South Africa’s FATF Exit, Crypto Market Turmoil: Weekly Crypto News Update | TawkWrap

Welcome to this week’s edition of Tawkwrap, where we break down the latest happenings in the crypto world in a casual, yet detailed way. We’re kicking things off with market price action, diving into some big African crypto news, and then covering all the other must-know headlines. Let’s jump right in!

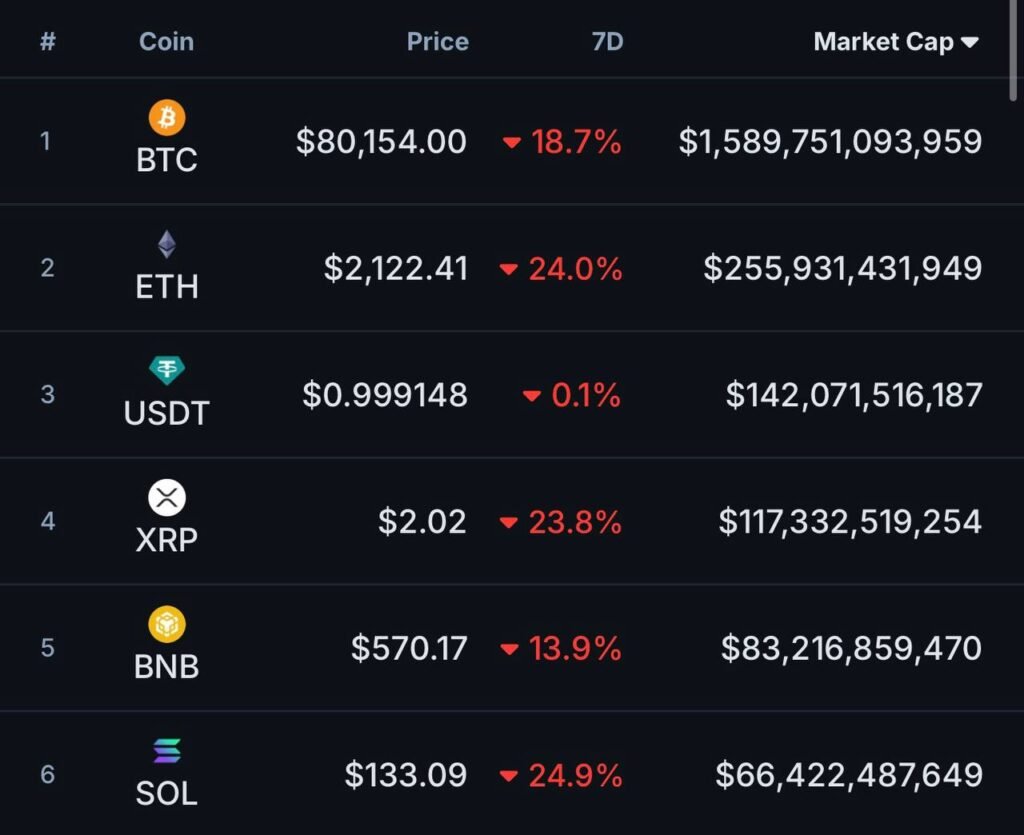

Market Price Action

It’s been a volatile week for crypto investors. Bitcoin (BTC) took a notable hit, dropping by 18% to settle at $80,100, while Ethereum (ETH) wasn’t far behind, sliding 24% down to $2,122. The downturn didn’t stop there—XRP fell sharply by 23% to $2.02, and Solana (SOL) saw an 24% decrease, now trading at $133. These rapid price swings remind us all of the inherent unpredictability in the crypto market, where value can change in the blink of an eye.

African Crypto News

South Africa Eyes FATF Grey List Exit

In some promising regulatory news, South Africa is on track to exit the Financial Action Task Force (FATF) grey list by October 2025. Authorities have successfully resolved 20 of the 22 action items flagged by the global watchdog, signaling significant progress in enhancing the nation’s AML/CFT measures. This move not only bolsters South Africa’s international reputation but also paves the way for increased confidence in its burgeoning crypto sector.

Ethiopian Blockchain Startup Transforms the Coffee Supply Chain

Ethiopia’s rich coffee heritage is getting a futuristic upgrade thanks to WAGA, a pioneering blockchain startup. Founded by Emanuel Acho (PhD) and Hana Terefe during their time at Nethermind, WAGA is set to streamline Ethiopia’s coffee supply chain through tokenization. By digitizing coffee batches and embedding critical data on the blockchain, WAGA aims to bring transparency, traceability, and fairer value distribution to the industry. This innovative approach could revolutionize how coffee is traded, benefiting smallholder farmers and coffee enthusiasts alike.

