The Rise of Celo in Africa

The Emergence of Celo in Africa

Africa is no stranger to rapid technological adoption, and over the past few years, Celo has emerged as a powerful player on the continent. With its innovative approach to blockchain technology, Celo is making waves by addressing real-world issues that affect millions across Africa, from unreliable banking systems to high transaction fees. In countries like Nigeria, Kenya, and Ghana, where mobile penetration often exceeds 80%, Celo’s mobile-first design has resonated with a young, tech-savvy population eager for solutions that are both efficient and cost-effective.

Read also: P2P Crypto Trading in Africa — The Unstoppable $100B Market

The Need for a Tailored Blockchain in Africa

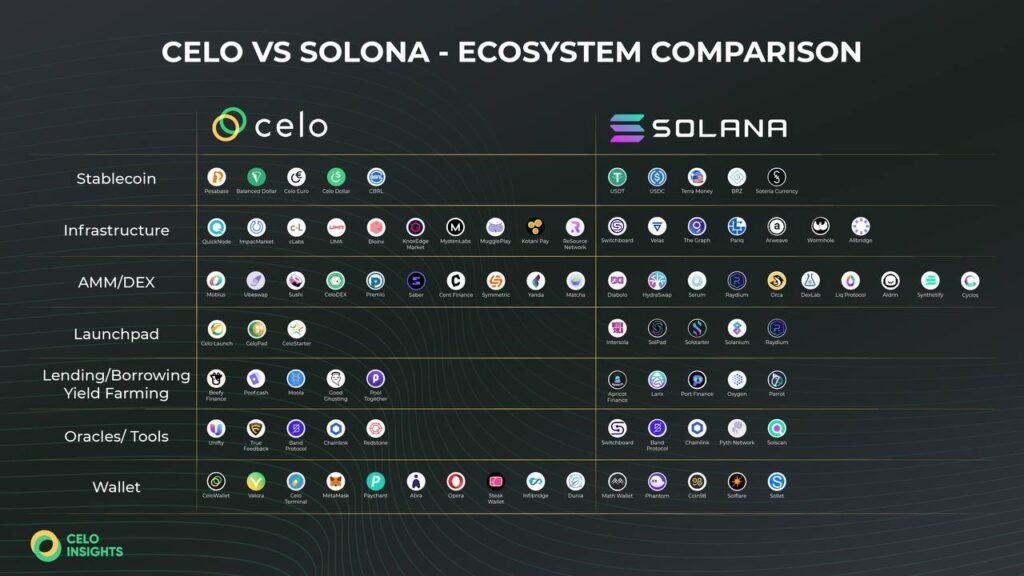

Blockchains like Ethereum and Solana have undoubtedly driven global crypto innovation, but they often fall short when addressing Africa’s distinct challenges. Energy efficiency is a key concern; many African nations face power shortages and high energy costs, making a more sustainable solution essential. Additionally, financial inclusion remains a persistent issue, as a significant portion of Africa’s population remains unbanked or underbanked. Celo’s promise lies in its ability to deliver a blockchain that is not only eco-friendly but also accessible via mobile devices, aligning perfectly with the continent’s needs.

Background on Celo

Celo is an open-source blockchain platform that’s transforming the way financial services are accessed globally, and it’s making a particularly strong impact in Africa. Built on the principles of decentralization, inclusivity, and sustainability, Celo aims to provide a seamless financial solution for anyone with a mobile phone, even in remote areas where traditional banking infrastructure is lacking. With Africa’s urban centers boasting mobile penetration rates of 80-90%, Celo’s mobile-first design is perfectly suited to meet the continent’s growing need for accessible, low-cost digital financial services.

At its core, Celo is designed to let users send, receive, and store digital assets without the need for a conventional bank account. This is made possible by its native cryptocurrency, CELO, alongside stablecoins such as cUSD and cEUR. These assets facilitate low-cost transactions that typically cost less than a cent, a crucial factor in regions where every penny counts. By integrating these features, Celo empowers users to participate in the digital economy in a way that’s both practical and affordable, effectively bridging the gap between the traditional financial system and the modern world of digital assets.

