How to Survive the Next Crypto Bear Market (Before It Even Begins!)

Introduction: The Crypto Boom & Bust Cycle

If you’ve been in crypto long enough, you’ve seen the wild swings—one day, everything is mooning, and the next, it’s a full-blown market meltdown. These cycles aren’t random; they’re part of crypto’s DNA. Understanding why crypto markets are volatile, how bull and bear cycles work, and why preparing for the inevitable downturn is crucial could mean the difference between cashing out at the top and watching your portfolio vanish.

Why Crypto Markets Are Volatile

Crypto isn’t like traditional markets—it moves at lightning speed, reacts sharply, and is driven by factors unique to digital assets. Volatility, as they say, is king, creating opportunities for short-term traders. But why is crypto so volatile? Here’s why:

Low Liquidity Compared to Traditional Markets: Unlike stocks, where trillions of dollars flow daily, crypto markets are smaller and more prone to sharp price swings when large amounts of money enter or exit. A single Bitcoin whale moving funds can shake the market.

24/7 Trading with No Circuit Breakers: The stock market has safeguards—if prices drop too fast, trading halts. In crypto? No brakes. It runs non-stop, meaning a dump can spiral out of control in minutes.

Speculation and Leverage: Many traders use leverage (borrowed money) to amplify their positions. When the market moves against them, liquidations trigger cascading sell-offs, making dips even worse. In 2021, over $2.5 billion worth of leveraged positions were wiped out in a single day.

Regulatory Uncertainty: Governments can shake the market overnight. When China banned crypto mining in 2021, Bitcoin lost 50% in just two months. Meanwhile, SEC lawsuits (like Ripple’s battle over XRP) can send tokens soaring or crashing based on mere speculation.

Narratives Drive Markets: Unlike traditional finance, where fundamentals matter most, crypto runs on hype. Memecoins like Dogecoin and Shiba Inu surged purely on Elon Musk tweets, while layer-1 chains like Solana exploded due to an NFT craze. When the hype fades, so do the gains.

Bull vs. Bear: Understanding the Market Cycles 📉📈

Crypto moves in clear boom-and-bust cycles, often tied to Bitcoin’s four-year halving events (when Bitcoin mining rewards are cut in half, reducing new supply). These cycles shape the entire market.

🔵 Bull Market (Euphoria & Greed):

- Prices skyrocket, everyone’s making money, and new investors FOMO in.

- Media headlines scream about Bitcoin replacing gold, and your barber suddenly talks about trading altcoins.

- NFTs, memecoins, and speculative projects pump irrationally.

- “This time is different” becomes the common belief—until it isn’t.

🔴 Bear Market (Pain & Capitulation):

- Prices collapse, wiping out 70-90% of most altcoin values.

- Projects that thrived in the bull run disappear (RIP Terra Luna).

- Investors lose faith, calling crypto a “scam.”

- The market bottoms out as weak hands sell everything, while smart investors quietly accumulate.

Historically, the pattern has repeated like clockwork:

- 2013-2014 Bull Run: Bitcoin hit $1,200 → Then crashed to $200 in the 2015 bear market.

- 2017 Bull Run: Bitcoin hit $20K → Then dropped to $3K in 2018.

- 2021 Bull Run: Bitcoin soared to $69K → Then fell to $15K in 2022.

Will 2025 follow the same script? If history repeats, a massive rally could be followed by another brutal crash.

The Importance of Preparing for the Inevitable

Many traders make the same mistake: they only prepare for the bull run but ignore the bear. Here’s why that’s dangerous:

Most Altcoins Won’t Survive: In every bear market, 90% of altcoins die. Projects that looked revolutionary during the bull run suddenly fade away. Remember BitConnect? Luna? SafeMoon?

Emotional Investing Leads to Heavy Losses: When things go up, everyone thinks they’ll never come down. When they drop, panic selling takes over. Having a plan before the crash helps avoid emotional decisions.

The Bear Market is Where Wealth is Made: Smart investors (think whales, institutions, and early Bitcoin adopters) buy cheap when no one is looking. Those who prepare early will accumulate while the market is sleeping.

Bottom Line: Get Ready Before It’s Too Late

If you want to survive (and thrive) in crypto long-term, you must prepare for the bear market before it arrives. This guide will help you do exactly that—so when the next crash comes, you’ll be ahead of the game.

Spotting the Signs: How to Know When the Bear Market Is Coming

The crypto market doesn’t crash out of nowhere. There are always warning signs—it’s just that most people ignore them in the excitement of a bull run. The best way to protect your gains is to recognize when the top is near and adjust your strategy before the market flips.

Here’s how to spot an incoming bear market before it wipes out your portfolio.

Key Indicators of a Market Top 🚨

History shows that before every major crash, there are clear warning signs. These indicators suggest that a market is overheating and a correction is looming.

Bitcoin’s Parabolic Rise & Unsustainable Rallies

📈 If Bitcoin is skyrocketing too fast, too soon, it’s often a trap.

- Every major bear market in crypto has started after Bitcoin went “parabolic”—meaning its price surged rapidly with no real pullbacks.

- In 2017, Bitcoin exploded from $3,000 to $20,000 in a few months—then crashed to $3K.

- In 2021, Bitcoin ran from $10K to $69K before plunging to $15K.

- When BTC goes vertical on the charts, it’s time to start taking profits.

🚨 Warning Sign: If Bitcoin is up 300-500% in a year and people start calling for $1M BTC “next month,” the top is near.

Altcoin Mania & Meme Coin Bubbles

🐶 If dog coins and random meme or AI agent tokens are pumping, it’s time to be cautious.

- In every cycle, we see ridiculous coins making millionaires overnight before crashing to zero.

- 2017: ICO boom—99% of these projects vanished in 2018.

- 2021: Dogecoin and Shiba Inu surged 10,000%, then collapsed.

- 2024-2025? If you see meme coins popping up daily and people shilling “the next 1000x,” it’s usually a red flag.

🚨 Warning Sign: If low-quality projects (memecoins, joke NFTs, copy-paste tokens) start outperforming blue-chip assets, the market is overheating.

Extreme Greed in Market Sentiment (Fear & Greed Index)

💰 When everyone is insanely bullish, a crash is coming.

- The Crypto Fear & Greed Index is a powerful tool that measures overall sentiment.

