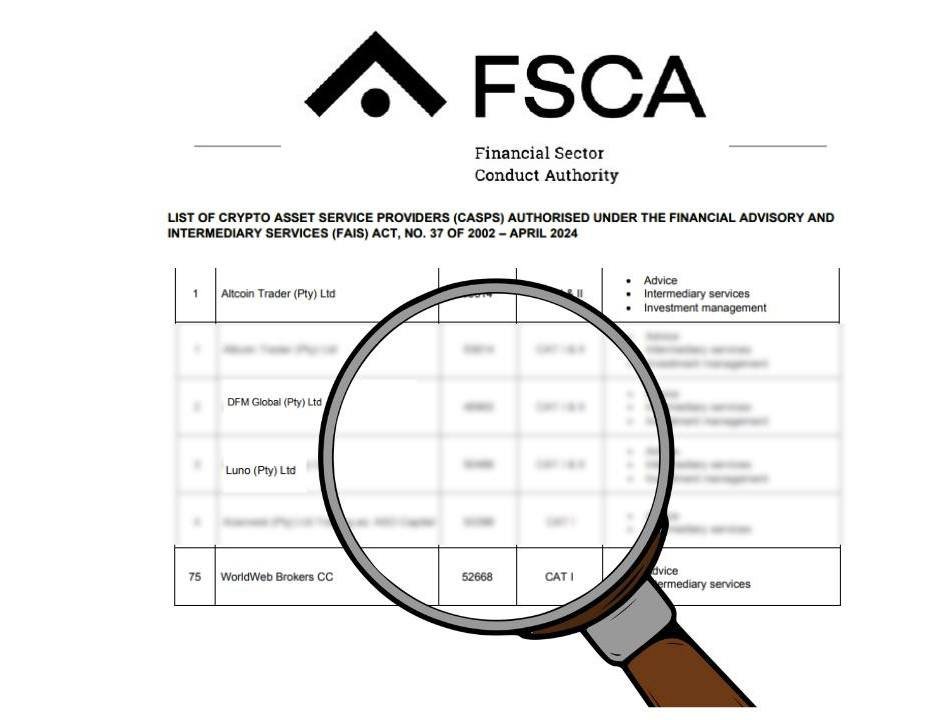

South Africa Approves 248 Crypto Providers Out of 420 Applications: FSCA Report

South Africa’s Financial Sector Conduct Authority (FSCA) has made significant progress in regulating the nation’s crypto industry by approving 248 Crypto Asset Service Provider (CASP) licenses from a total of 420 applications submitted. This milestone reflects the country’s ongoing efforts to establish a robust regulatory framework for crypto assets, ensuring consumer protection while fostering innovation in the burgeoning digital economy.

The FSCA’s latest update also revealed that only nine applications have been rejected, while 106 applications were voluntarily withdrawn after discussions with the regulator about the suitability of their business and operational models.

Key Details of the Licensing Process

- Approval and Rejection Statistics:

- Out of the 420 applications received:

- 248 CASPs have been granted licenses to operate legally in the country.

- 9 applications were rejected due to non-compliance with the regulatory requirements.

- 106 applications were voluntarily withdrawn after discussions with the FSCA, with applicants advised to refine their business models or address gaps in compliance.

- Out of the 420 applications received:

- Reasons for Rejection: Applications were primarily rejected for failing to meet the ‘fit and proper’ criteria outlined in the Financial Advisory and Intermediary Services (FAIS) Act. The FSCA identified two critical areas of deficiency:

- Operational Ability: Applicants failed to provide detailed business plans or descriptions of their operating models. These plans are required to outline crypto-related activities and demonstrate a robust operational framework.

- Competency: Many applicants lacked the necessary knowledge or practical experience to operate within the crypto asset industry, a vital requirement to ensure consumer protection and market integrity.

- Voluntary Withdrawals:

- Applicants who voluntarily withdrew their applications were advised to address shortcomings in their business models or demonstrate greater compliance with licensing requirements.

- The FSCA emphasized that these entities can reapply in the future, provided they meet all regulatory standards.

- Warning to Non-Compliant Entities:

- The FSCA cautioned that any individual or institution engaging in CASP-related activities without proper authorization will face regulatory action.

- However, institutions that submitted their applications before the November 30, 2023 deadline and are still awaiting finalization are exempt from this restriction until a decision is made on their applications.

Extended Deadline for Regulatory Exams

To provide CASPs and their key individuals with more time to meet regulatory examination requirements, the FSCA has extended the compliance deadline from November 11, 2024, to June 30, 2025.

Failure to meet these requirements could lead to severe consequences, including suspension or withdrawal of authorization to operate.

South Africa: A Leader in African Crypto Regulation

In 2022, South Africa became the first African country to classify crypto assets as financial products, bringing them under the regulatory purview of the FAIS Act. This groundbreaking move was designed to mitigate risks associated with the crypto market, such as fraud, money laundering, and financial misconduct, while ensuring consumer protection.

The FSCA’s regulatory approach positions South Africa as a leader in African crypto regulation, fostering a safer and more transparent environment for digital asset innovation. By approving CASP licenses, the authority ensures that only compliant and competent providers can operate within the crypto market, building trust among consumers and investors alike.

Future Opportunities for Crypto Providers

The FSCA’s decision to allow rejected or withdrawn applicants to reapply signals a willingness to engage constructively with the industry. To secure licenses in the future, applicants must:

- Develop comprehensive business plans that clearly outline their crypto activities and operational frameworks.

- Acquire the necessary knowledge and practical experience in crypto asset management to meet the competency requirements.

For businesses, this presents an opportunity to strengthen internal processes, improve compliance measures, and align with global best practices.

Protecting Consumers and Fostering Growth

By requiring CASPs to meet stringent licensing requirements, the FSCA aims to balance innovation with consumer protection. The regulatory authority remains committed to addressing the risks associated with the crypto market, including:

- Fraud: Ensuring only fit and proper entities operate in the market to protect users from scams.

- Money Laundering: Mandating compliance with anti-money laundering (AML) and counter-terrorism financing (CTF) standards.

- Market Integrity: Promoting transparency and trust in the crypto ecosystem.

Conclusion

South Africa’s FSCA is leading the way in shaping a regulated crypto landscape in Africa, setting the stage for increased adoption of digital assets under a structured framework. With 248 licensed crypto providers already approved, the country is well-positioned to become a regional hub for blockchain innovation. However, as the FSCA continues to enforce strict compliance measures, crypto asset service providers must prioritize operational excellence and regulatory adherence to thrive in this evolving ecosystem.

This proactive regulatory stance not only fosters consumer trust but also signals South Africa’s intent to leverage the potential of blockchain technology to drive financial inclusion and economic growth. As the deadline for regulatory examination approaches in 2025, the FSCA’s framework will continue to shape the future of crypto in South Africa and beyond.