Coinbase Stock ($COIN) Surges 19.76% to Close at $324.24, Breaking $300 for the First Time Since 2021

Coinbase Stock Reaches Milestone Amid Market Enthusiasm

Coinbase Global, Inc. ($COIN), one of the largest cryptocurrency exchanges in the United States, has made headlines once again with a dramatic price surge. On Thursday, $COIN closed at $324.24, representing a gain of 19.76% in a single trading day. This marks the first time since 2021 that Coinbase stock has breached the $300 mark, a milestone that reflects renewed confidence in the crypto market as a whole and increased investor interest in cryptocurrency-linked equities.

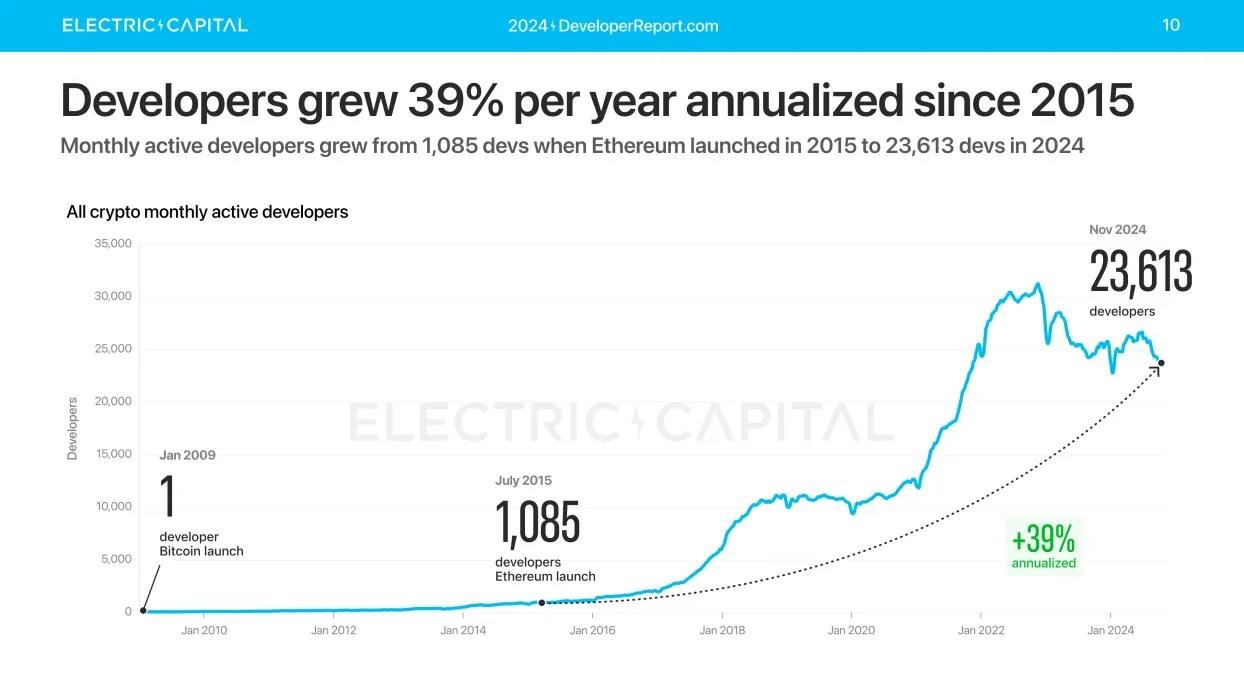

The surge in $COIN’s price underscores a strong rebound in the crypto sector, with rising Bitcoin and Ethereum prices driving enthusiasm among both retail and institutional investors. Coinbase, as a key player in the cryptocurrency industry, is now positioned to benefit from this resurgence and potentially reach new heights in the coming months.

What’s Driving the Surge in Coinbase’s Stock Price?

Several factors contributed to Coinbase’s remarkable performance, including the broader crypto market rally, positive quarterly earnings, regulatory developments, and institutional interest in the sector:

- Crypto Market Rally and New Bitcoin All-Time Highs: Bitcoin’s recent climb to new all-time highs has reinvigorated interest in the crypto market. As one of the most popular exchanges for trading Bitcoin and other digital assets, Coinbase’s performance is closely tied to the strength of the broader crypto market. As Bitcoin nears the $100,000 mark, investor enthusiasm for crypto-related stocks like $COIN has risen sharply.

