Leading Global Accounting Firm KPMG Urges Nigerian Banks to Embrace Cryptocurrencies and Blockchain

In a groundbreaking report titled ‘Crypto Risk and Opportunities in Nigeria: A New Banking Paradigm’, leading global accounting firm KPMG has urged Nigerian financial institutions to integrate blockchain technology and collaborate with cryptocurrency firms rather than distancing themselves from the sector.

The Impact of the CBN Crypto Ban and Nigeria’s Growing Crypto Adoption

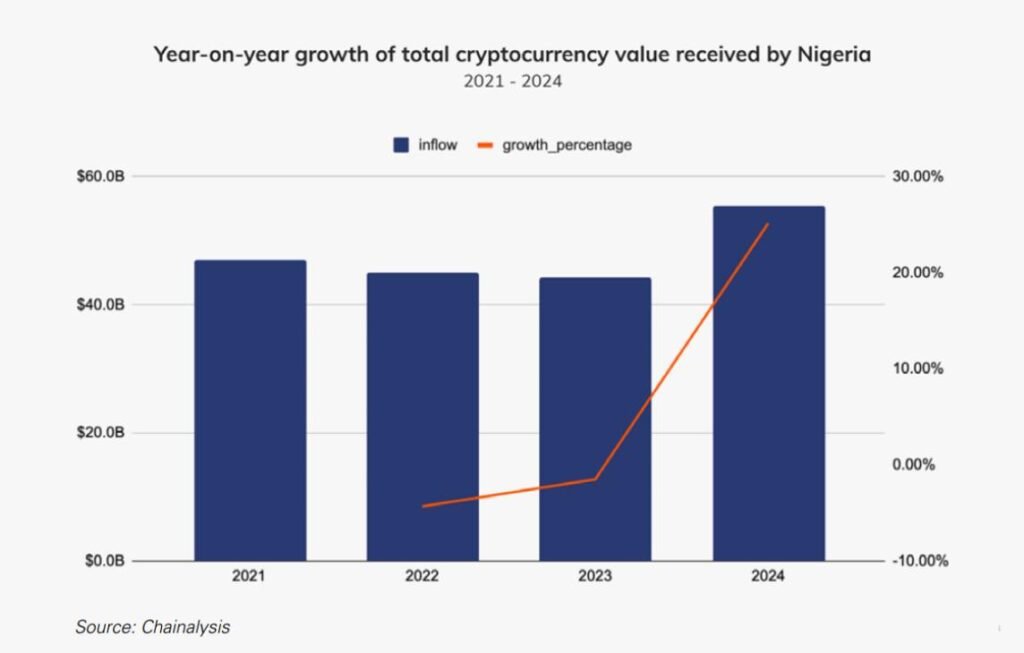

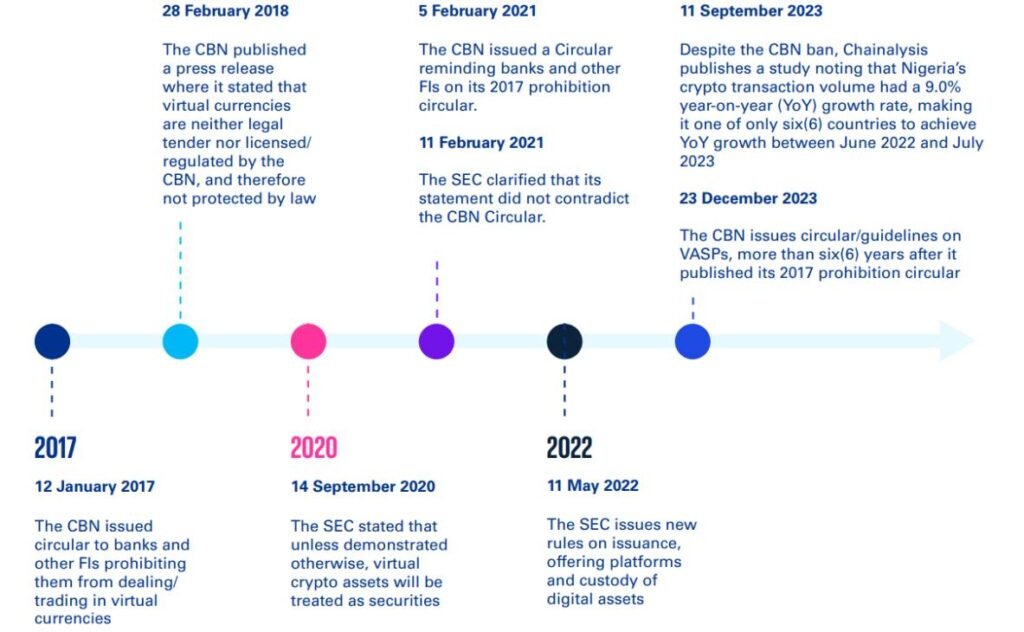

The March 2025 report critically examines the unintended consequences of the Central Bank of Nigeria’s (CBN) 2021 ban on banks processing cryptocurrency transactions. According to KPMG, data from Chainalysis indicates that the ban did not deter crypto adoption in Nigeria. Instead, Nigeria’s share of global crypto inflows has increased since 2021, reinforcing the country’s status as a major player in the digital asset space.

“Despite the CBN ban, Chainalysis publishes a study noting that Nigeria’s crypto transaction volume had a 9.0% year-on-year (YoY) growth rate, making it one of only six (6) countries to achieve YoY growth between June 2022 and July 2023,” the report states.

Additionally, the high costs associated with cross-border transactions through traditional finance channels have driven both domestic users and the Nigerian diaspora to leverage crypto for more cost-effective and efficient remittances.

While crypto inflows into Nigeria saw a decline in 2022 and 2023, this trend was consistent with global market downturns rather than being a direct consequence of the CBN’s restrictions. The report further highlights local factors such as regulatory penalties imposed on banks in 2022 and the Naira devaluation in 2024 as contributors to fluctuating crypto adoption patterns.

P2P Trading and Nigeria’s Progressive Crypto Regulations

Despite the regulatory restrictions, Nigeria remained a hotbed for crypto activity, with peer-to-peer (P2P) trading platforms thriving. The CBN’s decision to reverse its stance in December 2023, allowing banks to service licensed crypto firms, marked a pivotal shift in Nigeria’s regulatory framework.

