From Oil and Gold to Bitcoin: How Strategic Reserves Are Evolving in the Digital Age

Welcome to our deep dive into the evolution of strategic reserves. In this issue, we’ll explore how traditional commodity reserves—like oil and gold—are being reimagined in today’s digital era with Bitcoin and other cryptocurrencies. We’ll break down the differences in storage challenges, volatility, and global economic influence, using facts, stats, and plenty of examples to help you navigate this exciting transformation.

Introduction

The Evolution of Strategic Reserves

For decades, nations have recognized the critical role that strategic reserves play in maintaining economic stability and national security. Take oil, for example: after the oil embargo of the 1970s, countries around the world began to see the importance of having a backup supply. The United States established its Strategic Petroleum Reserve (SPR) in 1975, which today holds over 700 million barrels of crude oil. At an average price of around $70 per barrel, this reserve represents nearly $50 billion in stored energy—a vital buffer against sudden supply shocks or geopolitical tensions.

Gold, too, has long been a cornerstone of national reserves. It serves not only as a store of value but also as a hedge against inflation and currency devaluation. The United States, for instance, holds roughly 8,100 metric tons of gold in its vaults, making it the largest gold reserve in the world. Similarly, Germany and Italy boast significant gold holdings, ensuring that these countries have a tangible asset to fall back on during times of financial stress.

Beyond these hard numbers, strategic reserves have proven their worth in real-world crises. During the 2008 global financial meltdown, several central banks boosted their gold reserves as investors sought the safety of tangible assets amid widespread market turmoil. Likewise, the SPR has been tapped during periods of economic or political instability to stabilize markets and ensure continuous access to energy.

In essence, these reserves act like a financial safety net, allowing governments to manage unexpected shocks and maintain confidence in their economies. As we transition into the digital age, these traditional models are inspiring new ways of thinking about value storage—ushering in an era where assets like Bitcoin are beginning to join the ranks of national strategic reserves.

The Legacy of Traditional Commodity Reserves

A Historical Overview of Oil and Gold Reserves

Countries like the United States, China, and several European nations have built massive stockpiles of oil and gold over decades, recognizing their vital role in national security and economic stability. These reserves have served as critical safeguards during times of crisis and as long-term hedges against inflation and geopolitical instability.

Oil Reserves: A Buffer in Times of Crisis

The oil shocks of the 1970s, triggered by geopolitical tensions and the Arab oil embargo, fundamentally changed how nations viewed energy security. In response, the United States established the Strategic Petroleum Reserve (SPR) in 1975. Today, the SPR holds over 700 million barrels of crude oil, representing a multi-billion-dollar asset that provides a crucial buffer against supply disruptions. For example, during periods of international conflict or severe market volatility, the SPR has been used to stabilize domestic oil supplies and prices, ensuring that the nation can continue to function despite external shocks.

Other nations, including China and members of the European Union, have similarly recognized the importance of maintaining substantial oil reserves. These reserves are not only a safeguard against supply shocks but also a strategic tool for influencing global energy markets. By controlling a significant portion of their oil supply, countries can better manage price fluctuations and maintain energy security, which is essential for both economic stability and national defense.

Gold Reserves: The Timeless Hedge

Gold, often referred to as a “safe-haven” asset, has long been the cornerstone of national reserves. It is widely regarded as a hedge against inflation and currency devaluation. The United States, for instance, holds approximately 8,100 metric tons of gold, making it the largest gold reserve in the world. Other major holders include Germany, Italy, and France, which have accumulated thousands of metric tons over decades. During periods of economic uncertainty, central banks have often increased their gold reserves, viewing the metal as a stable store of value that can protect against financial turmoil.

Historically, gold played a central role in the global monetary system, most notably during the Bretton Woods era, when currencies were directly linked to gold. Although the gold standard was eventually abandoned, the metal retained its value as a critical reserve asset. During the 2008 financial crisis, many central banks expanded their gold holdings to shore up confidence in their economies, further cementing gold’s reputation as a reliable asset during times of economic distress.

Strategic Importance in National Security and Global Economy

Gold and oil are not merely commodities; they are pivotal strategic tools that nations leverage to secure economic stability and bolster national security. During times of economic uncertainty or geopolitical tension, these assets serve as a form of financial “insurance.” For instance, during the oil embargo of the 1970s, countries with substantial oil reserves were better positioned to weather energy crises and mitigate economic shocks. Today, the United States’ Strategic Petroleum Reserve (SPR) holds over 700 million barrels of oil, providing an essential buffer against supply disruptions and price spikes. Similarly, gold reserves—like the roughly 8,100 metric tons held by the U.S.—act as a hedge against inflation and currency devaluation. This “emergency savings fund” approach allows nations to negotiate from a position of strength on the international stage, as seen when countries use their reserves to stabilize markets or secure favorable trade deals during periods of instability.

