A sweeping new survey has confirmed what many in the crypto space have long suspected: Africa isn’t just warming up to stablecoins, it’s racing ahead of much of the world in adopting them. Nigeria and South Africa are at the center of this shift, posting some of the strongest demand growth figures ever recorded for dollar-pegged digital assets, and showing a level of optimism about their future that far outpaces wealthier nations.

The findings come from the Stablecoin Utility Report, a study conducted by polling firm YouGov in partnership with crypto infrastructure company BVNK, Coinbase, and blockchain analytics firm Artemis. More than 4,650 individuals across 15 countries were surveyed, all of whom either currently hold or plan to hold stablecoins or other cryptocurrencies.

The results paint a vivid picture of a continent where traditional finance is failing everyday people, and where digital dollars are quietly stepping in to fill the void.

Nearly 80% of Nigerian and South African Respondents Already Hold Stablecoins

That figure alone should stop anyone in their tracks.

In markets where banking penetration remains inconsistent, where inflation has historically ravaged purchasing power, and where sending money across borders can cost an arm and a leg, stablecoins have emerged as something genuinely practical, not just a speculative bet.

According to the report, over 75% of those existing stablecoin holders in Nigeria and South Africa plan to increase their holdings further over the coming year. That’s not passive interest. That’s conviction.

And among people who don’t yet own stablecoins? The intent to start is roughly twice as high in low and middle-income economies compared to high-income ones. The wealthier the country, the less urgency people feel. The more financially underserved the population, the more stablecoins make sense.

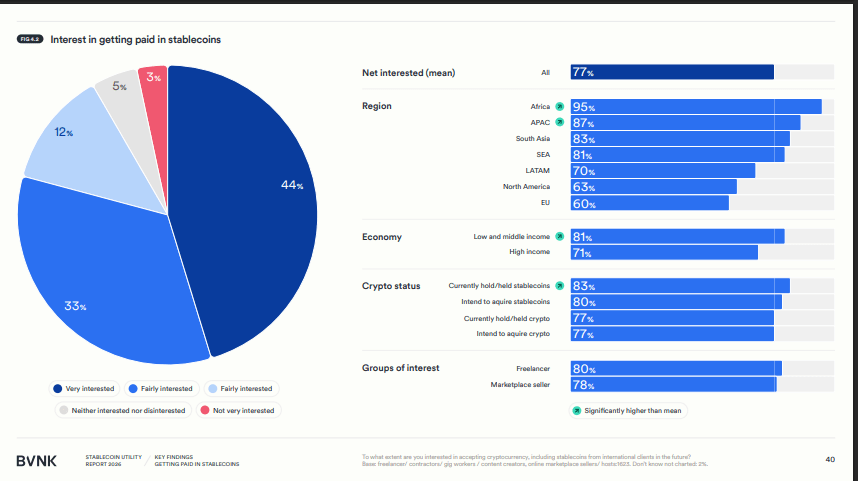

95% of Nigerian Respondents Would Rather Be Paid in Stablecoins Than Naira

This is perhaps the most striking data point in the entire report, and it speaks volumes about how Nigerians feel about their own currency.

The Naira has endured years of devaluations, foreign exchange shortages, and purchasing power erosion. Against that backdrop, it’s not hard to understand why nearly every Nigerian respondent surveyed would prefer to receive their wages, payments, or remittances in a dollar-pegged digital token instead.

This isn’t anti-patriotism. It’s economic pragmatism. When your local currency is volatile and your savings can lose significant value in a matter of months, locking value into a stablecoin is a rational hedge, one that more and more Africans are actively choosing.

