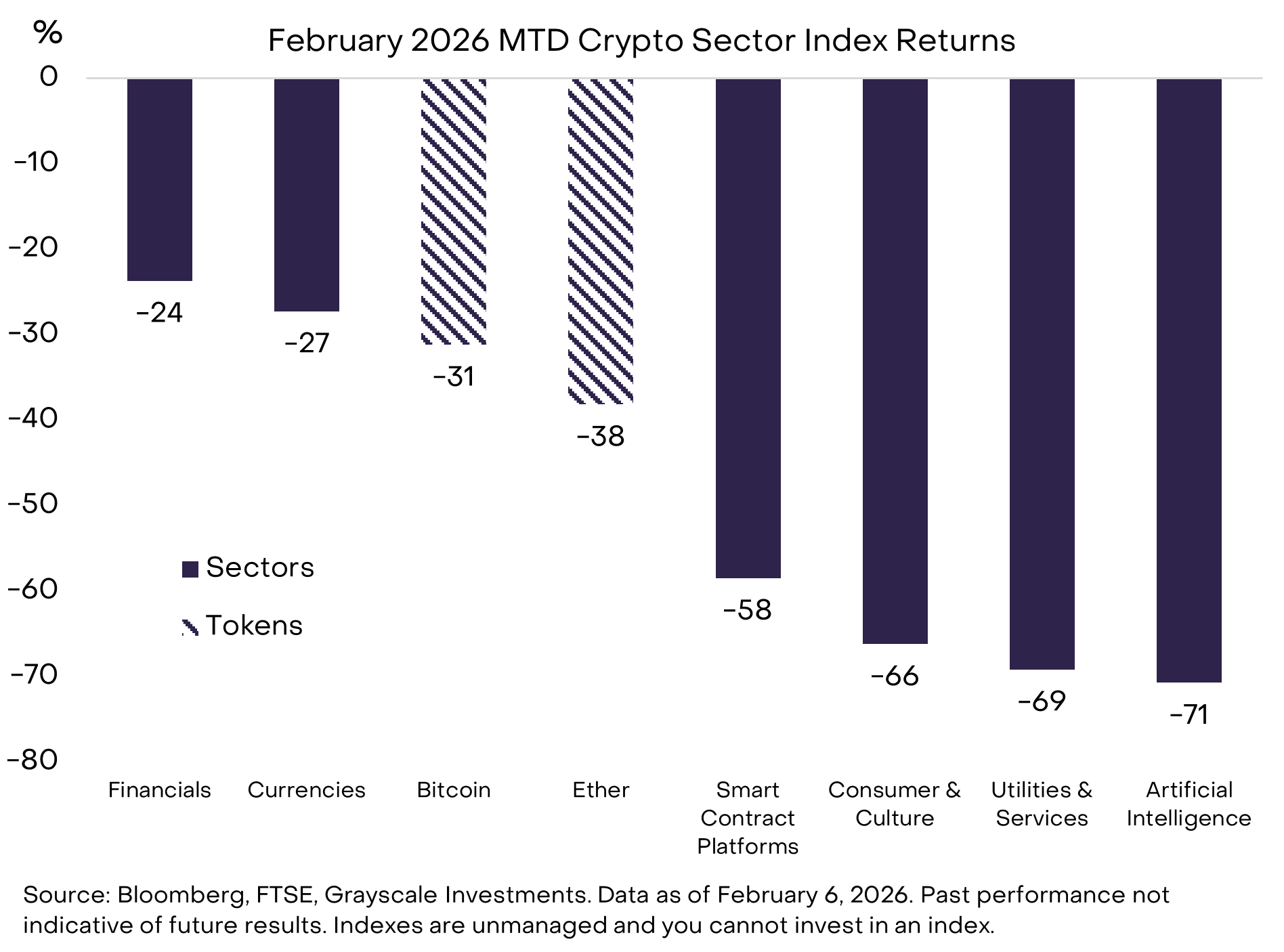

On February 5, Bitcoin touched a local low of around $60,000, marking a peak-to-trough drawdown of more than 50% from its recent highs. The drop wasn’t isolated to Bitcoin either. Across the board, crypto sectors took a beating, with some altcoin segments falling 65% to 70% in a single month.