Beyond serving as economic safeguards, strategic reserves play a critical role in international diplomacy. When geopolitical tensions arise, having robust reserves can offer a country significant leverage in negotiations, enabling it to exert influence and maintain economic resilience. For example, during the 2008 global financial crisis, several central banks ramped up their gold purchases as a means of reinforcing economic confidence. In a similar vein, nations with large oil reserves can use their energy security as a bargaining chip in global trade discussions, ensuring that they maintain a competitive edge.

Operational and Logistical Aspects of Traditional Storage

Managing the storage of oil and gold involves complex, resource-intensive operations that require sophisticated infrastructure and meticulous planning. Consider the U.S. Strategic Petroleum Reserve: stored in vast underground salt caverns along the Gulf Coast, this reserve is a marvel of engineering. These caverns are not only designed to hold enormous quantities of oil but also require constant monitoring to ensure safety, maintain optimal pressure, and prevent leaks. The sheer scale of this operation underscores the logistical challenges and the high cost—both in terms of initial capital investment and ongoing maintenance.

Gold storage, on the other hand, demands ultra-secure vaults with multiple layers of protection. Facilities like Fort Knox in Kentucky exemplify the stringent security measures in place, including biometric access, armed guards, and sophisticated surveillance systems. These vaults are designed to protect billions of dollars in assets from theft, natural disasters, or even internal mishaps. For example, the vaults are maintained under strict environmental controls to prevent any physical damage or degradation of the gold, which could be catastrophic given its value.

Moreover, the operational challenges extend beyond physical security. Both oil and gold storage involve extensive logistical networks to manage inventory, ensure timely maintenance, and facilitate rapid deployment if needed. For oil, this includes transportation networks for moving the commodity to refineries or export terminals, while gold reserves require highly coordinated systems to authenticate, audit, and insure the stored assets. The complexity of these processes not only demands cutting-edge technology and robust management systems but also a significant financial commitment to ensure that the reserves remain intact and accessible during times of crisis.

In summary, the strategic importance and operational complexity of maintaining oil and gold reserves illustrate why these assets have been, and continue to be, fundamental pillars of national security and economic strategy. They not only provide a safety net during turbulent times but also serve as potent tools in the geopolitical arena, reinforcing the notion that in the world of global finance, tangible assets remain as crucial as ever

The Rise of Crypto as a Strategic Reserve

Digital assets are rapidly emerging as a modern counterpart to traditional strategic reserves, and at the forefront is Bitcoin—often hailed as “digital gold.” Unlike physical commodities such as oil or gold, Bitcoin exists solely in the digital realm, offering a range of unique opportunities and challenges for its role as a reserve asset.

Bitcoin: Digital Gold in a Digital World

Bitcoin’s limited supply is one of its most compelling features. Capped at 21 million coins, this scarcity is built into its very code, creating an inherent deflationary quality that appeals to investors seeking a hedge against inflation. As of early 2025, approximately 19 million Bitcoin are already in circulation, which means that the remaining supply is dwindling—a factor that has contributed to its growing store-of-value narrative.

This scarcity, coupled with its decentralized nature, makes Bitcoin an attractive alternative to traditional assets. In times of economic uncertainty, investors have turned to Bitcoin much like they would to gold. For instance, during the COVID-19 pandemic, Bitcoin’s value surged as investors sought a safe haven amid unprecedented monetary expansion and market volatility. Today, its market capitalization has soared to over $1.5 trillion, reflecting its acceptance as a legitimate asset class by both retail and institutional investors.

Institutional Adoption and Real-World Examples

A clear indicator of Bitcoin’s growing stature is the wave of institutional adoption. Companies like Strategy (formerly Microstrategy) have made headlines by investing billions in Bitcoin as part of their treasury strategy. Strategy’s aggressive acquisition underscores the belief that Bitcoin can serve as a reliable long-term reserve asset. This move mirrors similar strategies by other corporations and even state-level actors, who see Bitcoin as a means to diversify their portfolios away from traditional fiat currencies.

El Salvador’s bold decision to adopt Bitcoin as legal tender in 2021 further highlights its strategic potential. Although controversial, this move positioned the small nation as a pioneer in integrating digital assets into its national economic framework. These examples illustrate how Bitcoin is increasingly seen not just as an investment, but as a fundamental component of a modern, diversified reserve strategy.