FSCA to Sandbox Select DeFi Use Cases

In regulatory developments, South Africa’s Financial Sector Conduct Authority (FSCA) is planning to incorporate certain decentralized finance (DeFi) use cases into the Intergovernmental Fintech Working Group (IFWG) regulatory sandbox. According to a recent survey, the number of DeFi users in South Africa is expected to hit nearly 400,000 by 2025, with retail customers (71%) leading the charge. This initiative is set to provide valuable insights and help shape future regulations, ensuring the growth of DeFi while mitigating associated risks.

Other Headlines

Bybit Hack: A $1.4 Billion Security Breach

Bybit suffered a massive $1.4 billion hack, making it one of the biggest crypto security breaches to date. The FBI has linked the attack to North Korea’s Lazarus Group, known for high-profile crypto thefts. Stolen funds were swiftly laundered across multiple networks, highlighting ongoing risks for centralized exchanges.

Bybit has pledged to enhance security, and offered a $140 million bounty for information leading to fund recovery. The breach underscores the urgent need for stronger cybersecurity measures as exchanges remain prime targets for sophisticated hackers.

$RAY Plummets 58% Amid “Pump Fun” own DEX

Speculation surrounding the platform “Pump Fun” launching its own DEX sparked panic selling, causing a sharp 58% decline in the price of $RAY (Radium). The sudden drop underscores the volatile nature of crypto coins, where market sentiment, social media buzz, can trigger rapid and extreme price movements.

While some traders saw this as an opportunity to buy the dip, others were left questioning the sustainability of these tokens. The incident highlights the risks of investing in speculative assets and the influence of social media in shaping short-term market trends.

Robinhood Gets a Regulatory Breather

In a welcome turn of events for retail traders, the Securities and Exchange Commission (SEC) has dismissed its crypto investigation into the popular trading platform Robinhood. This development removes a cloud of regulatory uncertainty hanging over Robinhood’s crypto operations, giving investors more clarity as the platform continues to expand its digital asset offerings.

OKX Fined $55 Million for AML Violations

Cryptocurrency exchange OKX has pleaded guilty to Anti-Money Laundering (AML) violations and agreed to pay $55 million in fines. This hefty penalty underscores the increasing scrutiny from regulators and the growing emphasis on compliance within the crypto industry, ensuring that exchanges maintain robust systems to prevent illicit activities.

FTX’s SBF Sends Shockwaves from Jail

In an unexpected twist, Sam Bankman-Fried (SBF), the embattled founder of the now-collapsed FTX exchange, made headlines by posting on X (formerly Twitter) from jail. This post led to a temporary 30% surge in the value of FTX’s native token, FTT, demonstrating Sbf’s lingering influence in the crypto community despite his incarceration

Citadel Securities Dabbles in Crypto Market-Making

Big names from traditional finance are dipping their toes into the digital asset pool. Ken Griffin’s Citadel Securities is reportedly exploring market-making activities on major cryptocurrency exchanges like Coinbase and Binance. This move signals a growing integration between conventional finance and the crypto market, hinting at more institutional participation in the near future.

MicroStrategy’s Bitcoin Bonanza Continues

Ever the Bitcoin bull, MicroStrategy has added another $2 billion worth of Bitcoin to its portfolio. This acquisition reinforces the company’s long-term belief in Bitcoin’s potential as a treasury asset, further cementing its status as a major player in the institutional crypto investment space.

Bitcoin ETFs See Record Outflows

US spot Bitcoin ETFs experienced a record $1 billion in outflows in a single day, marking a significant shift in investor sentiment. Whether driven by market volatility or broader macroeconomic concerns, this trend might indicate a cooling period for ETF investors and a reassessment of exposure to Bitcoin through these products.

PI Coin Hits an All-Time High

In positive news for the PI coin community, the token reached an all-time high, sparking renewed interest and optimism among supporters. This milestone reflects growing enthusiasm and confidence in the project, suggesting that innovative concepts can still capture the imagination of crypto enthusiasts.

Ethereum Foundation’s New Leadership

Change is in the air at the Ethereum Foundation, as the organization has welcomed a new president. This leadership change could steer the future direction of Ethereum’s development, influencing everything from technological upgrades to community initiatives, and setting the stage for what’s next in the Ethereum ecosystem.

Solana’s Inflation Slash Proposal

Solana enthusiasts might be in for some good news if a recent proposal to slash the network’s inflation rate by 80% goes through. Such a drastic change could have significant implications for Solana’s tokenomics, potentially stabilizing its price and enhancing long-term value for holders.

Presidential Meme Coins: A Legislative Push

Finally, House Democrats have introduced a bill aimed at banning presidential meme coins. This proposal reflects growing regulatory concerns about meme coins linked to political figures, with lawmakers seeking to curb market manipulation and protect investors from potentially misleading or harmful financial products.

That’s a wrap for this week’s Tawkwrap! We hope this roundup gives you a clear picture of the latest market trends and key developments in the crypto world. Stay tuned for more updates, and as always, happy trading!