After months of green candles and euphoric sentiment, the crypto market has been dealt a devastating blow. The past two weeks witnessed the largest liquidation event in cryptocurrency history, $19 billion wiped out in a matter of days, with 1.6 million traders liquidated. That’s nine times the previous record. Bitcoin slipped below key psychological levels, altcoins hemorrhaged 80-90% of their value, and Crypto Twitter erupted with declarations that “the bull run is dead.”

But is this really the end, or just an incredibly painful shakeout?

When fear grips the market and everyone’s screaming about capitulation, it’s tempting to join the chorus. But smart investors know better than to make decisions based on emotions and social media panic. The real question isn’t what Crypto Twitter thinks, it’s what the data actually shows.

In this piece, we’re cutting through the noise to examine what’s really happening beneath the surface. We’ll analyze the charts, dive deep into on-chain metrics, assess the macro environment, and separate genuine bear market signals from temporary corrections.

Are we witnessing the early stages of a bear market, or is this the healthy reset that sets up the next leg higher?

Let’s let the data do the talking.

What the Charts Say

Key Market Levels and Structure

Before we panic about short-term price action, let’s zoom out and look at what really matters: market structure on higher timeframes.

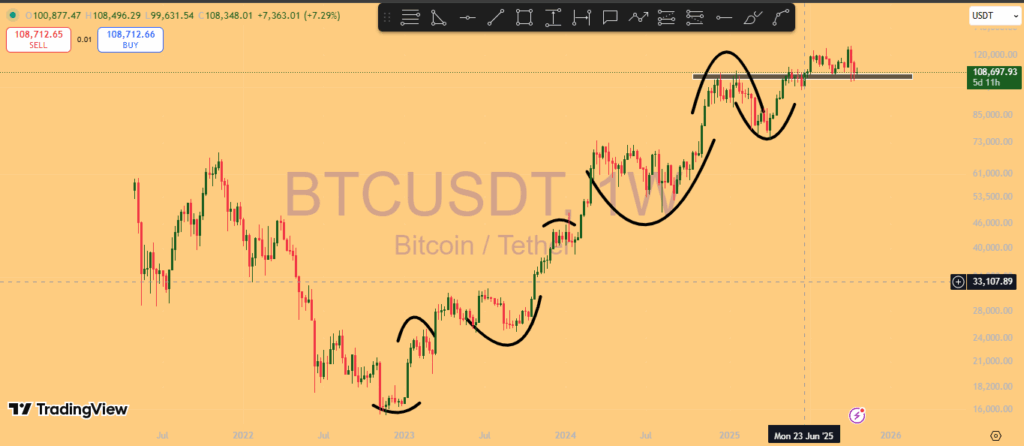

Using a top-down approach on the weekly BTC/USDT chart reveals something crucial that most traders overlook. On the weekly timeframe, Bitcoin hasn’t actually broken its bullish market structure yet. We’re still printing higher highs and higher lows, the fundamental definition of an uptrend. Until this pattern breaks on the weekly timeframe, we cannot definitively say the bull market structure is compromised.

Making decisions based on lower timeframes (daily or 4-hour charts) might suggest a correction, but not necessarily a trend reversal. This is a critical distinction that separates seasoned investors from those who get shaken out at the worst possible time.