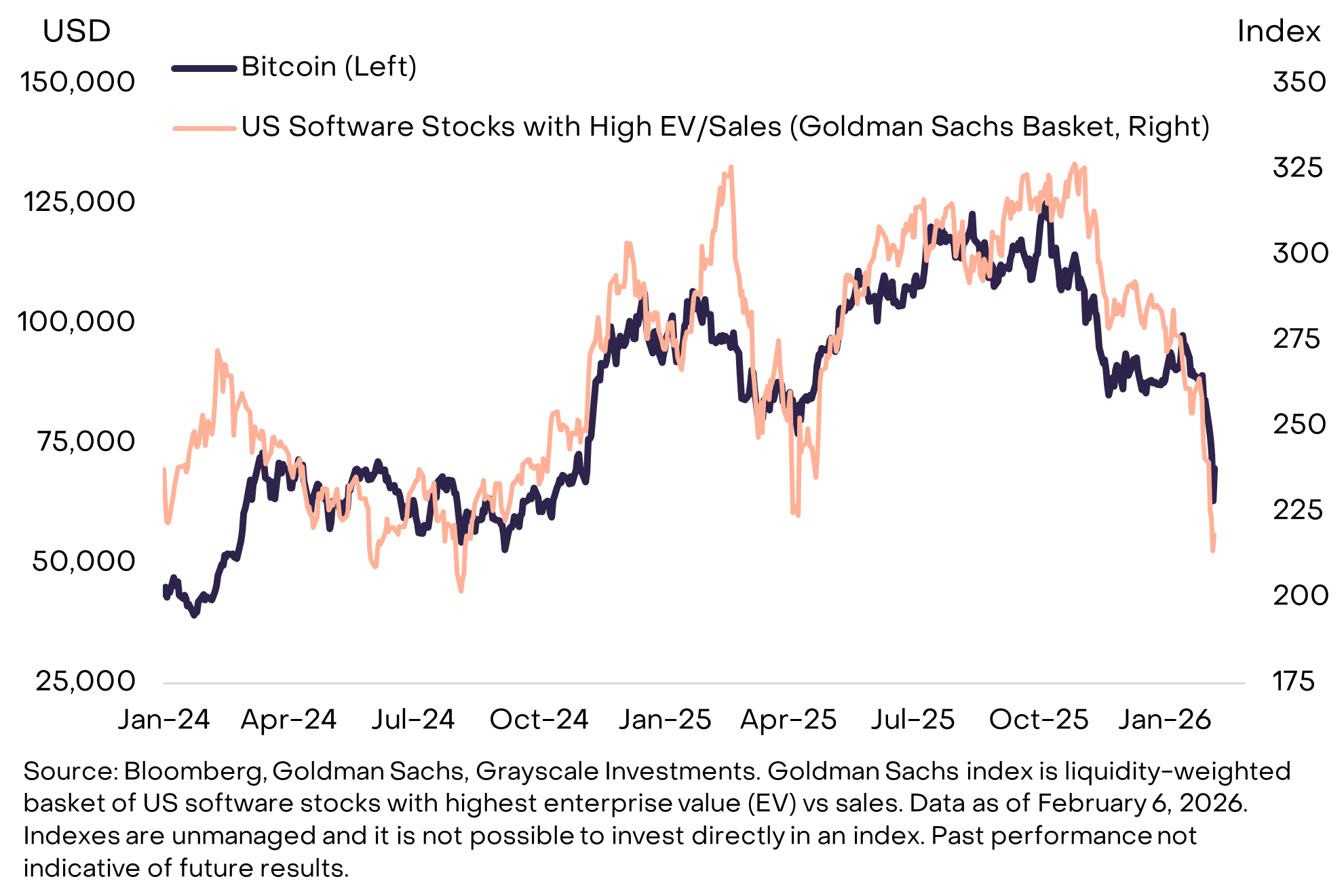

That kind of carnage naturally sparks panic. But here’s the thing, the sell-off had very little to do with anything fundamentally broken inside the crypto ecosystem. Instead, according to analysis from Grayscale, Bitcoin’s price moved in near-perfect sync with an index of U.S. software stocks that carry high enterprise value-to-sales ratios, the kind of companies investors buy when they’re betting on explosive future growth.

When those growth-oriented portfolios started getting unwound, Bitcoin went with them. It wasn’t a crypto problem. It was a risk appetite problem.

Who Was Selling? The Data Points to the U.S.

One of the more telling signals during this drawdown was a noticeable discount in Bitcoin’s price on Coinbase, the largest U.S. crypto exchange by volume, compared to Binance, the largest offshore exchange. When Coinbase trades meaningfully below Binance, it’s typically a sign that American-based sellers are driving the price lower.

That theory is supported by another data point: U.S.-listed spot Bitcoin exchange-traded products (ETPs) saw approximately $318 million in net outflows just since the start of February. The selling pressure was clearly coming from stateside investors pulling back from risk.