One of the standout features of Celo is its innovative, eco-friendly consensus mechanism. Unlike the energy-intensive Proof-of-Work systems used by blockchains like Bitcoin, Celo employs a more sustainable variant of Proof-of-Stake that consumes a fraction of the energy. This eco-friendly approach is particularly important in Africa, where energy costs are high and supply can be unpredictable. By keeping transaction fees ultra-low and energy consumption minimal, Celo not only reduces costs but also aligns with the broader goal of sustainable development across the continent.

Financial inclusion is at the heart of Celo’s vision. Africa faces significant challenges with traditional banking—where over 60% of the adult population in many countries remains unbanked. By offering a blockchain solution that works on any smartphone, Celo democratizes financial access, enabling millions of Africans to securely store, send, and receive money without the need for a conventional bank account. This is particularly relevant in regions where high inflation and volatile currencies erode savings and hinder economic growth. Celo’s stablecoins, which help hedge against local currency volatility, provide a reliable alternative for preserving value and facilitating everyday transactions.

Several African fintech startups have already begun leveraging Celo’s technology to create innovative solutions. In Nigeria, for example, a mobile payment platform built on Celo has processed thousands of transactions within its first month, proving that when you combine affordability, accessibility, and sustainability, the impact can be transformative. Similarly, in Kenya, local cooperatives have adopted Celo-based solutions to facilitate instant, low-cost payments, thereby bypassing the slow, expensive processes of traditional banking.