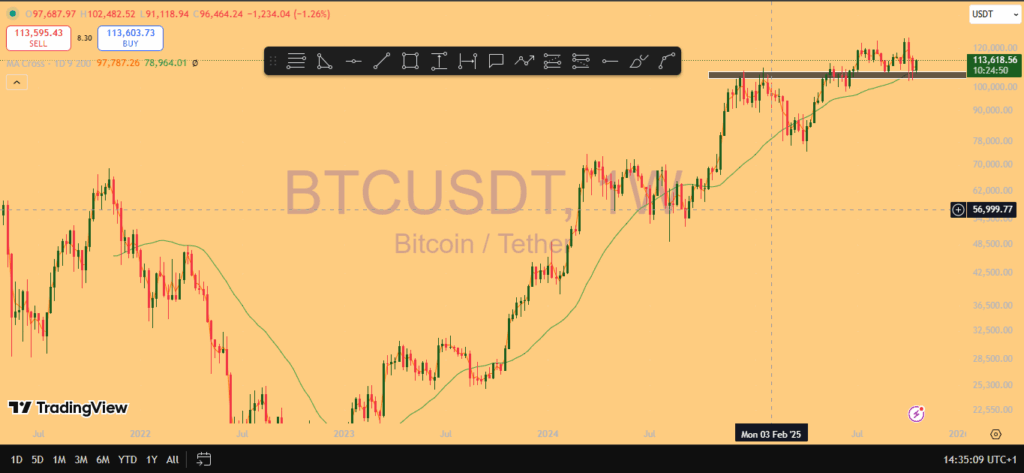

The 200-Day Moving Average: The Line in the Sand

Another crucial technical indicator to watch is the 200-day moving average, which historically signals major trend shifts. Right now, this level coincides almost perfectly with the bull market support zone around $100,000.

This isn’t just any support level, it’s where institutional money typically defends positions and long-term holders accumulate. As long as Bitcoin holds above this critical zone, the bull market thesis remains intact. A decisive break below would be a different story entirely, requiring a serious reassessment of market conditions.

The Cycle Timing Question

Here’s where things get interesting, and controversial.

Looking at previous cycles, there’s a pattern worth noting:

- 2017 cycle: Peaked at 1,059 days from the low

- 2021 cycle: Peaked at 1,067 days from the low

- Current position: Approximately 1,072 days

If we average the previous two cycles, we’re theoretically right at the point where the bull market should be ending. This has led some analysts to argue we’ve already seen the top and are now transitioning into a bear market.

But there’s a problem with this analysis: The traditional 4-year halving cycle that governed crypto for over a decade may no longer be the dominant force.

With over 96% of Bitcoin’s total supply already in circulation, the halving event has diminishing impact. Bitcoin is increasingly driven by traditional market liquidity cycles and macroeconomic factors, the same forces that move equity markets. This suggests we may be in an entirely new paradigm: an “ultra cycle” driven by institutional adoption and global liquidity, not just halving events.

Technical Indicators and Sentiment

RSI and Volume Divergences: Recent price action showed selling exhaustion rather than the beginning of a prolonged downtrend. Volume spikes during the crash were primarily liquidation-driven, not organic spot selling.

Fear & Greed Index:

The index plunged into extreme fear territory during the crash. Historically, extreme fear readings during bull markets have marked golden accumulation opportunities, not the beginning of bear markets. In the 2017 cycle, the index stayed at extreme greed for 150 consecutive days before the real top. We haven’t even touched extreme greed in this cycle yet.

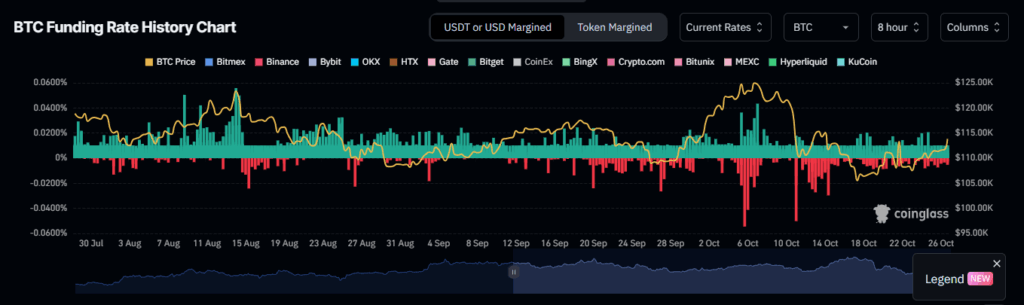

Funding Rates:

Coin-denominated Bitcoin funding rates went incredibly negative, reaching levels not seen since October 2023 when Bitcoin was trading around $28,000. Negative funding means shorts are paying longs, indicating widespread bearish sentiment, often a contrarian buy signal when it reaches extremes.

What On-Chain Metrics Suggest

While price charts tell us what’s happening, on-chain data reveals why it’s happening and who is behind the moves. This is where the story gets really interesting.

Leverage vs. Spot: The Real Story Behind the Crash

The $19 billion liquidation wasn’t a sign of capitulation from core holders, it was a deleveraging event that purged over-leveraged traders from the system.

