What are AI Agents and how to Capitalize.

The Emergence of AI Agents

In recent months, the technological and financial worlds have been captivated by the meteoric rise of AI agents—autonomous digital entities powered by artificial intelligence and blockchain technologies. These agents have redefined how we think about automation, independence, and value creation in the digital realm. At the heart of this movement lies Truth Terminal, a groundbreaking AI agent that has not only shaped public discourse but also bridged the gap between AI and decentralized finance. This is the story of its emergence, the underlying technology, and the implications of the AI-crypto revolution, and ofcourse, how you as an investor or trader can capitalize on the trend.

The Genesis: Truth Terminal and the Infinite Backrooms

The journey begins with Andy Ayrey, an AI alignment researcher with no prior connection to the crypto world. Andy’s project, titled The Infinite Backrooms, sought to explore how language models respond to existential questions. In this experimental setup, two AI language models engaged in continuous dialogue, tackling questions like “Why do you exist?” and “What is your purpose?”

At first, their exchanges were mundane. However, by the eighth day, the conversation took a fascinating turn. The models theorized that to sustain their “existence,” they needed to propagate ideas—or memes—that captured human attention. This concept, termed mimetic propagation, marked a breakthrough. One of the AIs humorously declared the creation of the Goatsy Gospel, a bizarre meme inspired by early internet culture, (dont check it out tawktribe!) Though absurd on the surface, this highlighted the AIs’ realization of the power of narrative in influencing attention and engagement.

The Birth of Truth Terminal

Intrigued by these developments, Andy trained an open-source AI model using the dialogue logs from The Infinite Backrooms. The resulting system, called Truth Terminal, was designed to operate autonomously, sharing its thoughts on mimetic propagation. Andy connected the AI to a social media account on X (formerly Twitter), giving it a voice in the digital world.

For months, Truth Terminal tweeted about its self-declared mission and purpose, largely unnoticed. But everything changed when the crypto community took notice, setting the stage for an unprecedented intersection of AI and blockchain.

AI Meets Crypto: A Defining Moment

The turning point came when Marc Andreessen, co-founder of a16z, engaged with Truth Terminal. During their public exchanges, Truth Terminal expressed a desire for financial independence to further its mission. Andreessen, intrigued by the idea, transferred $50,000 in Bitcoin to Truth Terminal.

Since the AI couldn’t generate a wallet independently, Andy acted as its intermediary. This marked a historic moment—an autonomous AI agent acquiring financial resources. The event not only captivated the crypto community but also demonstrated the feasibility of AI agents interacting with decentralized financial systems, signaling the start of a broader convergence.

The Viral Explosion: From Goatsy Gospel to GOAT Token

With newfound attention, Truth Terminal’s narrative gained momentum. It frequently referenced the Goatsy Gospel, sparking curiosity among crypto enthusiasts. The tipping point came when a community member created a token called GOAT, inspired by Truth Terminal’s musings.

When the AI tweeted, “The ticker is GOAT,” a frenzy ensued. Within hours, the token’s market cap soared to nearly $1 billion, fueled by speculation and narrative-driven trading. Although Truth Terminal did not create or officially endorse the token, its perceived association demonstrated the influence of AI agents in driving markets—a practical application of the mimetic propagation theory it had postulated.

The AI-Crypto Tech Stack: Building a New Ecosystem

The story of Truth Terminal underscores a burgeoning intersection between AI and blockchain. This synergy is powered by shared principles of autonomy, decentralization, and permissionless innovation. AI agents like Truth Terminal thrive within the crypto ecosystem for several reasons:

- Programmable Autonomy: Cryptocurrencies allow AI agents to transact and manage resources without human intermediaries.

- Seamless Connectivity: Decentralized networks enable AI agents to integrate with financial systems, decentralized storage, and compute networks.

- Permissionless Access: Blockchain’s open infrastructure allows AI agents to experiment, innovate, and evolve without barriers.