- Strong Q3 Earnings Report: Coinbase’s Q3 earnings report exceeded Wall Street’s expectations, with the company reporting impressive revenue growth and profitability despite a challenging regulatory environment. This solid performance has reassured investors that Coinbase can thrive even amid market volatility. Additionally, growth in monthly transacting users and trading volume highlighted Coinbase’s strength in user engagement and retention.

- Increased Institutional Adoption: Coinbase’s platform has continued to attract institutional investors, including large hedge funds, asset managers, and corporations seeking exposure to cryptocurrencies. With growing interest in Bitcoin ETFs and custodial services, Coinbase is well-positioned to capture a significant share of institutional activity in the crypto space.

- Positive Regulatory Developments: Recent moves toward regulatory clarity in the U.S. have bolstered market confidence. Although regulation has posed challenges for crypto companies, Coinbase’s proactive stance on compliance and recent approval for various licenses have provided a strong foundation for the company. Clearer regulatory frameworks are likely to benefit established players like Coinbase, who are well-prepared to meet compliance standards.

- Broader Market Optimism for Crypto Stocks: Beyond Coinbase, several cryptocurrency-focused companies have seen their stock prices surge as confidence in the sector grows. Positive sentiment in the financial markets has extended to crypto stocks, further propelling $COIN’s upward trajectory as investors look to capitalize on the burgeoning market for digital assets.

Breaking the $300 Barrier: What This Means for Coinbase and Investors

Breaking the $300 level is a significant psychological milestone for Coinbase, as it last traded above this level in late 2021, shortly after its high-profile IPO. Coinbase’s return to these levels suggests that investor confidence has been restored following a period of regulatory and market turbulence. The stock’s recent performance also signals that Coinbase could potentially reach new all-time highs if current trends in the crypto market continue.

For investors, the surge above $300 represents a notable turnaround, especially for those who have held the stock since its initial public offering. Coinbase’s move back into growth territory is not only a positive indicator for the company but also for the broader crypto industry, which could benefit from renewed investor interest and capital inflows.

Potential Risks and Challenges Ahead

While Coinbase’s recent performance is promising, several risks remain on the horizon that could impact the stock’s future trajectory:

- Regulatory Scrutiny: Although regulatory clarity has improved, potential new regulations targeting cryptocurrency exchanges and custodians could pose challenges. Coinbase has been proactive in its approach to compliance, but any unfavorable legislation could impact operations or profitability.

- Market Volatility: The crypto market is known for its high volatility, and a sharp downturn in Bitcoin or Ethereum prices could negatively impact Coinbase’s trading volume and revenue. Coinbase’s reliance on transaction fees means that significant price drops in digital assets could quickly translate to lower revenue figures.

- Competition in the Crypto Space: As more traditional financial institutions and fintech companies enter the crypto space, Coinbase faces increasing competition. The rise of decentralized exchanges (DEXs) also presents a challenge, as they provide trading alternatives without requiring traditional exchange fees or custodial services.

Analysts’ Perspectives and Future Outlook

Analysts have responded positively to Coinbase’s performance, with many revising their price targets upward in light of the recent rally. Wall Street has praised Coinbase’s strong revenue growth, expanding user base, and ability to navigate regulatory challenges effectively. However, some analysts caution that $COIN’s future performance will continue to depend on the health of the crypto market, particularly Bitcoin and Ethereum prices.

Looking ahead, Coinbase’s focus on diversifying revenue streams could be a pivotal factor in sustaining growth. In recent months, the company has expanded its offerings, launching subscription services, staking options, and even exploring potential ventures into the NFT space. These initiatives could provide new revenue sources that are less sensitive to trading volume fluctuations, helping Coinbase maintain stability in various market conditions.

Conclusion: A Milestone Moment for Coinbase and the Crypto Market

Coinbase’s recent rally past the $300 mark signals a resurgence of investor confidence in the cryptocurrency market and in Coinbase as a leading player. This milestone highlights the platform’s resilience and ability to adapt to a rapidly changing landscape, even amid regulatory and market pressures. As the crypto market continues to mature, Coinbase is likely to remain a bellwether stock for the industry, offering insights into the sector’s health and future trajectory.

For investors, Coinbase’s performance serves as a reminder of the potential rewards and risks associated with crypto-linked equities. With market sentiment turning bullish and Bitcoin approaching new highs, the next few months could hold even greater opportunities—or volatility—for $COIN. In either scenario, Coinbase’s recent achievements have solidified its position as a major player in both the crypto and traditional finance arenas.