Open Interest Data:

Leading up to the crash, leverage was building rapidly across major exchanges, reaching nearly $32 billion. The liquidation cascade saw Open Interest drop by approximately $10 billion instantly. This was forced selling from leverage, not genuine distribution from long-term investors.

Think of it this way: If a building collapses because it was poorly constructed (over-leveraged), that doesn’t mean the neighborhood is dying. It means bad structures got cleared out.

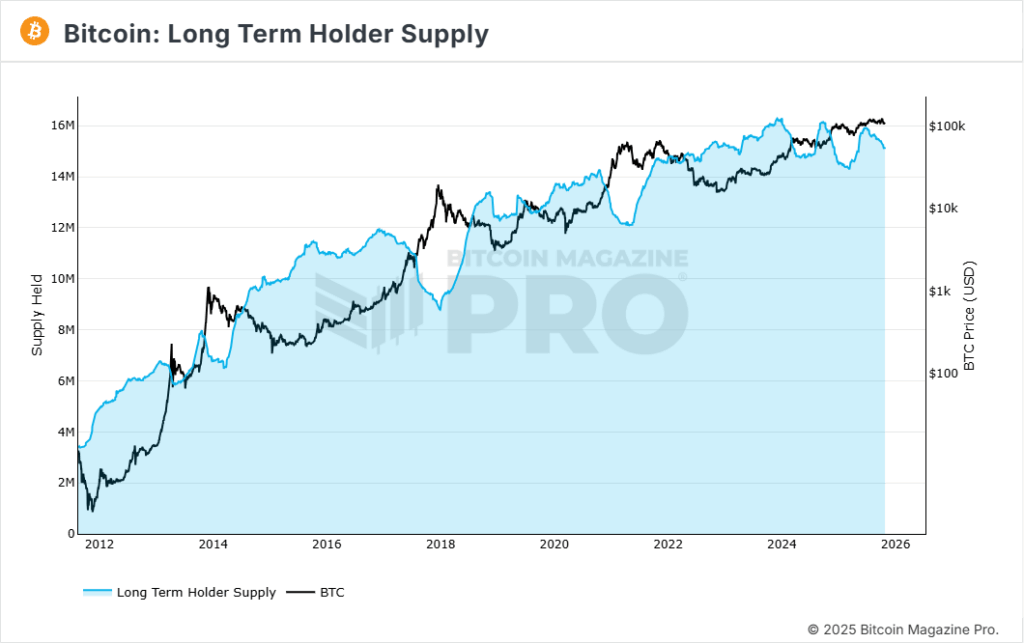

Long-Term Holder Behavior: Accumulation, Not Distribution

This is perhaps the most bullish signal in the entire dataset.

Long-Term Holder (LTH) Supply:

Throughout the crash, LTH supply continued increasing at a standard rate. These sophisticated investors, whales, institutions, and experienced traders who’ve held for 155+ days, aren’t selling. In fact, they’re holding a record $15 billion worth of Bitcoin and showing no signs of distribution.