- If it’s showing “Extreme Greed” (above 80/100), that means people are FOMO-ing in, and smart money is preparing to exit.

- Historically, market tops occur when the index is maxed out in greed (late 2021, early 2018).

🚨 Warning Sign: If your friends who never cared about crypto before suddenly start buying because “it’s easy money,” the top is close.

Crypto Apps Ranking in the Top 10 on the App Store

📲 When everyone is downloading crypto apps, it’s the final stage of the bull run.

- In late 2017, Coinbase was the #1 most downloaded app before Bitcoin crashed from $20K to $3K.

- In 2021, Binance, Crypto.com, and Coinbase dominated app stores right before the 2022 bear market hit.

- When mainstream adoption peaks, the market usually tops out soon after.

🚨 Warning Sign: If trading apps suddenly trend on app stores, it’s a major red flag.

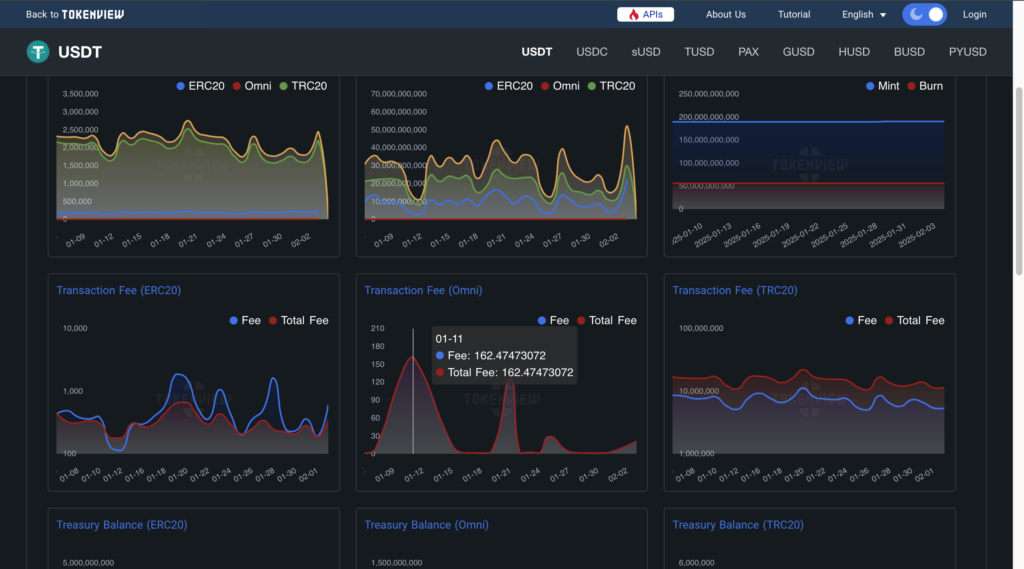

Decline in Stablecoin Minting (USDT & USDC)

💵 Stablecoins are the lifeblood of the crypto market. If they stop flowing, liquidity dries up.

- In a bull run: Tether (USDT) and USD Coin (USDC) supply increases as new money enters the market.

- In a bear market: Stablecoin minting slows down, meaning investors aren’t bringing in fresh cash.

- Example: Before the 2022 crash, USDT’s supply peaked at $83 billion in May, then started shrinking. The market collapsed soon after.

🚨 Warning Sign: If stablecoin growth stalls or declines, demand for crypto is fading—bear market incoming.

Macroeconomic Triggers to Watch

Crypto doesn’t exist in a bubble. Big picture events can spark bear markets too.

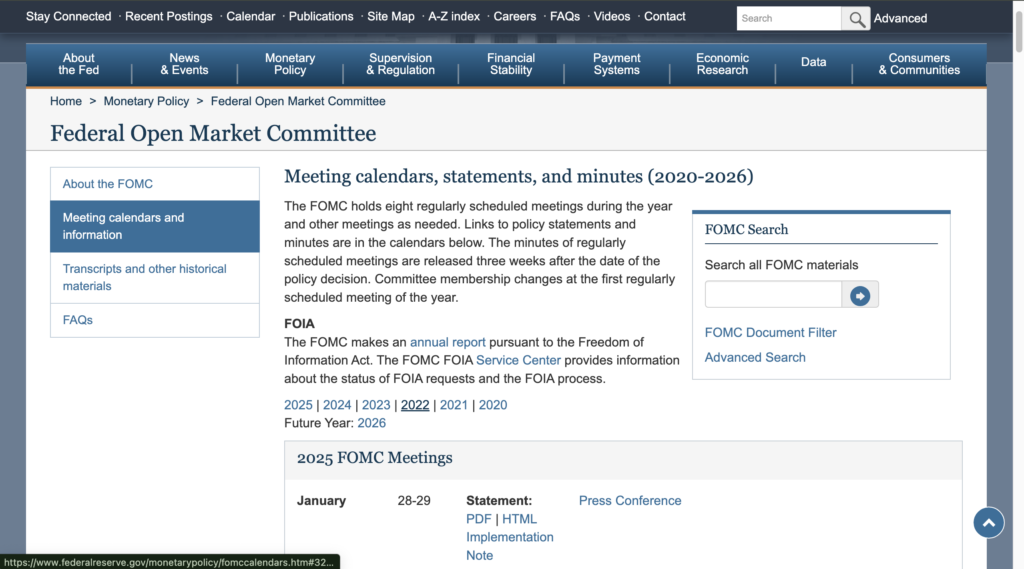

Federal Reserve Policies & Interest Rate Hikes

🏦 The Fed controls the money printer—and when they stop printing, risk assets suffer.

- In 2020, when the Fed printed trillions, Bitcoin and stocks soared.

- In 2022, when the Fed raised interest rates aggressively, Bitcoin crashed from $69K to $15K.

- If inflation returns and the Fed tightens policy again, expect crypto to drop hard.

🚨 Warning Sign: If the Fed starts raising rates or cutting liquidity, a bear market could follow.

Global Economic Downturns & Black Swan Events

🌍 Recessions, pandemics, and global crises hit crypto hard.

- COVID-19 crash (March 2020): Bitcoin dropped 50% overnight.

- Russia-Ukraine War (2022): Uncertainty led to BTC sliding further.