Interestingly, on-chain data suggests the so-called “OG Whales”, long-term Bitcoin holders who have been around since the early days, were not among the sellers. That’s actually a bullish signal hiding inside a bearish headline.

So Is Bitcoin Gold or a Tech Stock? The Answer Is: Both

This is the question every investor is asking right now, and Grayscale’s position on it is nuanced but worth understanding.

On one hand, Bitcoin has genuine monetary characteristics. Its supply is capped, it operates independently of any government, it’s decentralized, and it has survived multiple boom-and-bust cycles, competitive threats, and regulatory attacks. The infrastructure supporting it has grown to an enormous scale. For these reasons, Grayscale believes Bitcoin can function as a long-term store of value, essentially, digital gold.

On the other hand, Bitcoin is only 17 years old. Gold has been used as money for thousands of years and currently sits as the second-largest asset held in global foreign exchange reserves, right behind the U.S. dollar. Bitcoin hasn’t reached that level of adoption or institutional trust yet.

And that’s exactly the investment thesis.

Right now, buying Bitcoin is a bet on its future as a dominant monetary asset in a world increasingly shaped by AI agents, tokenized capital markets, and digital-native financial infrastructure. If Bitcoin wins that bet over the long run, its price behavior will likely start looking a lot more like gold, lower volatility, lower correlation to stocks, and steadier long-term returns. But we’re not there yet.

For now, it trades like a growth asset because, in many ways, it still is one.

Derivative Markets Are Showing Signs of a Local Bottom

Here’s something that tends to get overlooked in all the noise around price: what’s happening in Bitcoin’s derivative markets tells a much more interesting story.

Aggregate open interest across the four largest perpetual futures exchanges has fallen by more than half since October. Funding rates, the cost to hold long positions in perpetual futures, turned negative for the largest crypto assets. Options market skew moved to even more extreme levels than analysts were flagging last month.

All of this points to a significant deleveraging event, the kind that often signals a local bottom in the market cycle. The speculative excess has been flushed out, and that historically sets the stage for recovery, assuming macro conditions cooperate.

The CLARITY Act: A Cloud Hanging Over the Market

One factor that has undeniably weighed on crypto valuations recently is the uncertain fate of the CLARITY Act in the U.S. Senate. The bill, which is designed to bring regulatory clarity to the crypto industry, hit a snag in the Senate Banking Committee in January, and the delays appear to have spooked institutional investors.

The White House is reportedly working to convene a second meeting with crypto and banking industry participants to move the bill forward. While passing the CLARITY Act would be a meaningful positive catalyst for the market, it’s worth keeping some perspective here.

Regulatory clarity for crypto is a structural trend that’s much bigger than any single piece of legislation. The bipartisan GENIUS Act, sweeping changes by U.S. regulatory agencies, and parallel regulatory developments in other countries are all quietly driving institutional interest in stablecoins, tokenized real-world assets, and other blockchain-based applications. Even without the CLARITY Act, the train is moving.

How to Position for the Recovery

If you believe the worst of the sell-off is behind us, and the technical indicators suggest it might be, the question becomes: where do you put your money?

Grayscale’s analysis points to two major macro trends driving value in the crypto asset class right now:

1. Regulatory clarity fueling stablecoins and tokenized assets. The most direct beneficiaries here are leading smart contract platforms. Ethereum (ETH) and Solana (SOL) remain the dominant infrastructure for decentralized applications, making them natural plays on the growth of stablecoins and tokenized capital markets. Chainlink (LINK), as a critical middleware layer connecting blockchains to real-world data, also stands to benefit significantly as institutional adoption scales.

2. Innovation in three emerging areas, privacy, perpetual futures, and prediction markets. These segments have shown outsized price performance and growing user volumes. Zcash (ZEC), which functions like Bitcoin but with built-in privacy features, is worth watching here. So is Hyperliquid (HYPE), a decentralized perpetual futures exchange that appears to be expanding into prediction markets, a combination that could make it one of the more interesting infrastructure plays of the next cycle.

The Bottom Line

Bitcoin’s recent drop to $60,000 was painful, but context matters. The sell-off was driven largely by broad derisking of growth assets in traditional markets, with U.S. investors leading the charge. Long-term holders didn’t panic. Derivative markets have flushed out the leverage. And the fundamental trends, regulatory progress, stablecoin adoption, blockchain innovation, are still firmly intact.

Bitcoin is both a store of value and a growth asset. The tension between those two identities is exactly what makes it such a fascinating and complex investment today. And for investors willing to understand that nuance, the current environment might be offering an opportunity rather than just a warning.

As always at TawkCrypto, we’ll keep watching the data so you don’t have to.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry significant risk. Always do your own research before making any investment decisions.