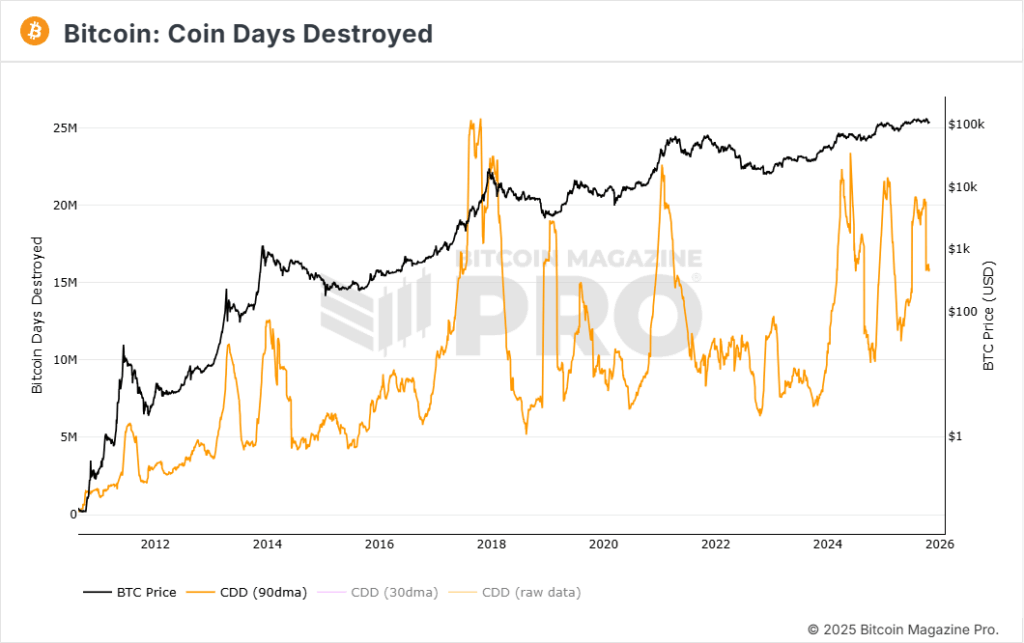

Coin Days Destroyed (CDD):

This metric measures the movement of old coins. If long-term holders were panicking, we’d see massive spikes in CDD. Instead, the Supply Adjusted Coin Days Destroyed has been rapidly decreasing, meaning those old coins are staying put.

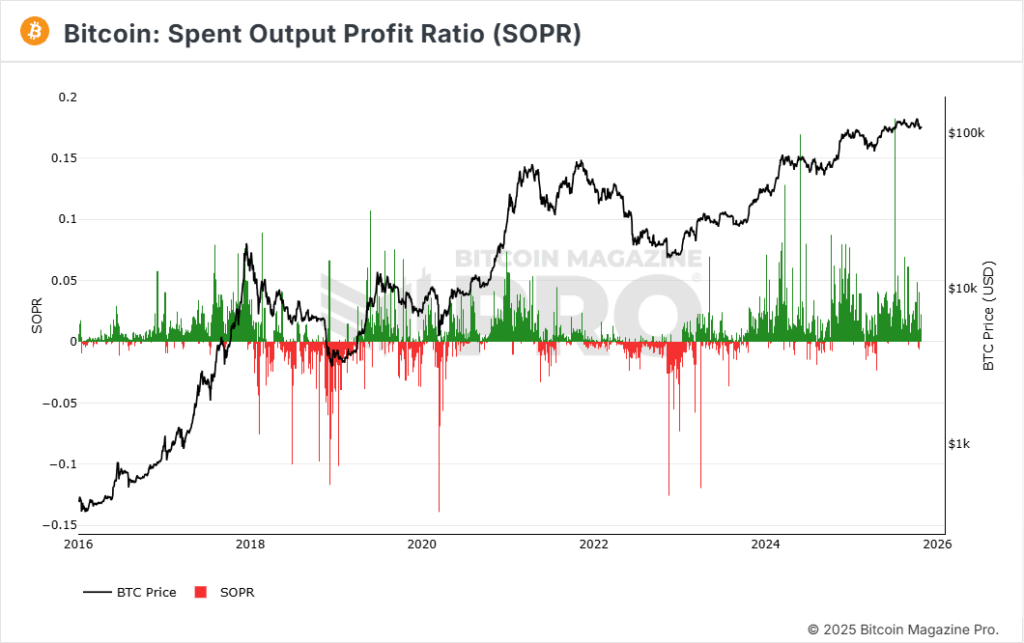

Spent Output Profit Ratio (SOPR):

During the crash, SOPR briefly went negative, indicating people were selling at a loss. But who was selling? Analysis shows it was primarily short-term holders who bought near the recent all-time high around $125,000 and panic-sold at a loss. The smart money? They were accumulating.