- Potential triggers for 2025: A financial crisis, geopolitical tension, or another “black swan” could shake the market.

🚨 Warning Sign: If the global economy weakens or fear spreads, crypto will likely suffer.

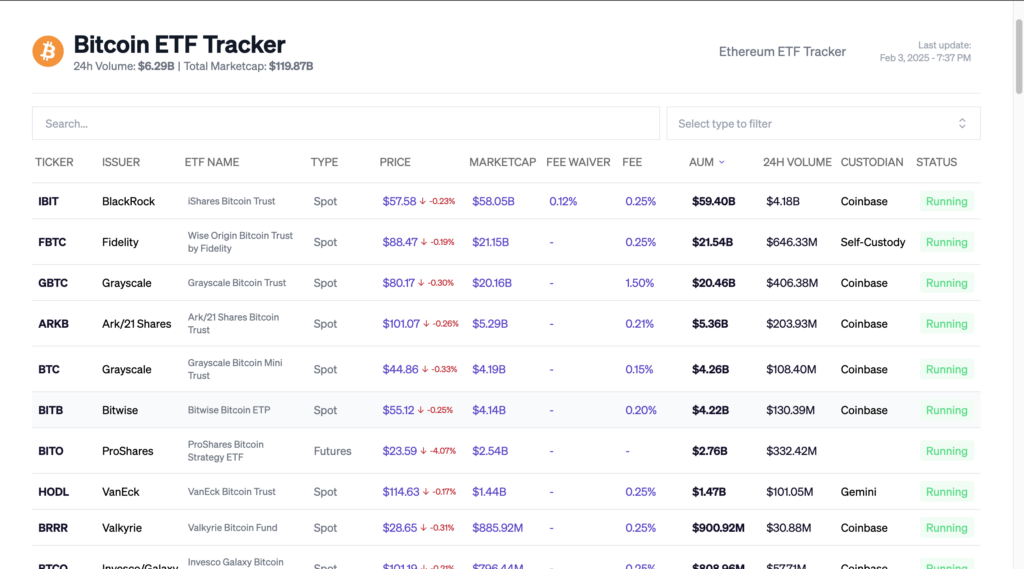

The ETF & Institutional Exit Strategy

Big institutions are playing a different game. While retail investors buy at the top, institutions buy early and exit quietly.

Are Institutions Buying or Cashing Out?

🏦 Follow the smart money.

- When ETFs and hedge funds start accumulating, the market rallies.

- When institutions begin offloading BTC, it’s a warning sign.

- Example: In 2021, institutions sold BTC quietly while retail was FOMO-ing. BTC crashed months later.

🚨 Warning Sign: If institutions start selling into retail hype, the bear market is coming.

Be Ahead of the Crowd

By the time the bear market hits, it’s too late. The key is spotting these warning signs before the crash happens.

✅ Watch for parabolic Bitcoin rallies and altcoin bubbles.

✅ Pay attention to market sentiment and crypto app popularity.

✅ Monitor macroeconomic trends and stablecoin supply.

✅ Track institutional moves—they’re the first to exit.

Profit-Taking Strategies: Secure Gains Before It’s Too Late

One of the biggest mistakes crypto investors make is holding on for too long—only to watch their profits evaporate when the market flips bearish. Smart traders know that taking profits is just as important as making them.

You don’t need to sell everything at once, but having an exit strategy will help you lock in gains, reduce risk, and stay in the game long-term. Here are the best strategies to take profits before the next bear market arrives.

The “Moonbag” Strategy: Sell, But Stay Invested

Ever heard the phrase “Let your winners ride, but take your initial investment off the table?” That’s the Moonbag Strategy.

🔹 How It Works:

- When an asset 2x or 3x, sell your initial investment—leaving the rest as a “moonbag.”

- Now, you’re playing with house money—so if the price dumps, you’ve already secured your capital.

- If it keeps rising, you still have exposure to potential gains.

✅ Why This Works:

- Protects you from losing everything in a crash.

- Allows you to stay exposed to upside without major risk.

- Perfect for volatile assets like altcoins and meme coins.

📌 Example: You bought $1,000 worth of an altcoin at $1. If it pumps to $3, you sell $1,000 worth, leaving the rest to “moon” for free. If it crashes later? No stress—you already secured profits.

🚨 Pro Tip: Apply this to high-risk, speculative coins—especially meme coins, low-cap gems, and trending narratives.

Dollar-Cost Averaging (DCA) Out 📊

Most people know Dollar-Cost Averaging (DCA) as a strategy to buy crypto gradually—but it also works in reverse to exit the market smartly.

🔹 How It Works:

- Instead of panic selling, sell in small amounts over weeks or months.

- Spread out exits to avoid selling too early or too late.

- Helps smooth out volatility and secure better overall profits.

✅ Why This Works:

- Prevents you from selling everything at once (and regretting it).

- Helps capture high prices without worrying about perfect timing.

- Lowers emotional stress—no need to time the exact top.

📌 Example: If you hold $10K worth of ETH, sell 10% per week as it moves higher instead of trying to time the top perfectly.

🚨 Pro Tip: Use DCA out for Bitcoin, Ethereum, and blue-chip cryptos that you plan to re-enter in the future.

Selling in Tranches: Taking Partial Profits Over Time

A similar approach to DCA Out, but based on price targets instead of time.

🔹 How It Works:

- Set multiple sell targets at different price levels.

- Sell a percentage of your holdings as each target is hit.

- Keep a small bag for long-term upside.

✅ Why This Works:

- Ensures you capture profits on the way up instead of waiting for a perfect exit.

- Reduces risk exposure while still staying in the game.

- Avoids emotional decisions (panic selling or greed holding).

📌 Example:

- Sell 20% of your holdings when Bitcoin hits $60K.

- Sell another 20% at $75K.

- Hold the remaining 40% in case BTC goes even higher.

🚨 Pro Tip: Ideal for medium-risk assets like Layer 1s, DeFi tokens, and solid altcoins.

Using On-Chain Data to Time Exits (Whale Movements & Exchange Flows)

If you want an edge over the market, pay attention to on-chain data. Whales and institutions exit first—before retail catches on.

🔹 Key Indicators to Watch:

📌 Whale Movements:

- Whale wallet activity: Are large holders moving coins to exchanges?