Expanding Beyond Bitcoin: Other Digital Assets

While Bitcoin remains the poster child of crypto reserves, other digital assets are also gaining traction. Ethereum, for example, has carved out its own niche as “programmable money” with its smart contract functionality, fueling the decentralized finance (DeFi) revolution. Although Ethereum is more volatile and its use cases differ from Bitcoin’s store-of-value proposition, its significant market presence and growing ecosystem of applications make it a valuable addition to a diversified digital reserve.

Other cryptocurrencies, such as Cardano (ADA) and Solana (SOL), are also being considered for their technological advancements and scalability. Each of these assets offers unique benefits, such as lower transaction fees or faster processing times, which can be critical for high-volume financial operations and as a complement to Bitcoin in a balanced reserve portfolio.

Digital Storage and Security Considerations

Unlike physical reserves that require secure vaults and logistical infrastructure, digital assets reside on blockchains—distributed, encrypted ledgers that provide transparency and security. Bitcoin is typically stored in cold storage, where private keys are kept offline to protect against cyberattacks. However, the digital nature of these assets introduces new challenges, such as the need for robust cybersecurity protocols, regulatory clarity, and advanced custody solutions to prevent hacking and unauthorized access.

For example, the recent high-profile hacks in the crypto space have underscored the necessity for state-of-the-art security measures. Institutions now invest heavily in cybersecurity frameworks to protect their digital holdings, a process that involves regular audits, multi-signature wallets, and the adoption of insurance products to mitigate risks.

The Future of Strategic Reserves in the Digital Age

The evolution of strategic reserves from tangible commodities to digital assets like Bitcoin marks a significant shift in how nations and institutions approach economic security. While traditional reserves offer the comfort of physicality and long-established regulatory frameworks, digital assets provide unparalleled advantages in terms of transferability, divisibility, and global accessibility.

As governments around the world explore the possibility of integrating crypto assets into their strategic portfolios, the next frontier may well be a hybrid reserve model that leverages the strengths of both traditional and digital assets. This integrated approach could provide a more resilient financial foundation, capable of withstanding both conventional economic shocks and the rapidly evolving dynamics of the digital economy.

Motivations Behind Adopting Crypto for Strategic Reserves

Countries and large institutions are increasingly eyeing digital assets for their strategic reserves, driven by the potential for high returns and the benefits of portfolio diversification. The appeal of cryptocurrencies like Bitcoin lies in their capped supply—Bitcoin, for instance, is limited to 21 million coins, creating scarcity that supports its value over time. With Bitcoin’s market capitalization having surged to over $1.5 trillion at its peak, many investors view it as a hedge against inflation, similar to how gold has traditionally been used.

Beyond high returns, the decentralized nature of blockchain technology offers a unique layer of security and transparency that traditional reserves cannot match. Blockchain’s immutable ledger enables real-time auditing and reduces the risk of corruption or mismanagement. For example, during periods of economic turmoil, some investors have turned to crypto as a safe haven—its digital nature allows for rapid, global transfers without the need for intermediaries, which is particularly appealing in times of financial stress.

Moreover, cryptocurrencies are highly divisible and easily portable, enabling swift responses to market changes or geopolitical events. Institutions like MicroStrategy have aggressively built up their Bitcoin holdings as part of a broader strategy to diversify away from traditional fiat currencies, reinforcing the notion that digital assets can serve both as an investment and as a reserve. Recent surveys indicate that a growing number of central banks and financial institutions are exploring the inclusion of digital assets, with some estimates suggesting that institutional investment in cryptocurrencies has increased by over 500% in the past few years.

Case Studies: Early Adopters and National Initiatives

Several governments and financial institutions are already leading the way in integrating digital assets into their strategic reserves. For instance, in a groundbreaking move, President Donald Trump recently announced the creation of a crypto strategic reserve that includes major digital assets like Bitcoin (BTC), Ethereum (ETH), Cardano (ADA), XRP, and Solana (SOL). This announcement marks a significant shift, positioning crypto alongside traditional reserves such as oil and gold in national financial strategies. By including these assets, the administration aims to leverage the potential for high returns and the decentralization benefits of blockchain technology, while also hedging against inflation and currency devaluation.

El Salvador, although more known for adopting Bitcoin as legal tender, provides another compelling case study. Their move not only sought to empower the economy with a modern financial tool but also aimed at reducing reliance on the U.S. dollar. Similarly, several countries in Africa and Asia are exploring digital asset reserves to diversify their national portfolios and safeguard against traditional financial system vulnerabilities.