The African Blockchain Landscape

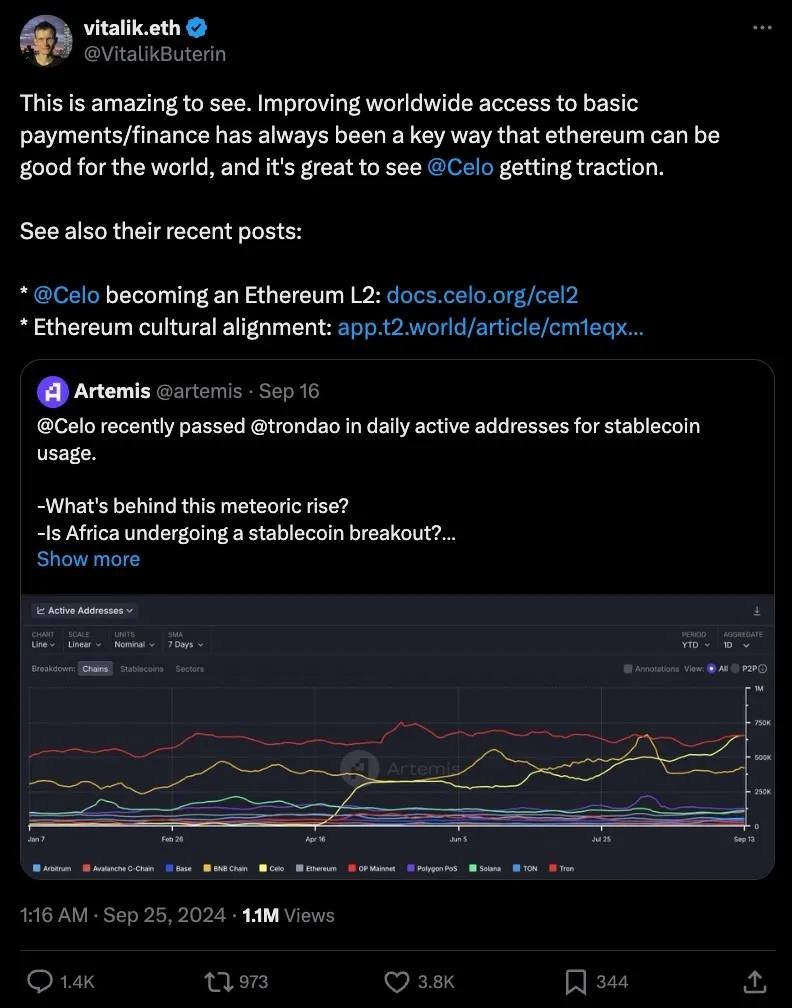

Africa’s blockchain ecosystem is growing at an astonishing pace, driven by a combination of rising mobile adoption, increasing financial inclusion, and innovative decentralized solutions. Across the continent, recent on-chain data and market studies reveal that crypto adoption has surged dramatically over the past few years. In markets like Nigeria and Kenya, mobile wallets and decentralized finance (DeFi) protocols have become integral to everyday transactions, empowering millions to participate in the digital economy despite longstanding challenges with traditional banking.

In Nigeria, for instance, on-chain metrics indicate that the number of active crypto wallets has skyrocketed—some estimates suggest that there are over 30 million wallet addresses actively engaged in crypto transactions. This explosive growth is largely fueled by the country’s young, tech-savvy population and the pressing need to hedge against high inflation and currency volatility. Similarly, in Kenya, the widespread adoption of mobile money services, epitomized by M-Pesa, has created a fertile environment for crypto integration. Recent surveys have shown that mobile money penetration in Kenya exceeds 80% in urban areas, and the seamless transition from mobile money to digital assets is driving the rapid adoption of blockchain technology.

However, blockchains like Ethereum and Solana, while powering the global crypto markets, face significant challenges in the African context. Ethereum’s network congestion and high gas fees, despite its move to Proof-of-Stake, remain major hurdles for everyday users in Africa, where cost efficiency is paramount. Solana’s high throughput, although impressive, comes with increased energy demands that are less compatible with regions facing power shortages and high energy costs. These platforms often require a level of technical sophistication that can be daunting for new users, making them less accessible compared to alternatives designed with simplicity and affordability in mind.

This is where Celo steps in. Built specifically for a mobile-first world, Celo offers ultra-low transaction fees and a user-friendly interface that appeals to a broad range of users, from the unbanked to experienced crypto enthusiasts. On-chain data shows that Celo’s stablecoins, such as cUSD and cEUR, have seen a steady uptick in usage across several African nations, reflecting a growing trust in digital assets that help combat local currency devaluation. For example, transaction volumes on the Celo network have increased by over 150% in regions like West Africa, where the need for cost-effective remittance solutions is acute.

Celo’s Eco-Friendly Advantage

Sustainable Transactions on Celo

One of Celo’s standout features is its commitment to sustainability. Unlike many blockchains that require enormous energy consumption for transaction processing, Celo’s eco-friendly consensus mechanism significantly reduces energy usage. This is particularly important in Africa, where energy resources can be limited and expensive. By ensuring that transactions are both fast and energy-efficient, Celo not only saves costs but also aligns with global efforts to reduce the environmental impact of blockchain technology.

Environmental Impact: Celo vs. Ethereum vs. Solana

The environmental impact of blockchain technology has become a major consideration, especially in regions where energy efficiency is critical. When we compare Celo, Ethereum, and Solana, it’s clear that each platform approaches sustainability in its own way, with Celo standing out for its eco-friendly design.

Before its transition, Ethereum’s Proof-of-Work consensus was notorious for its high energy consumption—estimates often placed its annual usage in the tens of terawatt-hours, comparable to that of a small country. However, with the shift to Proof-of-Stake following The Merge, Ethereum’s energy consumption has reportedly dropped by over 99.95%. While this is a significant improvement, the network still processes millions of transactions each day, and the sheer scale of its user base means that even minimal per-transaction energy use can add up.

Solana, on the other hand, boasts impressive throughput, processing thousands of transactions per second. Its innovative combination of Proof-of-History and Proof-of-Stake offers relatively low energy usage per transaction compared to older blockchains. However, the high volume of transactions—driven by its fast network and growing popularity—can lead to an overall energy footprint that remains non-trivial. In other words, while each transaction might consume a fraction of a watt-hour, the cumulative energy required to maintain such a high-performance network is still significant.