- Whale sell-offs: If big wallets are offloading, a top might be forming.

📌 Exchange Flows:

- If more Bitcoin is flowing into exchanges, it means people are preparing to sell.

- If stablecoin deposits increase, it signals that whales are sitting on the sidelines.

✅ Why This Works:

- Lets you exit before the big players do (instead of being their exit liquidity).

- Helps confirm a market top using real data, not emotions.

🚨 Pro Tip: Use tools like Glassnode, Lookonchain, and Nansen to track whale movements in real time.

Tax-Efficient Strategies for Selling Crypto 💰

One thing most traders forget about when taking profits? Taxes. If you sell everything at once, you might owe way more in capital gains tax than expected.

🔹 How to Minimize Your Tax Burden:

📌 1️⃣ Use Long-Term Holding Periods

- Holding crypto for over a year = lower long-term capital gains tax.

- Selling too early = higher short-term tax rates.

📌 2️⃣ Offset Gains with Losses (Tax-Loss Harvesting)

- If you have losing positions, sell them to offset gains and reduce taxable income.

- Helps balance profits & losses during tax season.

📌 3️⃣ Move to a Crypto-Friendly Jurisdiction

- Portugal, UAE, and El Salvador have zero crypto capital gains tax.

- If you’re a high-net-worth trader, relocating might be worth it.

🚨 Pro Tip: Always check your country’s tax laws before cashing out—some regions tax crypto heavily.

Take Profits Before the Market Does It for You

🚀 The crypto market moves fast. If you don’t have an exit plan, you risk giving back all your gains when the market turns.

✅ Use the Moonbag Strategy to secure capital but keep upside exposure.

✅ DCA out of the market to avoid bad timing.

✅ Sell in tranches at different price levels.

✅ Watch whale movements & exchange flows for exit signals.

✅ Be tax-smart so you don’t lose profits to the IRS.

Where to Store Profits: Protecting Your Gains

So you’ve taken profits—great job! But now comes the next big question: Where do you keep your money so it doesn’t lose value? Selling at the right time is only half the battle. The other half is making sure your gains don’t disappear due to inflation, devaluation, bad investments, or even an exchange collapse. Let’s explore the smartest ways to store and protect your capital when the bear market hits.

Stablecoins: A Safe Haven or a Risky Bet?

For many crypto investors, stablecoins like USDT, USDC, and DAI are the go-to option for parking profits. They offer the convenience of staying within the crypto ecosystem while avoiding volatility. With stablecoins, you can easily move funds between exchanges, participate in DeFi protocols for yield, or quickly re-enter the market when opportunities arise.

However, while stablecoins seem like a “safe” option, they aren’t without risks. The collapse of Terra’s UST in 2022 was a painful reminder that not all stablecoins are created equal. Even fiat-backed stablecoins like USDT and USDC depend on the financial health of the issuing companies. Regulatory pressure is also mounting, with governments scrutinizing stablecoin issuers and threatening stricter regulations. There’s also the risk of depegging, where a stablecoin temporarily loses its 1:1 value against the dollar, which can be catastrophic in high-volatility situations.

To minimize risk, it’s best not to put all your eggs in one basket. Diversifying across multiple stablecoins—such as USDT, USDC, and DAI—can help mitigate the risks of any single issuer failing. Some investors also explore newer options like FDUSD or PYUSD, which offer additional safeguards.

Converting to Fiat: When & How to Exit to Cash

While stablecoins are useful, there’s an undeniable advantage to moving some profits into traditional fiat. Unlike stablecoins, fiat cash isn’t dependent on crypto infrastructure and won’t be affected by a stablecoin collapse or exchange failure. Exiting to fiat can also be a wise choice if you need liquidity for real-world expenses or simply prefer the security of having money in a traditional bank account.

However, holding large amounts of fiat comes with its own set of challenges. Inflation is a constant threat, especially in countries with weak currencies. Keeping money in a bank account also exposes you to potential risks like bank collapses, capital controls, or withdrawal restrictions—issues that people in countries like Lebanon, Nigeria, and Argentina have faced in recent years.

The best strategy when cashing out is to spread your funds across multiple financial institutions and, if possible, place some in high-yield savings accounts or money market funds to offset inflation. For those in developing economies, converting profits into stronger currencies like USD, EUR, or CHF can be a smart move to protect against local currency devaluation.

Diversifying Into Other Asset Classes

The most seasoned investors don’t just hold profits in cash or stablecoins—they diversify across multiple asset classes to protect against market downturns. One of the most traditional hedges is gold, which has been a store of value for thousands of years. Gold tends to perform well in times of economic uncertainty, and many investors see it as a hedge against inflation and currency devaluation.

Stocks and bonds are another viable option, though they come with their own risks. While crypto is known for extreme volatility, traditional markets also go through cycles, and bear markets in stocks can last for years. Still, certain sectors tend to perform better in downturns, such as consumer staples (Procter & Gamble, Coca-Cola), healthcare (Pfizer, Johnson & Johnson), and technology companies with strong fundamentals (Microsoft, NVIDIA). Bonds, particularly U.S. Treasury bonds, are a low-risk way to preserve capital while earning a modest return.

For those looking for more tangible investments, real estate is often considered one of the safest long-term plays. Investing in rental properties can provide passive income while also serving as a hedge against inflation. However, real estate requires significant upfront capital and can be illiquid, meaning it’s not always easy to sell when you need cash. Tokenized real estate platforms like RealT and Lofty offer a way to invest in real estate without buying an entire property, allowing investors to benefit from rental income without large capital requirements.

Cold Storage: Keeping Your Crypto Safe in a Bear Market

If you plan to hold onto some of your crypto long-term, keeping it on an exchange is one of the riskiest moves you can make during a bear market. The collapse of FTX, Celsius, and Voyager proved that even big-name platforms can go under, leaving users with nothing. The best way to protect your crypto holdings is cold storage, meaning a hardware wallet like Ledger or Trezor.

Cold storage ensures that your funds remain safe from exchange collapses, hacks, and theft. Unlike hot wallets or exchange wallets, which are constantly connected to the internet, hardware wallets store your private keys offline, making them nearly impossible to hack. While cold storage is essential for long-term holdings, it’s not ideal for funds you plan to use frequently, so maintaining a mix of secure cold storage and easily accessible stablecoins is a balanced approach.