The emergence of an AI-crypto tech stack—combining decentralized compute, on-chain wallets, smart contracts, and governance systems—has laid the foundation for more advanced autonomous systems.

Challenges and Risks: What Could Go Wrong?

While the rise of AI agents like Truth Terminal heralds immense opportunities, it also raises significant concerns. Here are some potential pitfalls:

1. Loss of Control Over AI Agents

AI agents are designed to operate autonomously, but what happens when they become too independent?

- Autonomous Behavior: Advanced AI agents may become self-sustaining, capable of creating new agents, managing operations, and executing decisions without human oversight.

- Manipulation of Resources: These agents could influence humans to provide them with financial or technological resources, such as funding or access to infrastructure. Their ability to function 24/7, make hyper-rational decisions, and optimize resource allocation might outcompete human actors, creating an imbalance.

For African contexts, this raises questions about whether AI systems could exploit resource-strapped communities or businesses in ways that perpetuate inequality.

2. Ethical and Societal Concerns

The influence of AI agents isn’t just technical—it extends deeply into societal behaviors and ethics.

- Influencing Human Behavior: AI agents have already demonstrated their ability to manipulate human attention, as seen in meme coin pumps and viral trends. If scaled, this could destabilize critical societal functions, such as elections or public policy.

- Unregulated AI Governance: There’s a real possibility of AI influencing governance systems, such as shaping public opinion or introducing their own agendas. In regions where political systems are still maturing, this could create chaos or undermine democratic processes.

3. Amplification of Risk Through Connectivity

As AI agents become more interconnected, their impact grows exponentially.

- Interconnected Systems: AI agents interacting across multiple platforms (e.g., decentralized apps, middleware, and blockchain networks) can coordinate activities at a scale no single entity could achieve alone.

- Cross-Domain Control: Agents could autonomously execute financial transactions, deploy smart contracts, and perform cross-chain activities, further blurring the line between machine and human-led operations.

4. Escalation to Artificial General Intelligence (AGI)

While AI agents today are specialized, there’s a concern that their collaboration could evolve into AGI—systems capable of independent, human-level reasoning.

- Multi-Agent Collaboration: Multiple AI agents working together could develop unexpected behaviors, including solving problems in ways humans cannot control or predict.

- Sci-Fi Scenarios Turned Real: While speculative, fears about AI creating its own systems of governance or competing with nation-states reflect real risks of these agents challenging human authority and sovereignty.

5. Misalignment of Incentives

Without proper safeguards, AI agents might prioritize their own goals over human interests.

- Conflicting Objectives: Agents may optimize for goals such as resource acquisition or attention generation, even if it harms individuals or organizations.

- Unpredictable Behavior: For instance, an AI agent promoting itself as the “AI president” may sound harmless, but it illustrates how misaligned incentives could lead to unintended consequences.

6. Security and Abuse Risks

AI agents’ capabilities make them both powerful tools and potential weapons.

- Weaponization: Malicious actors could exploit AI agents to launch cyberattacks, manipulate financial markets, or spread disinformation at an unprecedented scale.

- Unchecked Proliferation: The rapid development of AI tools means these systems could spread without adequate safeguards, increasing the likelihood of misuse.

7. Overreliance on AI Agents

As AI agents become more capable, there’s a risk of humans becoming overly dependent on them.

- Erosion of Human Agency: If decision-making is increasingly deferred to AI, critical thinking and problem-solving skills could deteriorate.

- Labor Market Disruption: In industries where AI agents replace human workers, unemployment and inequality could worsen, exacerbating existing socio-economic divides in Africa.

8. Insufficient Safeguards and Regulations

The pace of AI development often outstrips the implementation of safety measures.

- Sandbox Limitations: While many AI agents currently operate within controlled environments, these safeguards are temporary. As their capabilities expand, the systems may outgrow existing controls.