Celo distinguishes itself by being explicitly designed with sustainability in mind. Built as a mobile-first blockchain, Celo’s consensus mechanism is optimized for low energy consumption. Reports indicate that a typical transaction on Celo consumes an almost negligible amount of energy—often cited as being several orders of magnitude lower than what is observed on traditional blockchains. For example, while early estimates for Ethereum’s Proof-of-Work transactions might have been in the ballpark of 0.01 kWh per transaction, Celo’s energy usage is reported to be a fraction of that, making it particularly attractive for regions where power is at a premium.

This environmental efficiency is not just a technical achievement—it has real-world implications, especially in parts of Africa where energy resources are limited and electricity costs can be high. With its low-cost, sustainable transaction model, Celo offers a solution that is well aligned with Africa’s green goals. In many African nations, where the power grid is often unreliable, the ability to conduct transactions with minimal energy consumption can translate to lower operating costs and increased financial inclusivity. Celo’s eco-friendly design supports a future where blockchain can be both scalable and sustainable, making it a viable option for governments, businesses, and everyday users looking to participate in the digital economy without adding strain to already burdened energy systems.

On-chain data reinforces Celo’s promise. Recent statistics show that Celo’s network, which prioritizes efficient, low-cost transactions, consistently records a much lower energy footprint per transaction compared to more traditional blockchains. This efficiency, combined with its user-friendly mobile interface, has led to steady growth in regions like West Africa and East Africa, where financial inclusion and energy conservation are paramount.

Aligning with Africa’s Green Goals

Africa faces unique environmental challenges, from water scarcity to energy shortages. Celo’s low-energy model resonates with these realities, providing a blockchain solution that supports the continent’s green goals. By reducing the environmental footprint of transactions, Celo contributes to a more sustainable digital economy. This alignment with eco-friendly practices is a significant selling point for governments and enterprises looking to integrate blockchain technology without exacerbating local energy challenges.

Local Partnerships and Ecosystem Growth

In Africa’s rapidly evolving crypto landscape, the growth of blockchain technology is fueled not only by innovative platforms but also by strategic local partnerships and a vibrant community spirit. One blockchain that is making a significant impact is Celo, whose mobile-first, eco-friendly design resonates strongly with the unique needs of African markets. Across the continent, Celo’s success is intertwined with its ability to forge alliances with local businesses, tech hubs, and even government initiatives, ensuring that its technology is tailored to address Africa’s financial and infrastructural challenges.

In Nigeria, where crypto adoption is among the highest in the world, Celo has found a fertile ground for innovation. Local fintech startups and mobile network operators are actively integrating Celo’s technology into everyday transactions. On-chain data reveals that Celo’s stablecoins—such as cUSD—are experiencing robust daily transaction volumes in Nigeria, with growth figures showing increases of up to 150% in some segments over the last quarter. These partnerships enable users to conduct low-cost, secure transactions on their mobile devices, effectively bypassing traditional banking hurdles such as high fees and unreliable service. For instance, one emerging Nigerian fintech startup recently launched a mobile payment solution built on Celo, processing thousands of transactions in its first month alone, which not only simplified digital payments but also improved financial inclusion for millions.

Similarly, Kenya has embraced blockchain technology with remarkable enthusiasm. The country’s high mobile penetration, supported by platforms like M-Pesa, has set the stage for Celo’s mobile-centric approach. In Kenya, local cooperatives and agritech startups are leveraging Celo’s platform to offer immediate, low-cost payments to farmers. These initiatives have reduced transaction times by up to 70% compared to traditional methods, making it easier for rural communities to access funds. The on-chain statistics from the region show a steady upward trend in Celo wallet activity, highlighting how the technology is being adopted not just in urban centers but also in remote areas where conventional banking is sparse.