Over Half of All Respondents Increased Their Stablecoin Holdings Last Year

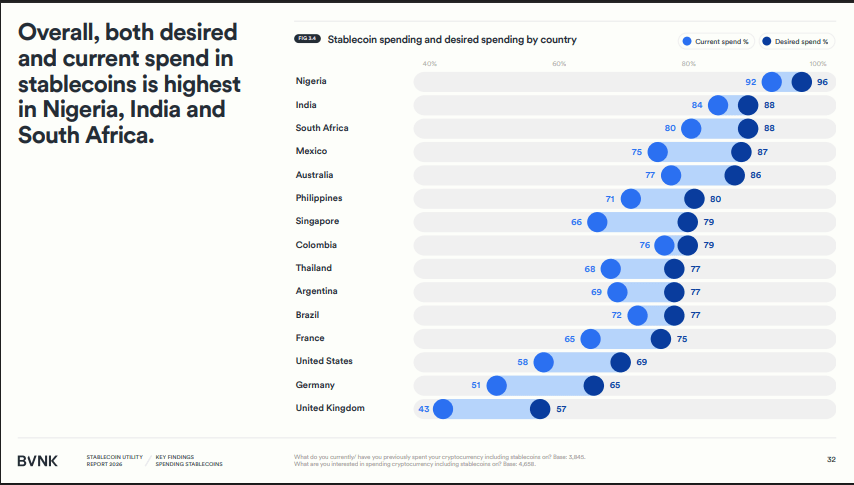

Across all 15 countries surveyed, more than half of respondents reported growing their stablecoin positions over the past 12 months. But the strongest trends were concentrated squarely in developing economies, a pattern that holds true beyond Africa, with India also emerging as a notable growth market in the data.

The global stablecoin market is now valued at more than $310 billion, dominated by Tether at roughly $185 billion and USDC at approximately $75 billion. Both are pegged to the US dollar, which is part of what makes them appealing in countries with currency instability , and part of what makes central bankers nervous.

“People Are Already Getting Paid and Spending Stablecoins”

Chris Harmse, co-founder of BVNK, didn’t mince words when commenting on the findings.

“People are already getting paid and spending stablecoins, especially where traditional payments are slow, expensive, or unreliable,” he said, adding that users are increasingly asking for “greater integration into their existing financial tools.”

That last point matters. Stablecoin adoption in Africa isn’t happening in a vacuum of tech-savvy early adopters tinkering with crypto wallets for fun. It’s happening because real people, freelancers, remote workers, small business owners, and families receiving remittances are finding stablecoins more useful than what the traditional banking system offers them.

Right now, the dominant use case for stablecoins globally is still crypto trading, nearly nine-tenths of all stablecoin transactions are tied to moving money between crypto markets, with only around 6% going toward payment for actual goods and services, according to a separate BCG report. But the trajectory in markets like Nigeria suggests that payments use case is growing, and fast.

The Remittance Problem Stablecoins Could Actually Solve

South African Reserve Bank Governor Lesetja Kganyago offered a telling illustration of why stablecoins matter so much in this region. Sending just $100 from South Africa to neighboring Mozambique can cost as much as $30 in fees through traditional channels.

That’s a 30% fee on a basic cross-border transfer. For families depending on remittances, those fees represent real money lost, food, school fees, medical costs that never arrive. Stablecoins, which can move value across borders faster and far more cheaply, represent a direct answer to this problem.

It’s a rare moment where the Governor of a central bank, an institution historically skeptical of crypto, is effectively acknowledging that stablecoins have a legitimate role to play

But Central Banks Are Still Watching Carefully

Not everyone is celebrating. Central banks across emerging markets remain wary of stablecoin adoption at scale, and their concerns are legitimate ones.

When citizens hold dollar-pegged tokens instead of local currency, it can erode the effectiveness of monetary policy. Banks could see deposits drain away. Capital flight becomes harder to monitor and control. These are real macroeconomic risks, especially in countries where central banks already have limited tools to manage economic shocks.

And since 99% of stablecoins are pegged to the US dollar, widespread adoption essentially means further dollarisation of already dollarisation-prone economies, a trend that makes it harder for governments to use exchange rate policy as an economic lever.

The regulatory picture is also shifting at the global level. In the United States, legislative moves like the GENIUS Act are expected to provide clearer frameworks for stablecoin issuers, which could accelerate market growth and bring more institutional players into the space.

The Biggest Remaining Barrier? Acceptance at the Point of Sale

Despite all the momentum, the survey flagged one stubborn obstacle: stablecoins still aren’t widely accepted where people actually shop.

Limited acceptance in physical stores and online platforms remains a significant hurdle for everyday adoption, subscriptions, groceries, utilities, transport. Until merchants and service providers begin integrating stablecoin payments more broadly, users will continue to hit a wall when trying to spend what they hold.

This is the missing infrastructure layer, and it’s arguably the most important one. The demand is clearly there. The question now is whether the payments ecosystem, merchants, point-of-sale providers, e-commerce platforms, can catch up with where African consumers already are.