Institutional adoption is also on the rise. For example, MicroStrategy’s ongoing Bitcoin purchases have made headlines; the company has added billions of dollars in Bitcoin to its treasury, underscoring a growing confidence in crypto as a store-of-value. Additionally, some central banks are cautiously testing the waters by holding small allocations of digital assets to assess their long-term viability as strategic reserves. According to industry surveys, nearly 40% of financial institutions plan to increase their crypto holdings over the next year as part of their diversification strategies.

These early adopters highlight a broader trend: the convergence of traditional financial prudence with innovative digital strategies. By combining the established security of traditional reserves with the groundbreaking benefits of blockchain technology, nations and institutions are laying the groundwork for a more resilient and adaptive financial future. This hybrid approach not only protects against economic uncertainties but also positions these entities at the forefront of the evolving global financial landscape

Storage Challenges: Physical vs. Digital

When it comes to storing assets, whether physical commodities or digital currencies, both methods come with unique challenges and costs. Let’s take a closer look at how each is managed, along with some fascinating facts, stats, and examples.

Traditional Storage: Infrastructure, Security, and Maintenance

Physical Commodities Storage:

For decades, the storage of physical assets like gold and oil has required sophisticated infrastructure and high levels of security. Gold, for example, is typically stored in highly secure vaults. Facilities such as Fort Knox in the United States are equipped with multi-layered security systems—including biometric access controls, armed guards, and advanced surveillance—to safeguard billions of dollars in gold reserves. According to industry reports, global gold storage facilities can cost anywhere from 2% to 5% of the asset’s value annually in insurance, maintenance, and security expenses.

Oil Storage Infrastructure:

Oil, on the other hand, is stored in specialized facilities like the U.S. Strategic Petroleum Reserve (SPR), which uses underground salt caverns to safely hold over 700 million barrels of crude oil. These storage tanks require constant monitoring and maintenance to ensure that they remain leak-proof and secure, with operational costs running into hundreds of millions of dollars annually. Such infrastructure investments are critical, as any failure in the system can lead to catastrophic supply disruptions.

Logistical Complexities:

Both gold and oil storage involve complex logistical challenges. Transporting these commodities requires robust supply chain networks to ensure that the assets reach their secure storage facilities safely. The need for temperature-controlled environments for oil, for example, adds an extra layer of complexity—and expense—that physical asset storage invariably entails.

Digital Storage: Cold Storage, Hot Wallets, and Custodial Solutions

Digital Asset Storage:

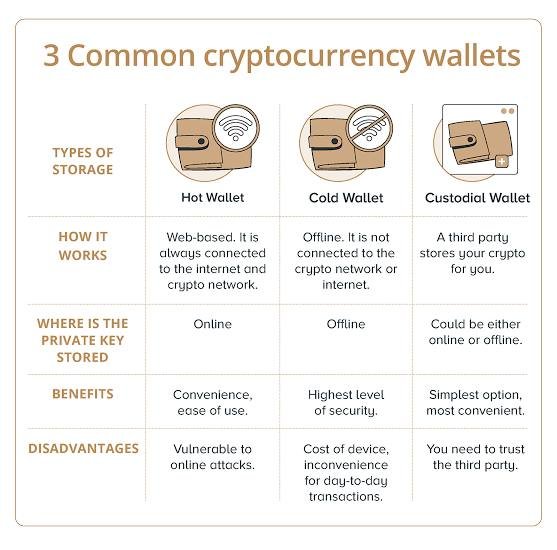

Unlike physical commodities, digital assets like Bitcoin exist purely in the digital realm. This means they require entirely different methods of storage—primarily revolving around the concept of “cold storage” and “hot wallets.”

- Cold Storage:

Cold storage refers to keeping cryptocurrency offline to protect it from cyber attacks. This might involve hardware wallets or even paper wallets that store the private keys needed to access digital assets. In 2023, it was estimated that nearly 80% of institutional crypto holdings were kept in cold storage, highlighting its importance for security. - Hot Wallets:

Hot wallets, in contrast, are connected to the internet and allow for quicker access to funds but come with a higher risk of hacking. Several high-profile hacks, such as the Mt. Gox incident in 2014, have underscored the vulnerability of funds stored in hot wallets. - Custodial Solutions:

Custodial solutions offered by platforms like Coinbase Custody or BitGo provide a hybrid approach, where assets are stored in secure, managed environments with multi-signature authentication and insurance coverage. These services are particularly valuable for institutional investors who need both accessibility and robust security.