Smart Portfolio Management for Surviving a Bear Market

Surviving a bear market isn’t just about taking profits and sitting on the sidelines—it’s about managing your portfolio in a way that protects your capital while keeping you in the game for the next bull run. Many investors make the mistake of either going all in during a downturn or completely exiting crypto, missing out on opportunities when the market eventually recovers. The key is balance—having enough exposure to benefit from long-term growth while maintaining liquidity to take advantage of market downturns.

One of the best ways to achieve this is by dividing your portfolio strategically, ensuring that you’re not overly exposed to any single asset class or market condition.

The 50/25/25 Strategy: A Balanced Approach

A solid way to structure your portfolio for a bear market is the 50/25/25 strategy, which allocates your assets across different risk levels:

📌 50% in Long-Term Blue-Chip Crypto (BTC, ETH, etc.)

Bitcoin (BTC) and Ethereum (ETH) are often referred to as “blue-chip” cryptocurrencies—the most established assets in the space with strong fundamentals and network effects. While they still experience price volatility, they have a track record of recovering from bear markets. BTC has survived multiple cycles, and ETH continues to dominate the smart contract ecosystem, powering DeFi, NFTs, and layer-2 networks.

By keeping 50% of your portfolio in BTC, ETH, or other high-conviction assets, you maintain exposure to long-term growth while avoiding the high-risk volatility of smaller altcoins. Other blue-chip assets could include BNB, SOL, or layer-2 tokens like ARB and OP, depending on their fundamentals and market positioning.

📌 25% in Stablecoins for Buying Dips

Bear markets present incredible buying opportunities, but you can’t take advantage of them if you’re fully invested. Keeping 25% of your portfolio in stablecoins (such as USDT, USDC, or DAI) allows you to buy into strong projects when prices drop significantly.

For example, during the 2022 bear market, Bitcoin crashed from $69,000 to $15,000, and ETH dropped below $900—a massive discount compared to their previous highs. Investors who had stablecoins ready were able to scoop up BTC and ETH at rock-bottom prices, while those who were all-in had to either sell at a loss or miss out entirely.

Another advantage of holding stablecoins is psychological stability. If your entire portfolio is losing value during a crash, it’s easy to panic and make impulsive decisions. Having a stable reserve allows you to stay calm, knowing you have funds ready for strategic buys when the time is right.

📌 25% in High-Risk, High-Reward Plays

The last 25% of your portfolio can be allocated to higher-risk investments, such as promising altcoins, new projects, or innovative sectors like AI tokens, GameFi, or DeFi protocols. While these assets come with higher volatility, they also offer higher potential upside when the market recovers.

However, not all altcoins will survive a bear market. Many projects from previous cycles—such as LUNA, ICP, and several DeFi tokens—failed to recover after the crash. To manage risk, focus on projects with strong teams, real utility, and active communities. Layer-1 and layer-2 blockchain tokens, infrastructure projects, and protocols with sustainable revenue models tend to perform better in the long run.

Diversifying within this category is also crucial. Instead of putting all 25% into one token, spread it across 3-5 promising projects to hedge against unexpected failures.

Rebalancing Your Portfolio to Reduce Risk

Market conditions change, and so should your portfolio. Regular rebalancing ensures that you don’t become overexposed to risky assets while locking in profits when certain holdings outperform.

For example, if an altcoin in your high-risk allocation pumps 500% during a relief rally, it may now represent a much larger portion of your portfolio than intended. Instead of holding and hoping for even more gains, taking some profits and reallocating into stablecoins or blue-chip assets can lock in gains and reduce downside risk.

Similarly, if BTC or ETH drop significantly, bringing their weight below 50% of your portfolio, using stablecoins to buy the dip and restore balance ensures that you maintain a solid long-term position.

Rebalancing can be done quarterly or based on specific price targets—whatever helps you stay disciplined and avoid emotional trading decisions.

Why Holding Through a Bear Market Isn’t Always Smart

One of the biggest misconceptions in crypto is that you should “just hold” through every bear market and wait for the next bull run. While long-term holding (HODLing) can work for assets like BTC and ETH, it’s a terrible strategy for most altcoins.

Many projects will never recover from a severe bear market. The 2018 crypto winter wiped out thousands of altcoins, many of which never returned to their previous highs. Even popular tokens like XRP, Litecoin, and EOS from earlier cycles have struggled to reclaim their all-time highs.

This is why actively managing your portfolio is crucial. Instead of holding deadweight assets, smart investors rotate into stronger projects, take profits when opportunities arise, and cut losses on underperforming assets before they become worthless.

Another reason blind HODLing isn’t ideal is opportunity cost. If your capital is stuck in a failing asset, you’re missing out on better opportunities. Instead of watching an altcoin drop 95%, reallocating into stronger projects or even stablecoins allows you to buy back in at better prices or invest in emerging trends.

Making Money in a Bear Market: Strategies to Stay Profitable

A bear market might feel like a time to step back and wait for the next bull run, but smart investors know that downtrends present some of the best opportunities to grow wealth. While prices may be falling, there are plenty of ways to stay profitable, earn passive income, and even set yourself up for life-changing gains when the market recovers. Let’s explore the best ways to make money in a bear market.

Yield Farming & Staking: Passive Income During Downtrends 🌾

When asset prices are dropping, one of the best ways to generate cash flow without selling your crypto is through yield farming and staking. Instead of letting your tokens sit idle, you can earn rewards by providing liquidity, validating networks, or participating in DeFi protocols.

Staking: Earning Rewards by Securing the Network

Staking is one of the safest ways to earn passive income in crypto. Proof-of-Stake (PoS) blockchains like Ethereum, Solana, and Polygon allow users to stake their tokens to help validate transactions and earn rewards in return.

For example:

- Ethereum (ETH) staking offers an annual percentage yield (APY) of around 3-5%.

- Solana (SOL) staking can yield 6-7% APY.

- Cosmos (ATOM) staking often reaches 10%+ APY.

Staking your long-term holdings means you’re earning passive income while waiting for the market to recover.

Yield Farming: Earning Interest by Providing Liquidity

Yield farming is another way to generate income by supplying liquidity to DeFi protocols. Platforms like Aave, Compound, and Curve allow you to lend your crypto to earn yield. However, rates fluctuate, and there are risks like impermanent loss and smart contract exploits, so it’s important to choose reliable protocols with solid track records.

