How to Spot Memecoins Before They Hit the Big Exchanges

Hold onto your Ugali and jollof rice, because TawkcCrypto is about to take you on a wild ride through the wacky world of memecoins!

Memecoins have taken the crypto world by storm, generating life-changing gains for early adopters while leaving others scratching their heads about how to get in. From tokens like Pnut to ChillGuy, these coins have proven that humor and community can drive massive trading volumes. But how do you spot these coins before they’re listed on major exchanges? Let’s break it down step by step.

What Are Memecoins?

Memecoins are cryptocurrency tokens created largely for fun, often inspired by internet memes, pop culture, or random jokes. Unlike traditional cryptocurrencies like Bitcoin or Ethereum, which are valued for their utility or technology, memecoins thrive on community hype, cultural appeal, and viral momentum.

Examples of popular memecoins include:

- Dogecoin (DOGE) – The pioneer memecoin inspired by the Shiba Inu dog meme.

- Shiba Inu (SHIB) – Marketed as the “Dogecoin killer,” SHIB grew to become a household name.

- Pnut, ChillGuy, GOAT, and Moodeng – Recent memecoins that delivered exponential returns, demonstrating how quickly new coins can explode in value.

Unlike other assets, memecoins aren’t valued based on intrinsic factors like utility or market cap. Instead, retail investors flock to these tokens because they appear “cheap” by dollar value. The perception of affordability often drives demand.

Exchanges Are Craving that Memecoin Money!

Picture this: you see a bunch of people at the market fighting over a limited batch of agege bread. That’s kinda what happens when it comes to memecoin listings.

Exchanges like Binance, Coinbase, and OKX see the revenue and trading volume these coins generate for Decentralized Exchanges (DEXes) and launchpads like Pump.fun, Moonshot, and Raydium. They smell that sweet, sweet profit and want a piece of the pie.

Here’s why and what they want:

- Revenue and Trading Volume

Decentralized exchanges (DEXs) like Pump.Fun, Moonshot, and Raydium have reported massive trading volumes thanks to memecoins. For example, some DEXs record millions of dollars in daily revenue just from memecoin trades. Centralized exchanges want a slice of this pie. - New Signups

Memecoins attract retail investors in droves. The first exchange to list a popular memecoin often sees a surge in new users, helping grow their customer base. - User Safety

While exchanges want to benefit from memecoins, they’re also cautious about protecting their users. They focus on tokens with strong communities, fair launches, and cultural relevance.

What Exchanges Look for Before Listing Memecoins

Not all memecoins make it to the big leagues. Exchanges evaluate several criteria:

- Strong Community

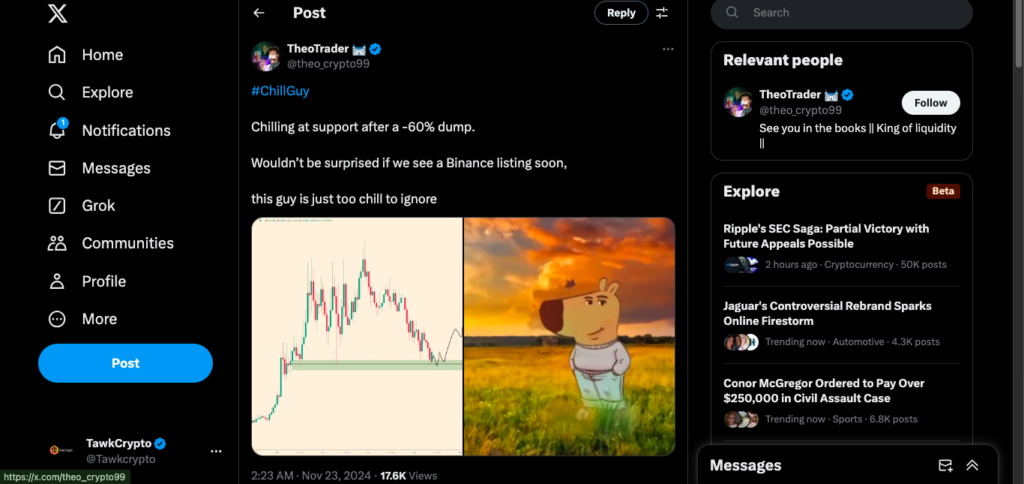

Tokens with active and engaged communities are more likely to succeed. Memecoins like ChillGuy gained traction because their communities spread the word on social media and forums, driving excitement.

- Cultural Appeal

Memecoins need to resonate with a broader audience. Fun, light-hearted tokens often perform better. Exchanges stay away from offensive or controversial names. - Growing Holder Count

A rising number of token holders indicates sustained interest. Use tools like HolderScan to monitor holder growth.

- Consistent On-Chain Volume

Healthy trading volumes over days or weeks suggest genuine interest. Platforms like DexScreener can help you track memecoins with growing volume. Tokens with plummeting volume are often red flags.