Real-World Impacts:

The stark differences in storage methods have significant implications. For instance, while physical storage demands constant physical security and maintenance, digital storage requires continuous cybersecurity investments and regular updates to encryption protocols. According to a report by CipherTrace, crypto-related hacks and thefts resulted in losses exceeding $1 billion in 2022 alone, emphasizing the need for advanced security measures in the digital realm.

Innovations in Storage and Security Technologies

Advances in Physical Storage:

Traditional storage methods are not static. Innovations in physical security have led to automated monitoring systems, AI-powered surveillance, and even drone patrols around storage facilities. For example, some modern vaults now integrate IoT sensors that monitor environmental conditions and alert security teams instantly if any anomaly is detected.

Revolution in Digital Security:

In the digital space, blockchain technology itself offers groundbreaking solutions for asset security. Smart contracts can automatically enforce security protocols, while decentralized finance (DeFi) platforms are experimenting with multi-layered custody solutions that combine cold storage with real-time risk management. Moreover, biometric authentication and multi-signature wallets are becoming industry standards. Major custodial firms are now offering insurance policies that cover up to $100 million per incident, aiming to provide institutional investors with a safety net against potential hacks.

Example – Hybrid Custodial Systems:

A prime example of innovation in digital storage is the emergence of hybrid custodial systems, where assets are split between cold and hot storage environments. This not only mitigates risk by reducing the exposure of any single asset to cyber threats but also ensures that funds remain liquid and accessible when needed. As reported by industry leaders, these solutions have reduced the frequency of successful breaches by more than 60% over the past few years

Both physical and digital asset storage come with their own sets of challenges, costs, and innovations. While traditional storage of gold and oil has relied on centuries-old practices fortified by modern technology, the digital realm continuously evolves with new cybersecurity measures and storage innovations. Understanding these differences is crucial for anyone involved in asset management, as it highlights the ongoing transformation in how we protect and manage value in an increasingly complex and digital world.

Volatility and Risk Management

The world of asset management is marked by inherent risks and market fluctuations, but the degree and nature of volatility differ greatly between traditional commodities and digital assets like Bitcoin.

Price Fluctuations in Oil, Gold, and Bitcoin

Traditional Commodities:

Oil and gold, while not immune to price changes, have historically been more stable than cryptocurrencies. For example, gold’s annualized volatility has typically ranged between 15% to 20%, reflecting its status as a safe-haven asset. Oil, on the other hand, is more sensitive to geopolitical events and supply disruptions, often exhibiting annualized volatility in the range of 30% to 40%. A notable example was the oil price crash in early 2020 during the COVID-19 pandemic, when prices briefly turned negative due to oversupply and storage shortages.

Digital Assets:

Bitcoin, often dubbed “digital gold,” has a markedly different volatility profile. Studies have shown that Bitcoin’s annualized volatility can soar to 70%-80% or even higher in turbulent market conditions. This dramatic fluctuation is evident from its history of multi-year bull runs followed by sudden, steep corrections. For instance, Bitcoin surged from around $3,000 at the start of 2020 to nearly $60,000 by early 2021, only to plunge by over 50% within the following months. Such swings illustrate both the high-risk and high-reward nature of digital assets.

Risk Management Strategies for Traditional and Digital Assets

For Traditional Assets:

Risk management for physical commodities like oil and gold typically involves diversified storage and comprehensive insurance measures. Governments and financial institutions maintain multiple storage facilities worldwide, ensuring that a disruption in one location does not compromise the overall reserve. In addition, these assets are often hedged using futures contracts and other derivatives to mitigate price risks. For example, many countries use oil futures to stabilize domestic energy markets, while central banks rely on gold to preserve the purchasing power of their reserves during economic downturns.

For Digital Assets:

In contrast, managing risk in the digital realm requires a blend of financial hedging strategies and advanced cybersecurity measures. Investors often mitigate Bitcoin’s volatility by diversifying their portfolios with stable assets like gold and fiat currencies. Moreover, sophisticated tools such as Bitcoin futures, options, and other derivatives allow investors to hedge against sudden market swings. Institutions also adopt robust storage solutions—using cold storage and multi-signature wallets—to protect against cyber threats. Notably, after experiencing several high-profile hacks, companies like Coinbase and BitGo have significantly enhanced their security protocols and even secured insurance policies to cover potential losses, with coverage sometimes reaching tens of millions of dollars.