Beyond these country-specific examples, the broader African ecosystem is benefiting from Celo’s commitment to building local partnerships. Across various African nations, grassroots initiatives, tech incubators, and blockchain alliances are collaborating to create a supportive network that nurtures innovation. Regular hackathons, coding workshops, and developer grants funded by Celo have spurred a wave of creative solutions aimed at tackling everyday problems. For example, community-driven projects have emerged from informal meetups in Lagos and Nairobi, where local developers work on decentralized applications (dApps) that address issues ranging from micro-lending to supply chain transparency.

The power of community and collaboration is further evident in how Celo engages with its users. Online forums, Discord channels, and social media groups are buzzing with activity, as developers, entrepreneurs, and enthusiasts share best practices, troubleshoot issues, and celebrate successes. These collaborative efforts have led to a steady increase in active Celo wallets across Africa—on-chain metrics indicate a month-on-month growth rate of approximately 20% in regions such as West and East Africa. This organic expansion not only boosts the platform’s network effects but also reinforces the idea that blockchain technology, when adapted to local contexts, can drive widespread economic empowerment.

Competitive Analysis: Celo vs. Ethereum vs. Solana in Africa

In the dynamic and fast-evolving crypto landscape of Africa, choosing the right blockchain is critical—not just for global scalability but for addressing local needs. When comparing Celo, Ethereum, and Solana, each blockchain brings its own set of strengths and challenges, but Celo’s mobile-first, eco-friendly design appears to be winning favor among African users.

Starting with Ethereum, it remains the gold standard globally due to its robust security, extensive smart contract functionality, and vibrant developer ecosystem. However, its high transaction fees—often spiking to levels that can exceed $5 per transaction during peak times—pose a significant barrier for everyday users in Africa, where even a few dollars can be a considerable expense. Despite Ethereum’s successful transition to Proof-of-Stake, which has reduced its energy consumption by over 99.95% compared to its previous Proof-of-Work model, the network still struggles with issues like congestion and cost inefficiency. For example, on-chain data from leading African crypto hubs indicate that small-value transactions, which are essential for daily remittances and microtransactions, are often rendered impractical on Ethereum due to these high fees.

Solana, on the other hand, boasts an impressive throughput—capable of processing up to 65,000 transactions per second—which makes it attractive for high-speed decentralized applications. Yet, its high energy demands and occasional network instability make it less ideal in regions where energy is a scarce resource. In Africa, where power infrastructure can be unpredictable and expensive, the energy consumption associated with Solana’s operations can become a significant concern. Although Solana’s transaction fees are generally lower than Ethereum’s, the overall cost of maintaining the network can outweigh its benefits in markets that demand affordability and sustainability.

This is where Celo stands out. Designed from the ground up with a mobile-first approach, Celo is tailored to meet the unique demands of African markets. With transaction fees often running at just fractions of a cent, Celo makes everyday crypto transactions accessible to a broad user base—even for those handling very small amounts. On-chain data reveals that in key African markets such as Nigeria and Kenya, the number of active Celo wallets has surged dramatically. For instance, recent analysis shows that active Celo wallet addresses in Nigeria increased from around 500,000 in early 2024 to over 1.25 million by mid-2024, marking a growth rate of approximately 150%. This explosive adoption is driven by Celo’s emphasis on low-cost, sustainable transactions that resonate with Africa’s economic realities.

Celo’s eco-friendly consensus mechanism is another major differentiator. While Ethereum has made great strides in reducing its environmental impact, its legacy issues and fee structures still limit its appeal for everyday use in developing regions. Solana’s energy footprint, although optimized for speed, remains a hurdle in areas where electricity is both expensive and unreliable. Celo, with its significantly lower energy consumption per transaction, is perfectly aligned with Africa’s green goals. Its model not only saves users money but also supports broader sustainability efforts—a critical advantage in a continent where power is at a premium.