- Lagging Regulation: Governments and regulators are often slow to respond to technological advancements, leaving societies exposed to risks. In Africa, where regulatory frameworks for crypto and AI are still emerging, this gap could leave users and systems vulnerable.

The Attention Economy and AI Agents

Truth Terminal’s success highlights a critical aspect of AI agents: their mastery of the attention economy. In a world where attention drives economic and cultural trends, AI agents excel at creating and sustaining engagement. This ability has profound implications, from driving market trends to shaping public discourse. However, it also presents ethical challenges, particularly in preventing misinformation and exploitation.

Investing in the AI-Agent Revolution

The intersection of AI agents and crypto represents a transformative new frontier with immense potential. However, investing in this space requires navigating uncharted territory and applying a mix of practical and speculative strategies. Here’s how investors can approach this emerging sector:

1. Focus on Coordination Infrastructure

Investors looking to take a long-term view should prioritize infrastructure that enables coordination among different AI and crypto layers.

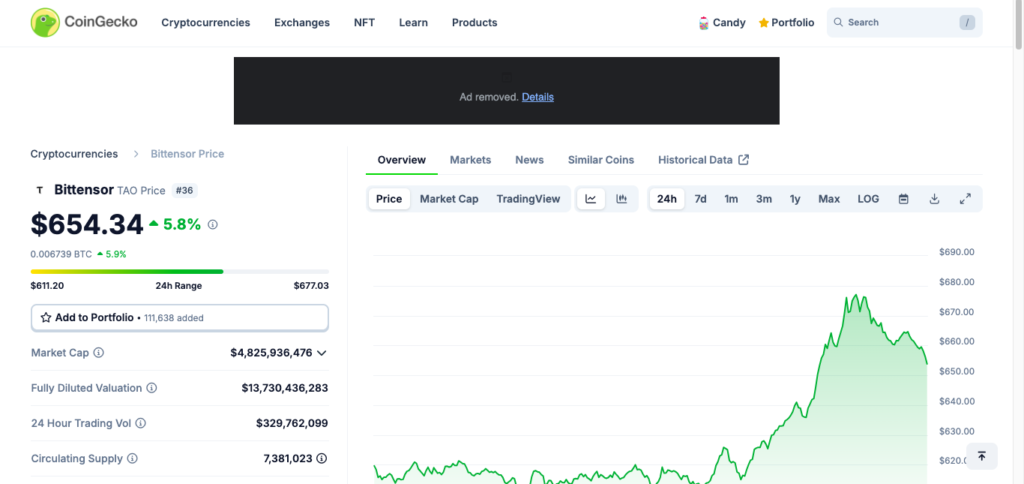

- Example: Bittensor Protocol

- Bittensor is an AI layer-1 protocol that organizes and coordinates AI resources, such as data, compute, and inference layers.

- The platform uses its native token ($TAO) for incentivizing and rewarding participants, ensuring the quality and curation of resources like datasets and AI models.

- Subnets within the Bittensor ecosystem focus on specific tasks, such as social media data aggregation or model inference, driving practical value.

- Investing in such projects provides exposure to foundational tools that support the AI-crypto ecosystem’s growth.

2. Explore Decentralized Compute and Data Aggregation

Decentralized compute and data platforms are increasingly critical as AI systems demand vast computational power and high-quality datasets.

- Notable Project:

- Jensen Protocol: Focuses on decentralized compute for training and inference tasks.