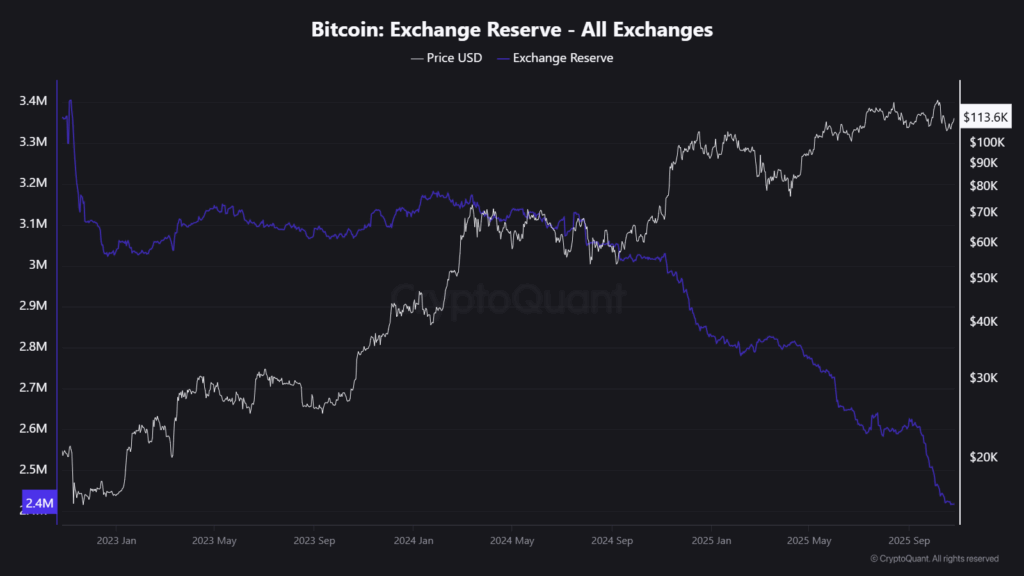

Exchange Flows: The Supply Shock Signal

Bitcoin Exchange Reserves:

Reserves are at a six-year low as investors continue pulling their coins into cold storage. This isn’t what happens at the end of a bull market, it’s what a supply shock looks like.

When people move Bitcoin off exchanges, they’re signaling long-term conviction. They’re not preparing to sell; they’re preparing to hold through volatility. Combined with institutional accumulation, this creates a powder keg of potential upside when the market sentiment shifts.

Network Health Indicators

Active Address Sentiment Indicator: This metric dipped beneath the lower standard deviation band during the crash, a divergence from network utilization that has historically marked discount accumulation opportunities.

NVT Signal (Network Value to Transaction): Similarly dropped beneath the standard deviation band, another signal that Bitcoin was trading at a massive discount relative to its network activity and transaction volume.

Short-Term Holder Realized Price: The price dipped to around $95,000-$100,000, which represents the average acquisition cost of new market participants. Historically, regaining this level after a dip has been a golden opportunity to accumulate before the next leg up.

What the Whales Are Doing

While retail panicked, institutional players and treasury companies continued their relentless accumulation:

- Treasury companies: Still holding and accumulating over 1 million Bitcoin

- ETFs: In a single week in October, Bitcoin ETFs purchased $3.2 billion worth of BTC

- Wall Street ownership: Between ETFs and treasury companies, institutional players now control approximately 15% of Bitcoin’s supply and 11% of Ethereum’s supply

This isn’t the behavior of smart money preparing for a bear market. This is the behavior of institutions positioning for the next major move higher.

What the Macro Looks Like

Crypto doesn’t exist in a vacuum. Global liquidity conditions, monetary policy, and traditional market dynamics increasingly dictate Bitcoin’s trajectory.