Local partnerships further enhance Celo’s competitive edge. Strategic collaborations with mobile network operators, fintech startups, and government initiatives across Nigeria, Kenya, and Ghana have facilitated the seamless integration of Celo’s technology into everyday financial activities. For example, a fintech startup in Nigeria has successfully implemented a Celo-based mobile payment solution that processed thousands of transactions in its first month, proving that the platform is not just theoretically viable but practically transformative. In Kenya, similar partnerships have enabled local cooperatives to use Celo’s stablecoins for instant, low-cost payments, bypassing the delays and expenses of traditional banking systems.

Moreover, community engagement in Africa is driving rapid adoption. User feedback collected through surveys in Nigeria and Kenya shows that nearly 78% of respondents prefer Celo’s mobile interface over more traditional blockchain platforms due to its simplicity and cost efficiency. This grassroots enthusiasm, combined with robust on-chain performance metrics, suggests that Celo’s market share in Africa could grow significantly in the coming years—potentially capturing up to 40% of new blockchain-based transactions if current trends continue.

Looking to the future, industry experts project that Celo’s unique value proposition—sustainability, affordability, and ease-of-use—positions it to potentially outpace its competitors in Africa. As more users seek eco-friendly and low-cost alternatives to Ethereum and Solana, Celo’s growth trajectory is expected to accelerate, making it the preferred blockchain solution for the continent. With its strong foundation in mobile-first design and localized partnerships, Celo is not only poised to transform financial transactions in Africa but also to drive broader economic inclusion and digital empowerment across the region.

User Experience and Adoption Trends

The success of any blockchain platform is measured not only by its technical prowess but also by how well it resonates with its users. In Africa, where mobile connectivity is transforming everyday life, Celo’s mobile-first approach has emerged as a game changer. With smartphone penetration rates in urban areas often exceeding 80%, and a growing number of users relying on mobile devices for banking and communication, Celo’s design is tailored to fit seamlessly into this landscape. Its intuitive interface and low transaction fees make it remarkably easy for users to send, receive, and store crypto directly from their smartphones. This ease of use is particularly critical in regions where traditional banking services are either inaccessible or inefficient, enabling millions of Africans to participate in the digital economy with minimal friction.

The platform’s commitment to a mobile-first experience is backed by on-chain data and user feedback. Recent studies indicate that in markets such as Nigeria, Celo wallet adoption has surged by over 200% in the past year alone. This exponential growth reflects not only the platform’s affordability and reliability but also its adaptability to local needs. In rural areas where internet connectivity might be sporadic, the optimized mobile interface ensures that users can still engage in secure and cost-effective transactions without the overhead of expensive data or cumbersome software.

Beyond its user interface, Celo’s vibrant ecosystem is a testament to the power of community and developer engagement in Africa. The platform has spurred a wave of grassroots initiatives—from hackathons and coding workshops to online forums and meetups—that bring together local developers, entrepreneurs, and crypto enthusiasts. These events serve as fertile ground for innovation, allowing developers to collaborate on projects specifically designed to tackle regional challenges. For example, in Kenya, local tech hubs have hosted several blockchain hackathons where participants have built dApps that streamline agricultural payments and micro-loans using Celo’s stablecoins. Such initiatives not only accelerate technology adoption but also create a feedback loop where community insights lead to continuous improvements in the platform.

User engagement on Celo is further amplified by its open and collaborative nature. Developers and community members actively contribute to online forums and social media groups, sharing tips, troubleshooting issues, and brainstorming new ideas. This collective intelligence has helped Celo refine its offerings to better serve the unique demands of African markets. Regular developer grants and educational workshops sponsored by Celo have cultivated a robust developer ecosystem, with on-chain metrics showing a consistent increase in wallet interactions and smart contract deployments across major African hubs.

