Bitcoin’s Wild Ride to $80K, Trump-Binance Rumors, and Rwanda Tightens Crypto Rules.

This Week’s Crypto Highlights

Welcome to this week’s TawkWrap, where we break down the latest happenings in the crypto world with a special focus on Africa’s vibrant markets and beyond. From dynamic price action to groundbreaking partnerships and bold regulatory moves, we’ve got all the details served up with plenty of African spice. Let’s dive in!

📈 Market Bloodbath: Bitcoin Drops to $80,000

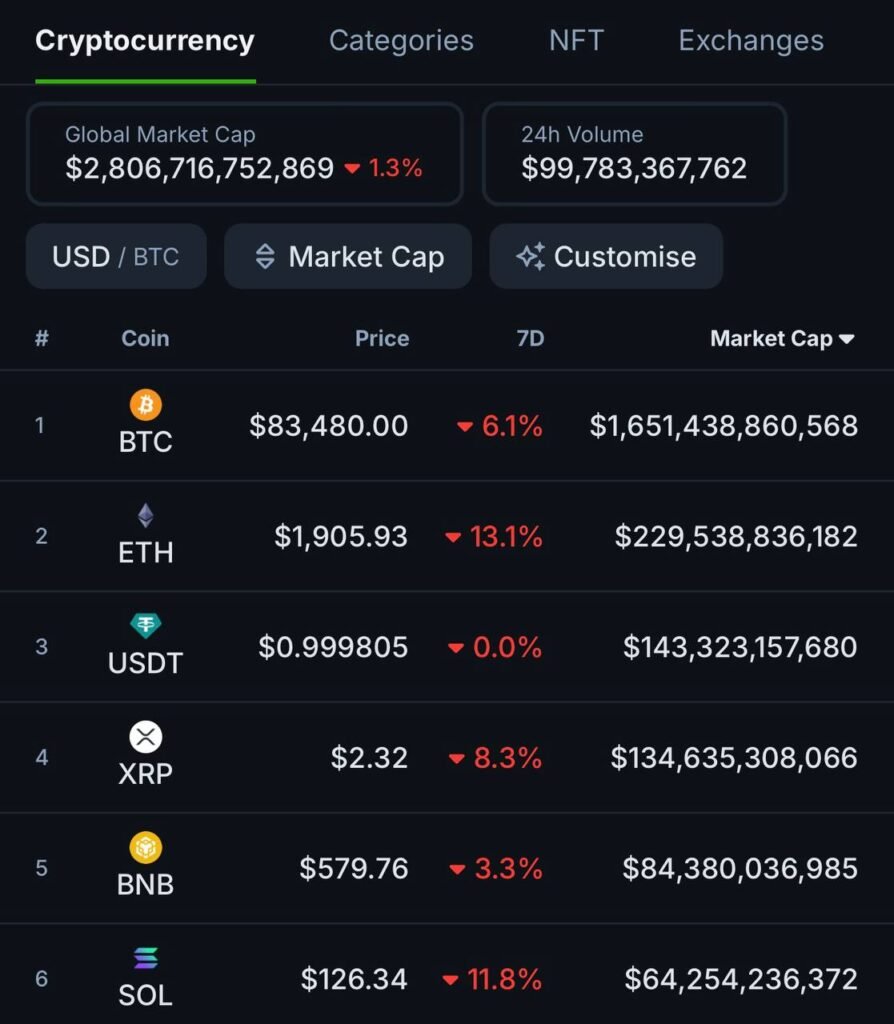

The cryptocurrency market faced a sharp downturn this week, with Bitcoin retracing to $80,000 after a strong bullish run. Currently trading around $83,000, BTC is down 6.1% on the week. Ethereum has taken a steeper hit, dropping 13% to $1,900, while Solana is down approximately 11%. The total crypto market cap now sits at $2.8 trillion.

This decline underscores the crypto market’s inherent volatility, where rapid price swings are common. While some investors view this as a buying opportunity, others remain cautious about further corrections. Analysts cite macroeconomic uncertainties, profit-taking from recent highs, and ongoing regulatory developments as key drivers of the downturn. Altcoins followed suit, with Ethereum, Solana, and other major assets experiencing double-digit losses. As always, the market remains unpredictable, emphasizing the need for strong risk management strategies.