Since then, Nigeria has positioned itself as a leader in crypto regulation within Africa. In 2024, the country granted multiple licenses to digital asset firms, signaling a move toward a structured and progressive approach to crypto adoption.

Opportunities in Bank-Crypto Collaboration

KPMG emphasizes that the recent shift toward crypto integration presents significant opportunities for both traditional banks and crypto firms.

By collaborating with blockchain companies, banks can leverage emerging technologies to enhance their existing financial systems. The report underscores how blockchain’s advanced monitoring capabilities surpass traditional oversight methods, offering improved security and fraud detection mechanisms.

“By integrating blockchain analytics into their compliance frameworks, forward-thinking banks and other financial institutions would enhance their ability to detect illicit finance, expand into new financial services, and position themselves at the forefront of an increasingly digital financial system,” the report highlights.

From the perspective of cryptocurrency exchanges and digital asset firms, partnering with banks allows them to benefit from the financial sector’s expertise in risk management. This collaboration can help crypto platforms strengthen financial integrity, implement robust anti-money laundering (AML) measures, and gain broader institutional acceptance.

The Future of Banking and Crypto in Nigeria

The report concludes that fostering synergy between traditional financial institutions and crypto firms will create a mutually beneficial ecosystem. KPMG stresses that embracing blockchain technology and regulatory clarity will pave the way for innovation while ensuring financial stability and risk management.

“The integration of traditional banking services with crypto firms creates a symbiotic cycle – banks gain exposure to technological innovation while bringing their institutional risk management expertise to the sector.”

As Nigeria continues to refine its crypto policies and integrate digital assets into the mainstream financial system, the role of banks in the crypto ecosystem will be crucial. With institutions like KPMG advocating for blockchain adoption, the Nigerian financial sector stands at the cusp of a transformative shift that could redefine the country’s banking landscape in the years to come.

Read also: P2P Crypto Trading in Africa — The Unstoppable $100B Market