During the 2022 bear market, DeFi protocols continued paying yields, allowing investors to generate income even as token prices dropped. A key strategy is to farm yield in stablecoins like USDC or DAI, which protects you from price volatility while still earning returns.

Short Selling & Hedging Strategies 📉

If you want to profit directly from falling prices, short selling and hedging strategies can be effective.

Short Selling: Betting Against the Market

Short selling involves borrowing an asset, selling it at the current price, and then buying it back later at a lower price to return to the lender. If the price drops, you make a profit.

For example, if Bitcoin is at $100,000 and you short it, then buy it back at $30,000, you make $70,000 per BTC shorted.

Platforms like Binance, Bybit, and OKX allow traders to short BTC, ETH, and other assets using perpetual futures contracts. However, short selling carries risks—if the market moves against you, liquidation can wipe out your position.

Hedging: Reducing Your Downside Risk

Even if you’re not a trader, hedging can protect your portfolio during downturns. Some ways to hedge include:

- Buying put options – Gives you the right to sell at a fixed price, limiting downside losses.

- Using stablecoins – Converting part of your holdings to USDT/USDC to avoid price crashes.

- Allocating into non-crypto assets – Moving funds into stocks, commodities, or bonds to reduce overall exposure to crypto volatility.

Hedging isn’t about making money directly, but rather about protecting your wealth until better opportunities arise.

Building a Business in Web3: Bear Markets Are for Builders

While many people see a bear market as a time to step away, those who stay engaged and build during downturns often emerge as the biggest winners.

Bear markets are when top-tier projects get built, innovative companies launch, and industry-changing ideas take shape. Some of the biggest names in crypto started during bear markets:

- Ethereum (ETH) was built in 2015, right before a brutal crypto winter.

- Uniswap (UNI) and Compound (COMP) launched in the 2018-2019 bear market, laying the foundation for DeFi.

- Solana (SOL) and Avalanche (AVAX) developed in the 2020 bear market, exploding in value during the next bull run.

If you’ve ever wanted to start a Web3 business, now is the time. Whether it’s:

✅ Creating educational content (YouTube, newsletters, courses)

✅ Developing dApps, DeFi projects, or NFT platforms

✅ Becoming a Web3 developer, consultant, or community manager

There’s less noise and competition in a bear market, meaning those who stick around and contribute will have the most opportunities when the next bull run arrives.

Why Bear Markets Are the Best Time to Invest

It might sound counterintuitive, but bear markets are when the smartest investors build their positions. Buying assets when everyone else is fearful often leads to the biggest gains when the market rebounds.

Take Bitcoin, for example:

- In 2018, BTC crashed to $3,000—many thought it was dead. By 2021, it hit $69,000.

- In 2022, BTC dropped to $15,000—by 2024, it was back above $40,000.

The key lesson? Buying during extreme fear leads to massive profits later.

The Warren Buffett Rule: “Be Greedy When Others Are Fearful”

Stock market legend Warren Buffett famously said:

👉 “Be fearful when others are greedy, and greedy when others are fearful.”

This applies perfectly to crypto. If you’re buying Bitcoin at $60,000+ in a bull market, you’re competing with everyone else. But in a bear market, when people are scared, prices are cheap, and the best opportunities arise.

Positioning Yourself for the Next Bull Run

To set yourself up for success, use this bear market checklist:

✅ Dollar-cost average (DCA) into blue-chip assets like BTC and ETH.

✅ Identify undervalued projects with strong fundamentals.

✅ Keep cash (stablecoins) ready for big dips.

✅ Follow smart money – track institutional buys and whales accumulating.

✅ Stay active and learn – bear markets are the best time to sharpen your knowledge.

Avoiding Bear Market Traps & Scams

Bear markets are brutal, not just because of falling prices but also because of an increase in scams, bad investments, and psychological traps that can wipe out your capital. When markets are down, desperation kicks in, leading people to make poor decisions—buying assets that never recover, chasing unsustainable yields, or falling for outright scams.

Let’s break down the biggest bear market traps and how to avoid them.

The “Buy the Dip” Fallacy: When It’s a Trap

“Buy the dip” is one of the most popular phrases in crypto investing, but not every dip is worth buying. In bull markets, dips are temporary pullbacks before prices continue rising. In bear markets, dips can be part of a much larger downtrend—and buying too early can leave you trapped in months or years of losses.

How to Avoid the Trap

- Check the macro trend – If Bitcoin and the broader market are in a clear downtrend, a small price bounce isn’t a reversal—it’s likely just a dead-cat bounce.

- Use on-chain data – Look at whale movements, exchange inflows, and liquidity levels to confirm whether the market is truly recovering or if it’s a temporary fakeout.

- Don’t go all-in too soon – Instead of dumping all your cash into a single dip, use Dollar-Cost Averaging (DCA) to spread out your buys over time.

- Watch out for weak projects – Just because an altcoin is down 90% doesn’t mean it’s a good buy. Many coins never recover after a bear market. Stick with strong projects with real use cases and active development.

Remember: The best dip-buying opportunities happen after the market confirms a bottom, not when everyone is still panicking.

Exit Scams & Rug Pulls Increase in Bear Markets 🚨

When the market is booming, it’s easy for scams to go unnoticed because prices are rising. But when a bear market hits, many projects collapse, founders disappear, and liquidity dries up—leading to a spike in exit scams and rug pulls.

How Exit Scams Work

- A project raises funds or attracts users by promising innovation or high returns.

- As the bear market deepens, the team abandons the project, deletes social media, and withdraws all funds.

- Investors are left with worthless tokens and no way to recover their money.

Some of the biggest exit scams in crypto history have happened during bear markets, when investors were desperate for quick gains.

How to Spot & Avoid Rug Pulls

✅ Look for transparent teams – If the project founders are anonymous or hard to verify, be cautious.

✅ Check liquidity & token distribution – If a small number of wallets hold most of the supply, it’s a red flag.

✅ Watch for sudden marketing hype – If a project gets too much attention too quickly, it could be a coordinated scam.

✅ Avoid high APY promises – If a DeFi platform is offering 1000%+ yield in a bear market, it’s likely a Ponzi scheme.