Market Dynamics and Global Economic Factors

Influences on Traditional Commodities:

The price dynamics of oil and gold are heavily influenced by global geopolitical events, supply chain issues, and economic policies. For instance, tensions in the Middle East often drive oil prices higher, as market participants anticipate supply disruptions. Similarly, during times of economic uncertainty or inflationary pressures, gold’s price tends to rise as investors seek a hedge against currency devaluation. These patterns have been well-documented; during the 2008 financial crisis, gold prices surged as investors flocked to safer assets amid widespread market instability.

Influences on Digital Assets:

Bitcoin, however, is subject to a different set of factors. Regulatory developments, technological innovations, and shifts in investor sentiment can all trigger rapid changes in its value. For example, announcements from major economies regarding crypto regulation can cause immediate market reactions. Similarly, technological upgrades in blockchain protocols or breakthroughs in cybersecurity can either boost confidence or fuel uncertainty. The decentralized and borderless nature of Bitcoin means that it is more susceptible to global digital trends and market sentiment shifts, making it a complex yet fascinating asset to monitor.

Broader Implications:

Both traditional and digital assets are deeply intertwined with global economic trends, serving as barometers for broader financial health. While gold and oil have long been trusted by governments to secure economic stability, Bitcoin’s rapid growth and volatility have positioned it as an emerging alternative for diversification—albeit one that comes with its own set of challenges. As investors and policymakers navigate these dynamics, the contrasting characteristics of these asset classes underscore the need for a well-balanced, diversified portfolio that can weather both physical and digital market uncertainties.

Global Economic Influence and Strategic Implications

The evolving nature of strategic reserves—whether traditional commodities or digital assets—is not just a financial curiosity; it has far-reaching implications for global economic policy and international relations.

Impact of Traditional Reserves on International Trade and Policy

Traditional reserves like oil and gold have long been the backbone of national economies, playing a critical role in global trade and monetary policy. These reserves provide countries with a tangible asset base that supports monetary stability. For instance, the United States’ gold reserves, totaling around 8,133 metric tons, have historically helped bolster the dollar’s value and provided a safeguard during times of economic turbulence. Similarly, oil reserves—such as the U.S. Strategic Petroleum Reserve, which holds over 700 million barrels—act as a crucial buffer during supply shocks. When geopolitical tensions or natural disasters disrupt oil supply, these reserves can stabilize domestic markets and influence global oil prices.

In international trade, having substantial reserves offers nations a form of leverage. Countries with robust oil reserves can negotiate better terms in energy-related trade agreements, while significant gold holdings can serve as collateral in international finance. This dynamic has been evident during crises like the oil embargoes of the 1970s, when nations with secure energy reserves were less vulnerable to external pressures. Overall, traditional reserves have served as a financial safety net, enabling governments to steer their economies through unpredictable global events.

The Role of Crypto Reserves in Economic Sovereignty

As digital assets gain legitimacy, they are increasingly seen as tools for achieving economic sovereignty. Bitcoin, often dubbed “digital gold,” offers a novel way for countries and institutions to diversify their reserves away from traditional fiat currencies. With its capped supply of 21 million coins, Bitcoin is inherently deflationary—a quality that makes it attractive as a hedge against inflation and currency devaluation.

Recent moves by institutions and governments underline this trend. For example, President Donald Trump recently announced a crypto strategic reserve that includes Bitcoin (BTC), Ethereum (ETH), Cardano (ADA), XRP, and Solana (SOL). This initiative is designed to complement traditional reserves, allowing for a more diversified approach to managing national wealth. Beyond the U.S., nations like El Salvador have taken bold steps by adopting Bitcoin as legal tender, while several central banks are cautiously exploring small allocations of digital assets to test their potential as reserve currencies.

These strategic shifts are driven by the need for economic resilience in a rapidly digitizing world. A recent survey indicated that over 60% of institutional investors view digital assets as an essential component of a diversified portfolio. The underlying idea is that combining the reliability of traditional reserves with the innovative, decentralized nature of blockchain technology can help nations protect against systemic risks and inflationary pressures, thereby enhancing their economic sovereignty.

Geopolitical Considerations and Future Trends

The integration of crypto into national reserves could significantly reshape the geopolitical landscape. Countries that embrace digital assets may gain a strategic advantage in an increasingly digital and decentralized global economy. For instance, nations that successfully incorporate Bitcoin into their reserve portfolios could leverage it as a tool for economic diplomacy, potentially reducing their dependence on the U.S. dollar and mitigating the impact of international sanctions.

Geopolitical shifts are already underway. As central banks and financial institutions around the world begin to allocate portions of their reserves to cryptocurrencies, the traditional centers of economic power could be challenged. This is particularly relevant in regions with volatile currencies or limited access to conventional financial markets, where digital assets offer a more stable alternative.