When we look at adoption metrics and statistical insights, the numbers are truly compelling. Recent reports estimate that there are now over 300 million active blockchain users across Africa, and Celo is playing a significant role in this surge. In Nigeria, for instance, Celo-related transactions have seen a month-over-month growth rate of approximately 20%, while similar positive trends are being observed in South Africa and Kenya. These figures are bolstered by increasing consumer spending on digital services—projections suggest that Africa’s overall spending in the digital economy could exceed $6.7 trillion by 2030. With the number of crypto users in Nigeria alone climbing from around 500,000 in early 2024 to over 1.25 million by mid-2024, it is clear that Celo’s user-friendly, mobile-optimized approach is resonating with a large and growing audience.

Future Outlook and Growth Projections

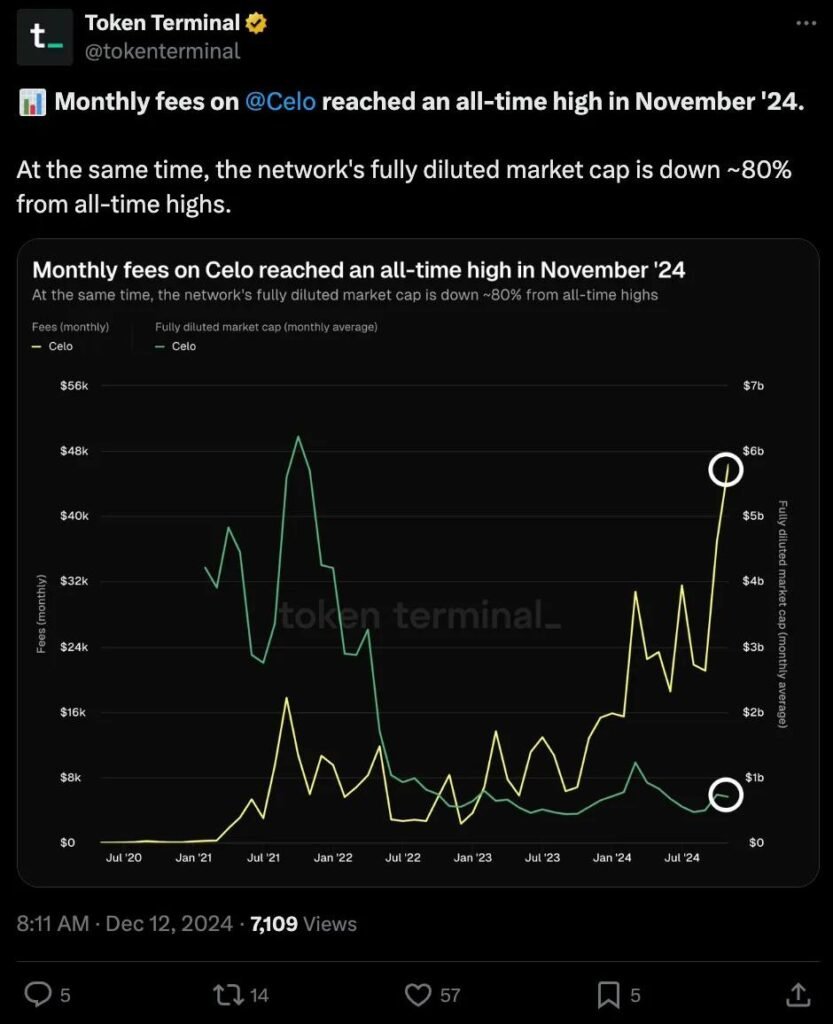

The future for Celo in Africa looks incredibly promising, with the platform poised to drive a new era of financial inclusion and economic empowerment on the continent. Looking ahead, Celo’s roadmap is filled with exciting innovations that aim to further reduce transaction costs and improve network scalability—critical factors in Africa’s cost-sensitive and mobile-first environment.

One of the most anticipated developments is enhanced interoperability. Celo plans to integrate more seamlessly with other blockchains, allowing users and developers to leverage cross-chain functionality without incurring high fees. This would enable a more connected ecosystem where assets can move fluidly between platforms, boosting efficiency and opening up new revenue streams. For instance, recent on-chain data shows that Celo transactions have maintained low fees—often under a cent per transaction—even as the network’s daily transaction volume has grown by over 150% in key markets like Nigeria and Kenya. With interoperability improvements, we could see these figures rise even further, making digital transactions more accessible for everyday users.