The Liquidity Super Cycle

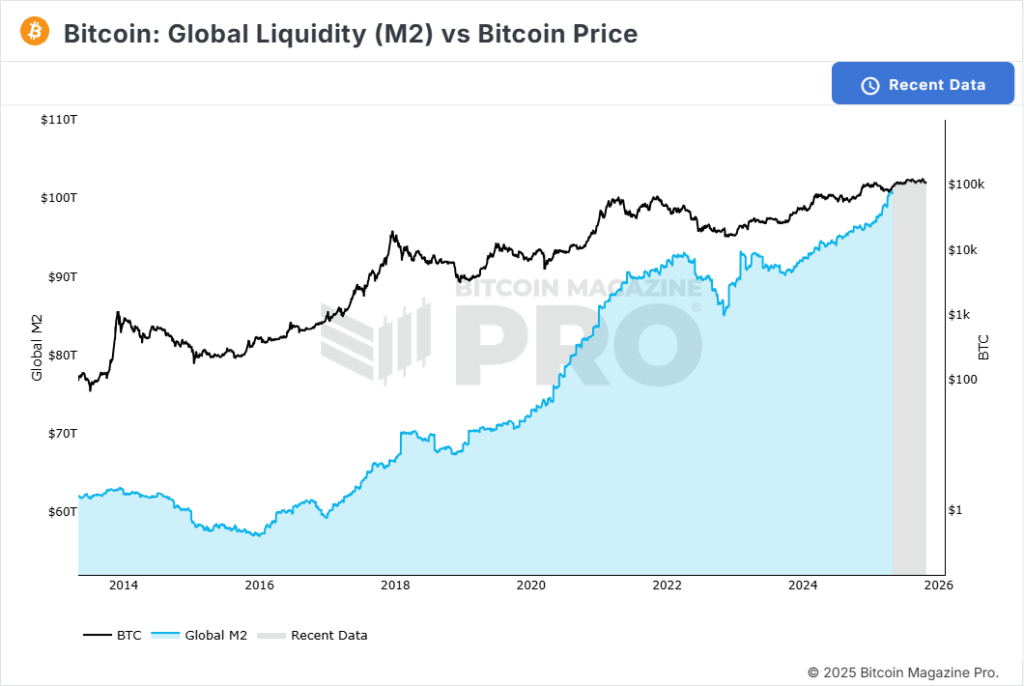

Global M2 Money Supply:

This measures the total amount of money circulating in the global economy. After a period of contraction, global M2 is rising again. Historically, Bitcoin and risk assets lag gold by 90-100 days when liquidity increases. Gold recently hit new all-time highs, suggesting a massive catch-up trade is coming for Bitcoin.

US Debt Maturity Extension:

In a quiet but profound shift, the US Treasury extended the average maturity of its debt from 4 years to 6 years. This means money that would have returned to the market in four years will now take six years to cycle through. This single change stretches the entire business cycle, making it much longer than traditional models predict.

Interest Rates: Still Early in the Easing Cycle

The Federal Reserve’s interest rate policy is perhaps the most critical macro factor for risk assets.

Historical Pattern: Markets typically only top after interest rates have been lowered and are on the way back up, when the Fed is attempting to slow down a previously overheated economy.

Current Position: We just saw the first few rate cut, and forecasts indicate rates may only bottom in late 2026 when the Fed completes its rate-cutting cycle. This suggests we’re still very early in this liquidity wave.

Historical Performance: Risk assets, including Bitcoin, rally strongest 12 to 18 months after the first rate cut. If history rhymes, the biggest move is still ahead of us.

The ISM Manufacturing Index: Economic Expansion Ahead

The ISM Manufacturing Index measures economic activity and business confidence. During bull market peaks, this index goes parabolic, often hitting 58-61.

Current reading: The index just started moving from its lows, having bottomed at 46 and recovered to 48. It hasn’t even crossed 50 yet, the threshold that separates contraction from expansion.

Implication: The real expansion phase that fuels massive bull markets hasn’t even started yet. We’re in the early innings, not the final quarter.

Dollar Strength and Risk Assets

The US Dollar Index (DXY) tends to have an inverse relationship with Bitcoin and risk assets. When the dollar weakens due to monetary easing and increased liquidity, capital flows into alternative stores of value like Bitcoin.

With rate cuts continuing and liquidity expanding, pressure on the dollar should benefit Bitcoin in the medium to long term.

The Psychology of “Max Pain”

Markets often move to inflict maximum pain on the most participants. With 1.6 million traders liquidated and 70-80% of over-leveraged positions wiped out, what would hurt the most people now?

An exponential rally to new highs, leaving all those liquidated traders watching from the sidelines as the market rips higher without them. That’s the “max pain” scenario, and it’s entirely consistent with how Bitcoin has moved throughout its history.

The Verdict: Bull, Bear, or Something In Between?

After analyzing the charts, on-chain data, macro environment, and sentiment, let’s address the fundamental question: Where are we really in this cycle?