Looking ahead, experts predict that the rise of crypto reserves could lead to a hybrid model where traditional and digital assets coexist, offering the benefits of both. This model may drive future global economic policies, with nations striving to balance the stability of gold and oil with the innovative potential of digital currencies. As regulatory frameworks evolve and technological advancements continue, the strategic landscape of global reserves is set to become more dynamic, flexible, and integrated—ultimately redefining how economic power is distributed on the world stage.

Comparative Analysis: Traditional Commodities vs. Crypto Assets

As nations and institutions explore new frontiers in reserve management, understanding the strengths and weaknesses of both traditional commodities and digital assets is crucial. Let’s delve deeper into a comparative analysis, looking at the advantages and limitations of oil and gold, the benefits and drawbacks of Bitcoin and other cryptocurrencies, and the potential synergies—and challenges—of a hybrid reserve model.

Advantages and Limitations of Oil and Gold as Reserves

Advantages:

- Proven Track Record:

Oil and gold have been cornerstones of national reserves for decades. Gold, for example, has been used as a store of value for thousands of years. The U.S. gold reserve, which totals around 8,100 metric tons, is often cited as a benchmark for economic stability. Oil, stored in facilities like the U.S. Strategic Petroleum Reserve (SPR) with over 700 million barrels, provides a critical energy buffer that has helped countries navigate supply shocks and geopolitical tensions. - Tangible and Stable Value:

These assets are physical and widely recognized. Gold is seen as a hedge against inflation and currency devaluation, while oil is essential for energy security. Their prices, though subject to fluctuations, generally exhibit lower volatility compared to digital assets. For instance, gold’s annualized volatility is typically between 15% and 20%, offering a level of predictability in uncertain times.

Limitations:

- High Infrastructure Costs:

The physical nature of oil and gold requires substantial infrastructure. Gold must be stored in highly secure vaults with robust security measures, like those at Fort Knox, which involve multi-layered defenses, insurance, and environmental controls. Similarly, oil requires specialized storage facilities such as underground salt caverns or refrigerated tanks, all of which entail significant operational costs. - Physical Risks:

Being tangible assets, oil and gold are vulnerable to physical risks such as theft, damage, or loss due to natural disasters. The logistics of transporting and maintaining these reserves add another layer of complexity and expense. In extreme cases, such as during conflicts or major natural disasters, these assets can be physically compromised.

Benefits and Drawbacks of Bitcoin and Other Cryptos

Benefits:

- Ease of Transfer and Divisibility:

Bitcoin and other cryptocurrencies can be transferred globally within minutes, bypassing the need for intermediaries like banks. Its digital nature allows for divisibility down to eight decimal places, facilitating micro-transactions that would be impossible with physical assets. - Resistance to Censorship and Decentralization:

As decentralized assets, cryptocurrencies operate on blockchain technology, which inherently resists censorship. No single entity controls the network, providing a level of security and independence that traditional assets do not offer. - High Potential Returns:

Cryptocurrencies have demonstrated the ability to generate high returns. For example, Bitcoin’s price history includes explosive growth periods—rising from under $1,000 in 2013 to over $60,000 at its peak—though these swings come with considerable risk.

Drawbacks:

- Volatility:

Bitcoin’s annualized volatility can exceed 70% during turbulent market periods. This extreme fluctuation is in stark contrast to the relatively stable prices of gold and oil, making digital assets more suitable for high-risk, high-reward scenarios rather than as a purely stable reserve. - Digital Storage Challenges:

Storing cryptocurrencies securely requires advanced technology. Cold storage solutions (offline wallets) offer high security but can be less accessible, while hot wallets, connected to the internet, are more vulnerable to cyberattacks. Several high-profile hacks in the crypto space, including breaches of major exchanges, highlight the risks associated with digital storage. - Evolving Regulatory Landscape:

The regulatory frameworks governing cryptocurrencies are still in development. Uncertainty in this area can lead to market instability. For instance, regulatory announcements in major economies have previously led to sharp declines in Bitcoin’s value, reflecting the ongoing concerns over how digital assets will be governed.