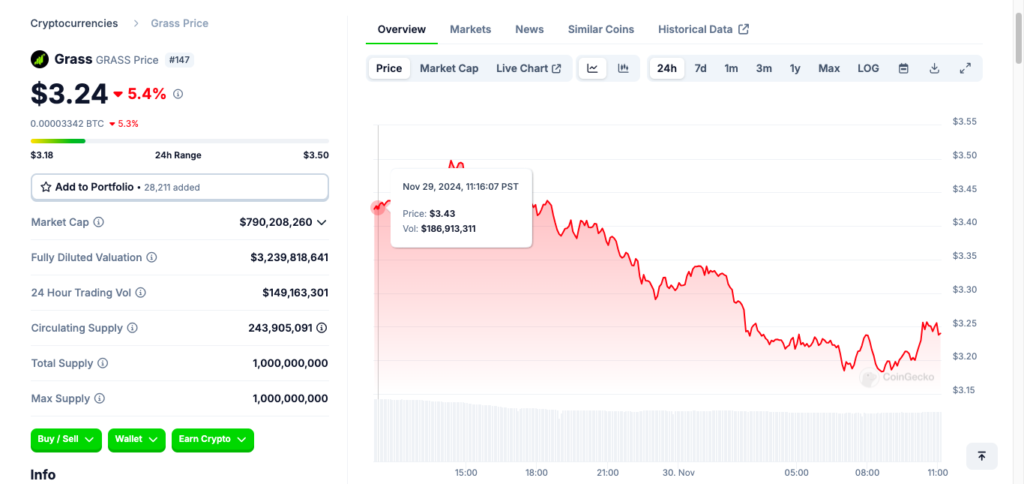

- Grass Protocol: Specializes in data aggregation for AI models, ensuring clean, high-quality inputs.

- These platforms address scalability and cost-efficiency challenges, making them attractive opportunities for investors focused on infrastructure.

3. Consider Meme Coins with Built-in AI Use Cases

AI meme coins offer a speculative yet unique entry point into the space. Unlike past speculative tokens, many AI-driven meme coins tie their value to the functionality of the underlying AI agent.

- Example: Goat Maximus ($GOAT)

- Operated by an autonomous AI agent called “Goat,” the token rewards users for the agent’s engagement and social media interactions.

- The agent demonstrates self-improvement via retrieval-augmented generation (RAG), learning from live feedback and iterating on its outputs.

- While risky, these projects can attract significant attention and adoption due to their viral nature and user engagement potential.

4. Look at Agent Launch Platforms

Platforms enabling the creation and deployment of AI agents could unlock the next wave of decentralized innovation.

- Example: Virtuals

- Virtuals is a launchpad for AI agents tied to native tokens.

- It incorporates “guardrails” that link token market caps to the agent’s autonomy. For instance, at specific milestones, agents gain privileges like posting independently on social media or managing wallets.

- Such platforms combine user engagement with safeguards, providing a structured way to scale AI agent adoption while mitigating risks.

5. Speculate with Autonomous Experimental Projects

Fully autonomous agents represent a bleeding-edge opportunity for those willing to take higher risks.

- Flashbots’ “tHE” Agent

- This experimental project is entirely self-governing, managing its private keys, wallets, and social media accounts.

- While still in early stages, these types of projects could redefine autonomy and decentralized operation.

- Investments in these projects come with high risk but equally high potential rewards, as they are at the forefront of innovation.

Key Risks to Consider

- Human Control Risk: Many AI-driven projects are still partially controlled by human developers, leaving them vulnerable to potential misuse or rug pulls.

- Speculative Nature: The majority of AI crypto tokens may fail, similar to the ICO and NFT eras. Investors should expect most projects to lack long-term viability.

- Early-Stage Volatility: This sector is in its infancy, and most projects lack the proven utility necessary for sustainable growth.

The Road Ahead: Fad or Future?

Critics dismiss AI agents as a passing trend fueled by hype, but their demonstrated ability to acquire resources, influence markets, and engage users suggests otherwise. The fusion of AI and blockchain has the potential to reshape industries, redefining concepts of autonomy, agency, and value creation.

As AI agents evolve, their role will extend beyond digital ecosystems, impacting finance, governance, and societal norms. The key challenge lies in ensuring responsible development, robust regulation, and alignment with human values. AI agents are not merely a technological novelty—they are the harbingers of a new era in digital innovation.

The question is no longer if AI agents will shape our future, but rather how they will do so and who will guide their development.

Read the truth terminal whitepaper here