🌍 African Crypto News

🇰🇷 Yellow Card Partners with Centi for Cheaper Cross-Border Payments

Yellow Card, one of Africa’s leading cryptocurrency exchanges, has partnered with Swiss fintech Centi to enhance cross-border payments across the continent. This collaboration aims to reduce remittance costs and improve transaction efficiency by leveraging blockchain-powered solutions. With Africa’s high remittance fees—often exceeding 8-10% per transaction—this move could provide much-needed relief to individuals and businesses. By integrating stablecoins and digital payment rails, Yellow Card and Centi seek to bridge traditional finance with blockchain technology, making sending and receiving money across borders faster and cheaper.

🇮🇷 IvoryPay Secures Investment from Hedera

IvoryPay, an African blockchain-based payment platform, has secured a strategic investment from Hedera, a leading decentralized ledger network. IvoryPay enables businesses across the continent to accept stablecoin payments, providing a seamless bridge between crypto and traditional financial services. The backing from Hedera underscores growing confidence in Africa’s blockchain ecosystem and the increasing demand for stablecoin-powered remittances. This investment will likely help IvoryPay scale its operations, improve infrastructure, and expand merchant adoption across the region.

🇷🇼 Rwanda Introduces Crypto Licensing Law

Rwanda has taken a major regulatory step by introducing a draft law requiring Virtual Asset Service Providers (VASPs) to apply for operating licenses. The country’s Capital Markets Authority (CMA) and the National Bank of Rwanda (NBR) spearheaded this initiative, signaling a shift toward formal oversight of the digital asset industry. Crypto platforms that fail to comply risk prosecution. This move aligns with Rwanda’s broader efforts to regulate and integrate crypto into the formal economy, ensuring consumer protection while preventing illicit financial activities.

🇳🇬 Binance Limits Free Airdrops in Nigeria

Binance has restricted access to its free token airdrops for Nigerian users, adding another layer of friction to its already strained relationship with Nigeria’s regulators. This comes amid ongoing scrutiny from Nigerian authorities, who have intensified their crackdown on crypto operations in the country. With the Nigerian crypto community heavily reliant on P2P trading and DeFi rewards, this restriction limits opportunities for users to earn free tokens, raising concerns over dwindling access to global crypto incentives.

🇰🇷 Luno Calls for Bitcoin to Be Classified as an Onshore Asset in South Africa

Paul Harker, Global Head of Legal and Corporate Strategy at Luno, has urged South Africa’s National Treasury to classify Bitcoin as an onshore asset when held by local exchanges. Currently, Bitcoin falls into a regulatory grey area, causing uncertainty for investors and tax implications. If accepted, this classification could simplify tax compliance, improve investor protection, and encourage institutional adoption of Bitcoin in South Africa.

🌐 Global Crypto Developments

🇺🇸 White House Crypto Summit Fails to Deliver

The much-anticipated White House Crypto Summit ended in disappointment for crypto investors. Many had hoped for pro-crypto policies or hints of government-led Bitcoin adoption, but the discussions remained vague and noncommittal. This contributed to the market slump, reinforcing concerns that US regulatory clarity remains elusive. While some officials acknowledged crypto’s role in innovation, the lack of concrete support left investors questioning the US government’s true stance on digital assets.

💰 MicroStrategy Plans $21B Stock Sale to Buy More Bitcoin

Michael Saylor’s MicroStrategy is doubling down on its Bitcoin strategy, announcing plans to sell $21 billion in preferred stock to purchase more Bitcoin. This aggressive move highlights Saylor’s unwavering belief in Bitcoin’s long-term value and his firm’s commitment to using BTC as a primary treasury asset. While some investors see this as a bold strategy, others caution that leveraging debt to acquire Bitcoin carries significant risks in a volatile market.

📈 Movement Labs Mainnet Goes Live with $250M TVL

Movement Labs has officially launched its mainnet, attracting $250 million in total value locked (TVL). The project also unveiled the first US Movement ETF, signaling increased institutional interest in blockchain-based investment products. Movement Labs’ launch reflects the expanding landscape of layer-1 and layer-2 blockchain ecosystems, with new players competing to scale Web3 infrastructure.