The Case for a Continuing Bull Market

The evidence is compelling:

- On-chain accumulation: Long-term holders aren’t selling; they’re accumulating. Exchange reserves are at six-year lows. Smart money is positioning for higher prices.

- Institutional buying continues: Treasury companies hold over 1 million BTC. ETFs are buying billions. Wall Street owns 15% of Bitcoin supply and is recommending allocation to trillions in client assets.

- Macro tailwinds: Interest rates are being cut, global M2 is expanding, and we’re 12-18 months away from when risk assets historically perform best in the rate cycle.

- Market structure intact: Weekly timeframe shows unbroken bull structure above key support at $95k-$100k.

- No euphoria yet: Fear & Greed Index hasn’t stayed in extreme greed territory. Retail FOMO hasn’t arrived. The CBBI (Crypto Bull-Bear Index) isn’t near top levels.

- Early-stage altcoin rotation: Historically, Bitcoin dominance falls and money rotates into ETH, then large caps, then small caps over 8-12 months. We’re just starting this rotation now.

- Supply dynamics: With 96% of Bitcoin mined and institutional hoarding accelerating, supply shocks become more likely, not less.

The Case for an Emerging Bear Market

The bearish argument shouldn’t be dismissed entirely:

- Cycle timing: At 1,072 days, we’re at the average peak point of previous cycles (1,059 and 1,067 days).

- Technical breakdown risk: If Bitcoin convincingly breaks beneath $100,000 (the one-year Volume Weighted Average Price), it would signal a major trend change.

- Leverage damage: The brutal liquidation event may have scared away participants and reduced market liquidity for an extended period.

- Macro uncertainty: Geopolitical tensions, potential policy mistakes, or unexpected economic shocks could derail the bull thesis.

- Diminishing returns: Each cycle produces lower percentage gains. Expectations of 10x moves may be unrealistic, potentially disappointing investors.

The Middle Ground: Mini-Cycle Reset

Perhaps the most nuanced view is that we’re experiencing a temporary risk-off phase within a larger bull market, a mid-cycle correction that shakes out weak hands and over-leveraged positions before the next expansion.

This interpretation aligns with:

- The deleveraging event clearing systemic risk

- On-chain data showing accumulation, not distribution

- Macro conditions that typically support 12-18 more months of upside

- Institutional adoption still in early stages

- Historical precedent of mid-cycle corrections of 30-40%

Our Take: Data Over Emotion

While the charts flash caution signals, the fundamentals don’t suggest capitulation. This doesn’t feel like the end of the bull market, it feels like the shakeout phase that defines who survives the next leg up.

The crash was brutal, but it was primarily a leverage purge, not a fundamental breakdown. Long-term holders are accumulating, institutions are buying, macro conditions are supportive, and market structure on higher timeframes remains intact.

The critical level to watch is $100,000 zone. As long as Bitcoin holds above this zone (the 200-day MA, one-year VWAP, and Short-Term Holder Realized Price confluence), the bull thesis remains valid.

If we break decisively below $100,000 with confirmation on higher timeframes, then, and only then, should we seriously consider that the cycle has topped.

Our base case:

We’re 6-12 months away from the true blow-off top, which will likely coincide with the U.S. Fed completing its rate-cutting cycle in late 2025 or mid-2026. The biggest move of this bull market is still ahead.

That doesn’t mean it’ll be a straight line up. Volatility is the price of admission in crypto. But selling now, after the crash, when smart money is accumulating and fundamentals remain strong? That’s like selling Bitcoin at $30,000 in the last cycle.

Closing Reflection

In crypto, bull markets test patience; bear markets test conviction.

Right now, we’re being tested. The market just delivered one of the most brutal liquidation events in history. Crypto Twitter is declaring the party over. Fear is palpable. But this is exactly when the data matters most.

When everyone is screaming “sell,” check the on-chain metrics. When panic reigns, look at what institutions are doing. When charts look scary on low timeframes, zoom out to weekly structure.

We don’t know with certainty what comes next. No one does. But we can stack probabilities in our favor by following the data, not the emotions.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Crypto investments carry significant risk. Always do your own research and never invest more than you can afford to lose

Read also: Top 5 Crypto Exchanges in South Africa (2025)