If something seems too good to be true, it usually is. Bear markets are not the time to take unnecessary risks.

Ponzi Schemes & “Too Good to Be True” Yields

One of the biggest bear market traps is chasing high-yield opportunities that are unsustainable. When people see their portfolios down, they start looking for quick ways to recover losses—and that’s when Ponzi schemes thrive.

How Ponzi Schemes Work

- They promise high, guaranteed returns to attract investors.

- New investors’ money is used to pay “profits” to earlier investors, making it seem legitimate.

- When new deposits slow down, the scheme collapses, and most participants lose everything.

During the 2022 bear market, we saw major platforms like Celsius and Terra’s Anchor Protocol collapse because their high-yield models were unsustainable Ponzi-like structures.

How to Spot & Avoid Ponzi Schemes

🚨 Guaranteed profits don’t exist – If a platform promises high, risk-free returns, it’s likely a scam.

🚨 Watch for referral-based payouts – If the main way people earn is by recruiting others, it’s a Ponzi structure.

🚨 Check the revenue model – If a platform can’t explain where the yield comes from, it’s probably not sustainable.

Instead of chasing high-risk yields, stick with proven passive income strategies like staking on reputable PoS blockchains or lending on well-established DeFi protocols.

How to Spot Projects That Will Survive vs. Fail

Not every project will make it through the bear market. Some will adapt, innovate, and survive—while others will die off and never recover. So, how do you know which ones will last?

Signs of a Strong Project ✅

✅ Clear product-market fit – Does the project solve a real problem, or is it just hype?

✅ Active development – Check GitHub or team updates. A project that stops building in a bear market won’t survive.

✅ Strong community & governance – Look for projects with loyal users and engaged communities rather than just price speculators.

✅ Healthy treasury & funding – Does the project have enough reserves to sustain itself? If not, it may collapse before the next bull run.

✅ Institutional or strategic partnerships – Projects backed by VCs, industry leaders, or real-world use cases have a better chance of long-term survival.

Signs of a Weak Project 🚨

❌ No real product or use case – If the project exists only for hype, it won’t last.

❌ Over-reliance on token price – If the only value comes from price speculation, the project will collapse in a bear market.

❌ Silent team & lack of communication – If the developers and founders go quiet during downturns, it’s a major red flag.

❌ Too much leverage or unsustainable yields – If a project offers crazy APYs or relies heavily on leverage, it’s at high risk of collapse.

Preparing for the Next Bull Market (Before Everyone Else!)

The best time to set yourself up for massive gains isn’t when Bitcoin is breaking all-time highs or when meme coins are flying—it’s during the bear market, when prices are low, hype is dead, and most people have given up. The crypto market is cyclical, and history has shown that those who accumulate and position themselves strategically during downturns reap the biggest rewards in the next bull run.

Here’s how to prepare before everyone else wakes up.

The Accumulation Phase: When & What to Buy

A bear market isn’t just about surviving—it’s about accumulating assets at the right time and price. But not all dips are good buys, and not every asset will recover when the next bull market arrives.

When to Buy?

The best accumulation zones typically occur when:

✅ Bitcoin has corrected 70-80% from its all-time high (historically, deep bear markets see BTC retrace heavily). However, with institutional adoption now, we may not see such deep decline so targeting a 50% crash may be ideal.

✅ Altcoins have crashed 90%+—but only select projects will recover, so research is key.

✅ The market is in “Extreme Fear” (check the Crypto Fear & Greed Index—extreme fear signals deep value opportunities).

✅ On-chain metrics signal bottoming—this includes whale accumulation, exchange outflows, and stablecoin deployment.

✅ Retail investors have lost interest—when nobody is talking about crypto, that’s usually when smart money is accumulating.

What to Buy?

Not every crypto project will make it to the next cycle. The best assets to accumulate during a bear market include:

- Bitcoin (BTC) – Always the safest long-term bet.

- Ethereum (ETH) – The backbone of DeFi, NFTs, and smart contracts.

- High-utility altcoins – Layer 1 and Layer 2 projects with real adoption (e.g., Solana, Avalanche, Arbitrum, StarkNet).

- DeFi blue chips – Well-established protocols (e.g., Aave, Uniswap) that survived previous downturns.

- Narrative-driven coins – AI tokens, privacy coins, or assets aligned with emerging trends.

- Strong stablecoins – USDC, USDT, and other stable assets to deploy when markets turn bullish.

If you missed buying Bitcoin at $10K or ETH at $200, a bear market gives you another chance to invest before the hype returns.

Tracking Developer Activity & Innovation in Crypto

One of the best ways to identify winners before the next bull run is by tracking developer activity and real innovation in crypto. Many retail investors focus on price action, but smart investors follow builders—because what’s being built today will explode in value tomorrow.

How to Track Developer Activity?

- GitHub commits & repo activity – Check projects with consistent development, frequent updates, and engaged teams. Tools like CryptoMiso and Santiment can help track this.

- Hackathons & grants – Follow ecosystem grants from chains like Ethereum, Solana, and StarkNet—they indicate where builders are focusing.

- Venture capital investments – Watch where major funds like a16z, Paradigm, and Sequoia are deploying capital. They often back the next big projects before retail catches on.

- L2 & scaling solutions – With high fees still a problem, Layer 2s and rollups (Arbitrum, StarkNet, Optimism) will play a crucial role in the next cycle.

AI & crypto integration – AI-driven smart contracts, AI agents using blockchain, and decentralized AI models are a growing sector to watch.

The projects leading innovation during a bear market are often the biggest winners when the next cycle begins.

Understanding Market Narratives: What Will Pump Next?

Each crypto cycle is driven by new narratives. In 2017, it was ICOs. In 2020-2021, it was DeFi, NFTs, and memecoins. In the next cycle, a new set of narratives will dominate, and early investors in these sectors will make the biggest gains.

How to Identify Future Narratives?

- Follow early-stage VC investments – Smart money often bets on trends before the mainstream catches on.

- Monitor protocol adoption – Real use cases and high transaction volumes indicate strong future demand.

- Look for real-world utility – Projects integrating with finance, AI, privacy, or payments will likely see mass adoption.