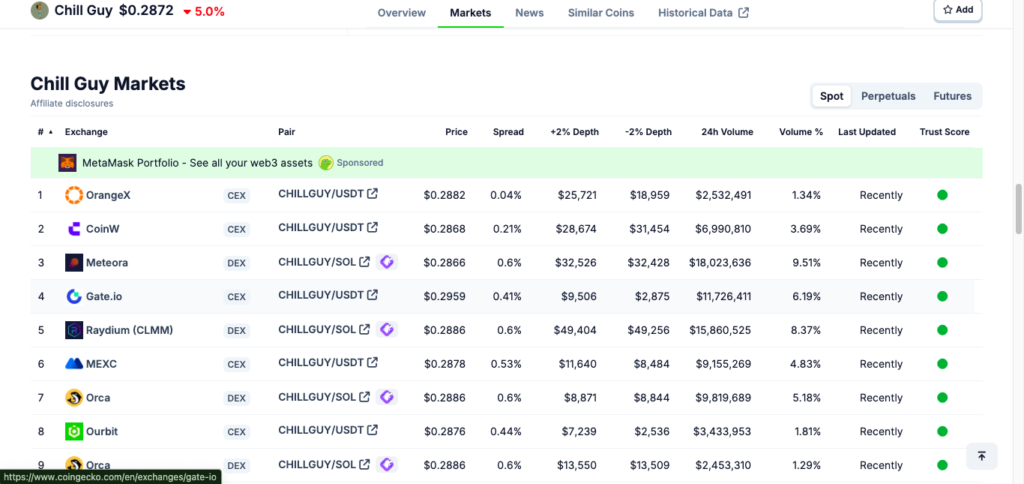

- Previous Listings on Smaller Exchanges

Before listing a memecoin, big exchanges check whether it’s already available on smaller platforms. This helps ensure the token’s legitimacy. You can check if exchanges like gate.io, mexc etc have listed them.

Check using platforms like coingecko

The Difference Between Spot and Futures Listings

Understanding the type of listing is crucial for predicting price movements:

- Spot Market Listings: These create demand for the actual token, often driving prices up as traders buy the asset.

- Futures Market Listings: These allow traders to speculate on price movements without holding the token, often leading to downward pressure as many traders bet against the coin (short selling).

If you’re betting on a memecoin, spot listings usually offer the best opportunity for price spikes.

How to Spot a Memecoin Ready for a Big Exchange Listing

- Monitor Token Accumulation

Look for unusual on-chain activity, such as accumulation by market makers like Wintermute. Tools like Arkham can help you track these wallets and identify patterns.

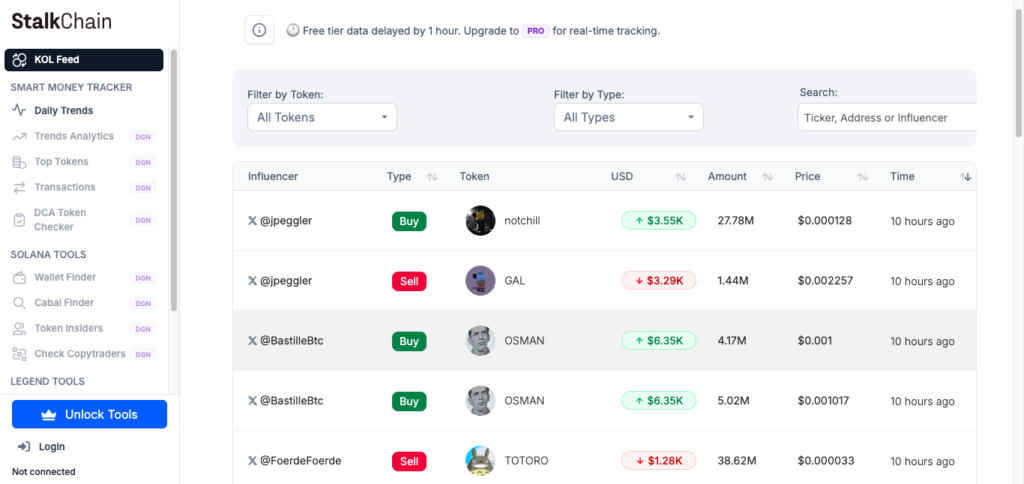

- Watch for KOL (Key Opinion Leader) Promotions

Influencers often start promoting memecoins before exchange listings. A sudden wave of endorsements can be a strong signal.

Tools like StalkChain can help you

- Track Community Engagement

Check for memes, jokes, and social media buzz. A thriving community is often the backbone of a successful memecoin.

- Check Holder and Volume Trends

Use tools like HolderScan and DexScreener to analyze holder counts and on-chain volume. Coins with steady growth are more likely to succeed.

When to Sell is the Million Dollar Question

Timing your exit is just as important as entering early. Most memecoins experience a price spike between the announcement of a major exchange listing and the actual start of trading. Selling just before trading begins or the first 24 hours is often the safest bet, as prices may dip once early adopters cash out.

That said, some memecoins defy expectations and continue to rise post-listing. It’s always wise to stay updated and adapt your strategy based on the token’s performance.

Final Thoughts

The memecoin frenzy offers huge opportunities but also comes with risks. By staying vigilant, using the right tools, and understanding the dynamics of exchange listings, you can increase your chances of spotting the next big memecoin early.

For Africa’s growing crypto community, memecoins represent an exciting gateway into blockchain, often offering life-changing returns for those who get in early. Platforms like TawkCrypto are here to guide you through the noise and keep you ahead of the curve.

BUT Remember, the memecoin market is risky. Do your own research, invest only what you can afford to lose, and never chase blindly. Now go forth and conquer that crypto jungle!

Have you spotted any promising memecoins? Share your thoughts in the comments below or join the discussion in our TawkCrypto community! Let’s keep the conversation going.