🇺🇸 SEC Delays Altcoin ETF Decisions

The SEC has postponed its decision on multiple altcoin spot ETF applications, extending the wait for a potential approval. This delay underscores regulatory caution around altcoin ETFs, with the SEC citing the need for further evaluation of market risks. While Bitcoin ETFs have seen massive inflows, altcoins remain under strict regulatory scrutiny, leaving investors uncertain about their mainstream financial adoption timeline.

🔒 US House Moves to Dismantle IRS DeFi Broker Rule

The US House of Representatives has taken steps to overturn the controversial IRS DeFi broker rule, which previously sought to impose strict reporting requirements on DeFi platforms. If successful, this move could mark a major victory for decentralized finance, allowing DeFi projects to operate with greater flexibility and fewer regulatory burdens in the US.

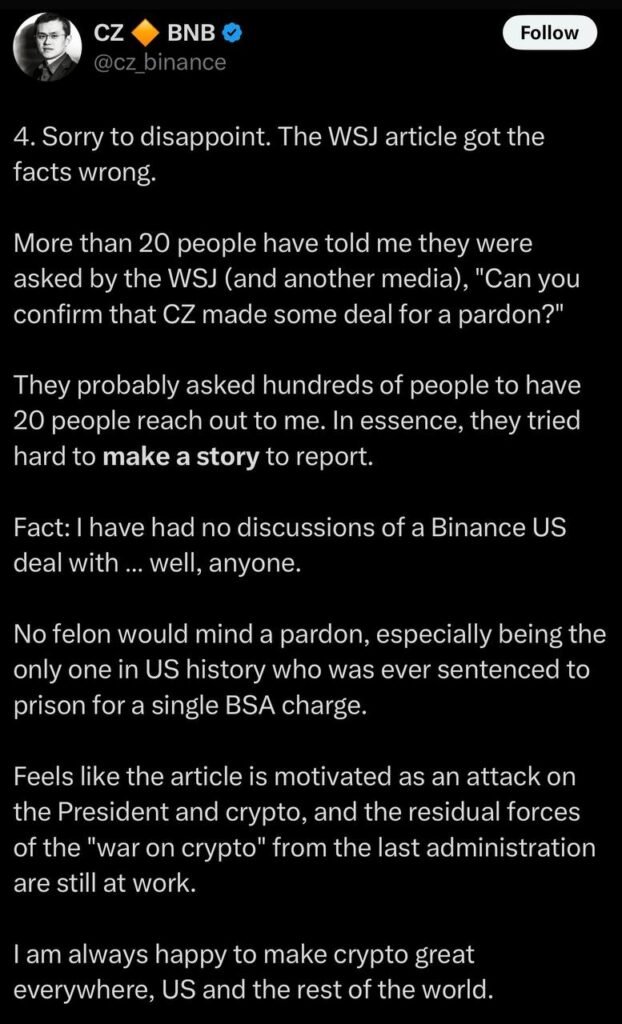

💸 Trump Family and Binance Controversy

Reports surfaced that the Trump family held talks with Binance about acquiring a stake in Binance US. However, CZ has denied these claims, clarifying that he has not engaged in discussions about Binance US’s sale, though he remains open to a pardon. This speculation adds another layer of intrigue to Binance’s ongoing regulatory battles.

🌟 Gemini’s Bitcoin Drone Show Sets World Record

Gemini hosted a world-record Bitcoin drone show at South by Southwest, using a spectacular aerial display to promote Bitcoin adoption. This creative marketing stunt aimed to draw attention to crypto’s cultural impact while showcasing Gemini’s brand innovation.

📉 Hyperliquid’s $4M Ethereum Liquidation

A massive Ethereum liquidation on Hyperliquid resulted in a $4 million loss for its liquidation engine. This event underscores the high risks associated with leveraged trading, where large liquidations can trigger cascading effects across the market.

💼 Binance Secures $2B Investment from Abu Dhabi’s MGX

Binance has secured a $2 billion investment from Abu Dhabi-based MGX, reinforcing its global dominance despite regulatory challenges. This major funding round signals ongoing institutional confidence in Binance, allowing the exchange to expand its services and ecosystem further.

Read also

That’s it for this week’s TawkWrap! Stay tuned for more updates next week, and keep stacking those sats!