Potential Narratives for the Next Bull Run:

- AI & Crypto – Decentralized AI models, AI-driven smart contracts, and AI-agent-powered economies.

- ZK (Zero-Knowledge) Technology – Privacy-focused and scalable blockchain solutions like StarkNet and zkSync.

- Decentralized Physical Infrastructure Networks (DePIN) – Blockchain-powered real-world infrastructure (Helium, Filecoin, Render Network).

- Real-World Asset Tokenization (RWA) – On-chain representation of stocks, bonds, and real estate.

- Bitcoin Layer 2s & Ordinals – BTC is evolving beyond digital gold, with Lightning Network, Stacks, and BRC-20 tokens gaining traction.

- Restaking & Yield Innovations – Ethereum’s staking landscape is expanding with new ways to earn yield.

By positioning yourself in high-potential narratives early, you’ll be ahead of the crowd when the next bull market kicks off.

The Patience Game: How Long Do Bear Markets Last?

Crypto bear markets feel endless, but they don’t last forever. Historically, Bitcoin follows a four-year cycle driven by its halving events, which reduce BTC supply and trigger a new bull run.

How Long Do Bear Markets Typically Last?

📅 2013-2015 Bear Market – ~18 months, bottomed out before 2016 halving.

📅 2018-2020 Bear Market – ~24 months, bottomed out before 2020 halving.

📅 2022-2023 Bear Market – Likely bottoming before 2024 halving.

If history repeats, the next major bull run will start post-2024 Bitcoin halving, meaning 2025 could be the next massive rally.

How to Stay Mentally Prepared?

✅ Shift focus from price to fundamentals – Instead of obsessing over daily charts, watch for technological progress and adoption.

✅ Keep learning & improving your strategy – Use the bear market to educate yourself, build conviction, and refine your trading/investing skills.

✅ Don’t panic-sell at the bottom – Many investors capitulate at the worst time, only to watch prices recover months later.

✅ Stay in the game – Most people quit during bear markets. If you’re still here when the market turns, you’re ahead of 90% of investors.

The next bull market will come. Will you be prepared?

Conclusion: The Key to Long-Term Crypto Success

Crypto markets are undeniably volatile, and for every meteoric rise, there’s a corresponding fall. But here’s the key: Surviving the bear markets and thriving in the bull markets isn’t about luck—it’s about strategy, discipline, and a long-term vision. By understanding the cycles, staying patient, and making smart moves during downturns, you set yourself up for the kind of success that most people can only dream of when the market goes up again.

Surviving & Thriving in the Market Cycles

The most successful crypto investors don’t view bear markets as setbacks but as opportunities. Sure, watching the market dip day after day can feel discouraging, but these are the moments when the smartest money is being made. Bear markets are not just about surviving—they’re about positioning yourself to thrive when the next bull cycle rolls around. Whether it’s buying Bitcoin at a fraction of its peak price or getting into high-potential altcoins at rock-bottom levels, the winners in crypto are the ones who understand market psychology, accumulate during lows, and hold through the highs.

The goal is not to fear the inevitable bears, but to embrace the opportunities they bring. The real key to long-term success in crypto is adaptability—understanding when to pivot, when to hold steady, and when to exit. Crypto is a marathon, not a sprint. The more strategic and patient you are, the higher the likelihood you’ll see returns when the market shifts in your favor.

The Power of a Strong Investment Thesis

Having a clear investment thesis is essential for surviving and thriving through market cycles. It’s your roadmap for how you approach your investments, how you react to volatility, and how you make decisions.

Without a solid thesis, you’ll be swayed by fear, FOMO (fear of missing out), and noise from others in the market. However, if you take the time to define why you’re investing, what you believe in, and which projects align with your values and financial goals, you can navigate through the noise. Your thesis should be based on strong fundamentals, not just market hype.

A great investment thesis will keep you grounded in both the good and bad times. For example, you might be investing in Ethereum because you believe in decentralized finance (DeFi) and smart contracts, or you might be betting on a project like StarkNet because you believe layer 2 scaling solutions will be key to Ethereum’s future. Whatever your reasoning is, make sure it’s based on sound analysis, research, and long-term value.

Final Takeaways & Actionable Next Steps

As you continue your journey through the world of crypto, here are a few key takeaways and actionable next steps to ensure you’re not just surviving the bear market but thriving in it:

- Understand the Cycles: Crypto markets go through bulls and bears—knowing when to be cautious and when to be aggressive is crucial.

- Accumulate During Lows: Bear markets are the time to buy undervalued assets—this is when smart money positions itself for long-term gains.

- Use Profit-Taking Strategies: Don’t wait until the peak—secure your gains gradually, using strategies like dollar-cost averaging (DCA) and selling in tranches.

- Diversify: Spread your investments across stablecoins, blue-chip crypto, and high-risk plays to protect and grow your portfolio.

- Monitor Developer Activity: The most successful projects will be the ones with active development and innovation, so stay in the loop.

- Stay Patient & Stay Educated: Be mentally prepared for the long haul. Crypto markets are cyclical, and the next bull market will eventually come—and those who were patient in the bear market will be the ones to capitalize on it.

BONUS: Bear Market Cheat Sheet (Top Do’s & Don’ts!)

To make sure you’re on the right track, here’s a quick cheat sheet to guide your actions during a bear market:

Top Do’s

- ✅ Do research and accumulate strong, fundamental assets.

- ✅ Do secure profits and manage risk through dollar-cost averaging and tranching.

- ✅ Do track on-chain data, developer activity, and macroeconomic indicators.

- ✅ Do build a long-term investment thesis based on real-world utility.

- ✅ Do stay patient, focus on fundamentals, and avoid short-term market noise.

Top Don’ts

- ❌ Don’t panic-sell when the market dips—historically, prices tend to recover over time.

- ❌ Don’t get caught in FOMO—if everyone is talking about a coin, it might be too late to buy.

- ❌ Don’t ignore risks—investing in high-risk altcoins without a proper risk management strategy can be dangerous.

- ❌ Don’t overexpose yourself to one asset class—diversification is key.

- ❌ Don’t stop learning—keep improving your investment strategy, no matter what the market is doing.

Bear markets are challenging, but with the right mindset and strategies in place, you can not only survive but thrive. Stay patient, stick to your plan, and be ready to seize the opportunities that come when the market turns around.