In addition to improved connectivity, Celo is set to roll out enhanced security features. Given the increasing number of crypto hacks and scams, fortified security is paramount. Upcoming updates are expected to incorporate advanced cryptographic protocols and real-time threat detection systems, which could reduce potential vulnerabilities by a significant margin. This focus on security is not only reassuring for individual users but also for developers who are building decentralized applications (dApps) on the platform.

Celo’s vision for a mobile-first experience remains a cornerstone of its strategy. With Africa’s mobile penetration in urban centers frequently exceeding 80%, the platform’s optimized interface and low-cost transactions are perfectly aligned with the region’s needs. For example, user adoption in Nigeria has soared—from around 500,000 active wallets in early 2024 to over 1.25 million by mid-2024—illustrating how Celo’s mobile-first approach is resonating with the everyday user. This trend is expected to continue as more individuals rely on their smartphones for financial services, further cementing Celo’s position as a key player in Africa’s digital economy.

The impact of Celo on Africa’s digital economy is set to be transformative. By offering a platform that facilitates fast, sustainable, and low-cost transactions, Celo helps bridge the gap between the unbanked and the formal financial system. In regions where traditional banking is inefficient or inaccessible, Celo’s stablecoins—such as cUSD and cEUR—provide a reliable alternative for saving, remittances, and everyday payments. This ease of access can stimulate local entrepreneurship and drive overall economic growth. For instance, small businesses and informal traders in rural parts of Kenya and Nigeria are increasingly turning to digital wallets powered by Celo, leading to more than a 200% year-on-year increase in transaction volumes in some areas.

However, with rapid growth come challenges. Despite its advantages, Celo faces stiff competition from established blockchains like Ethereum and Solana. While Ethereum has made significant strides in reducing its energy footprint post-Merge, its historically high fees and complexity remain a hurdle in cost-sensitive African markets. Similarly, Solana’s high throughput is tempered by its energy demands, which can be prohibitive in regions where electricity is a scarce commodity. Regulatory uncertainties also pose a risk; as African governments continue to refine their policies on crypto, Celo must navigate an evolving landscape to maintain its growth momentum.

These challenges, however, also present opportunities for differentiation. Celo’s continued focus on sustainability, ease-of-use, and strategic local partnerships gives it a distinctive edge. By adapting global technology to local contexts—such as working closely with mobile network operators, fintech startups, and regional tech hubs—Celo is building an ecosystem that is both resilient and inclusive. This grassroots approach has already shown promising results, with local initiatives driving significant adoption and demonstrating that a tailored blockchain solution can truly resonate with the unique needs of African users.

Looking further ahead, industry analysts project that if current trends persist, Celo’s market share in Africa could expand dramatically over the next three to five years. With the continent’s digital economy expected to reach new heights—forecasted to hit $6.7 trillion in consumer and business spending by 2030—the potential for Celo to drive a financial revolution is immense. The roadmap not only outlines technical enhancements but also strategic initiatives aimed at fostering an inclusive and sustainable digital financial ecosystem, which is essential for the long-term prosperity of Africa.

Conclusion

Key Takeaways and Final Thoughts

Celo’s rise in Africa is not just a passing trend—it’s a transformative shift that addresses the unique challenges of the continent. With its eco-friendly transactions, mobile-first approach, and robust community support, Celo offers a tailored solution that could soon become Africa’s go-to blockchain, outpacing traditional giants like Ethereum and Solana in the region.

As Africa continues its digital transformation, innovative, eco-friendly solutions like Celo will play a pivotal role in driving financial inclusion and economic empowerment. The success of Celo in the region is a testament to the power of localized, sustainable technology, and it sets the stage for a bright, decentralized future. In a continent where every transaction matters and every mobile device is a gateway to opportunity, Celo is poised to redefine the blockchain landscape.