Synergies and Conflicts in a Hybrid Reserve Model

Potential Synergies:

- Diversification and Risk Hedging:

A hybrid reserve model that includes both traditional commodities and digital assets can offer the best of both worlds. By diversifying reserves, countries can hedge against different types of risks. For instance, during periods of market volatility, the stability of gold and oil can counterbalance the high-risk, high-reward nature of Bitcoin. Recent surveys indicate that over 60% of institutional investors advocate for diversified portfolios that include both traditional and digital assets. - Enhanced Liquidity and Flexibility:

Digital assets offer unparalleled liquidity and ease of transfer, which can complement the more stable but less liquid nature of physical assets. In times of crisis, having a mix of both could enable faster access to funds while maintaining overall portfolio stability. - Technological Innovation and Transparency:

Blockchain technology can introduce new levels of transparency and efficiency to asset management. For example, smart contracts can automate compliance and auditing processes, potentially reducing the costs associated with managing physical assets.

Potential Conflicts:

- Operational Complexity:

Integrating physical and digital assets into a single reserve model presents significant logistical challenges. The maintenance of physical assets like oil and gold involves different processes and infrastructures compared to the management of digital assets, which rely on cybersecurity measures and digital custodianship. - Regulatory Divergence:

The regulatory environments for traditional commodities and cryptocurrencies differ substantially. Navigating these divergent regulatory frameworks can be challenging for institutions attempting to manage a hybrid reserve. For instance, while gold trading is heavily regulated with established protocols, the crypto market is subject to rapidly evolving rules that vary by jurisdiction. - Market Perception and Trust:

Traditional reserves benefit from centuries of established trust and proven performance. In contrast, digital assets, despite their innovative advantages, are still viewed by many as speculative. This perception gap can create friction when trying to convince stakeholders of the viability of a hybrid reserve model.

Real-World Examples:

- Institutional Adoption:

Companies like MicroStrategy have embraced Bitcoin as part of their treasury strategy, allocating billions of dollars alongside traditional cash reserves. This move illustrates the growing acceptance of digital assets as a complement to conventional financial instruments. - Government Initiatives:

President Donald Trump’s recent announcement of a crypto strategic reserve that includes Bitcoin, Ethereum, Cardano, XRP, and Solana represents an early experiment in integrating digital assets into national reserve strategies. This initiative signals a broader trend towards a hybrid model that aims to combine the stability of traditional reserves with the dynamic potential of digital currencies.

Policy and Regulatory Landscape

Regulatory Frameworks Governing Traditional Reserves

Traditional commodities such as oil and gold have long benefited from well-established regulatory frameworks. For instance, gold trading and storage are regulated by international standards set forth by organizations like the London Bullion Market Association (LBMA) and the World Gold Council. These entities ensure that gold is stored securely, traded transparently, and meets stringent quality standards. The U.S. and European Union, among others, have developed decades of policy that governs everything from mine production to physical vault security. Similarly, oil is subject to extensive regulation—from the Environmental Protection Agency (EPA) in the U.S. to OPEC agreements that influence global supply and pricing. These regulatory measures provide stability and predictability, fostering confidence among investors and governments alike. For example, the U.S. Strategic Petroleum Reserve (SPR), with over 700 million barrels of oil, operates under rigorous federal oversight to ensure readiness in times of crisis.

Emerging Crypto Regulations and Their Impact

In contrast, the regulatory landscape for cryptocurrencies is still evolving. Governments around the world are working to develop comprehensive frameworks that address the unique challenges of digital assets. In the United States, regulatory bodies such as the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) are beginning to set guidelines on how crypto should be traded and stored, though debates continue on issues like classification and investor protection. The European Union is also taking significant steps with its Markets in Crypto-Assets Regulation (MiCA), which aims to provide a unified framework for digital asset markets across member states. Countries like Switzerland and Singapore have emerged as crypto-friendly jurisdictions, offering clear guidelines that have attracted numerous blockchain startups and institutional investors. These regulatory advancements are crucial, as studies have shown that transparent, well-defined rules can reduce market volatility and foster greater institutional participation. For example, a recent survey by Deloitte indicated that over 70% of institutional investors believe that clear regulatory frameworks are key to the long-term viability of crypto markets.

Future Policy Directions and Strategic Considerations

Looking ahead, policymakers face the challenge of balancing innovation with security. As more institutions consider incorporating crypto into their strategic reserves, there will be a growing need for forward-thinking regulations that can adapt to rapid technological changes. Future policy directions might include integrated oversight mechanisms that combine the strengths of traditional financial regulation with the flexibility required for digital assets. Hybrid regulatory frameworks could allow for seamless coexistence between conventional reserves and crypto assets, ensuring that both are protected while capitalizing on their unique advantages. Strategic considerations may also involve international cooperation, as digital assets are inherently borderless. Recent initiatives, such as the G20’s discussions on global digital finance regulation, underscore the importance of harmonizing policies to avoid regulatory arbitrage and to support global economic stability.

Conclusion and Future Outlook

Summary of Key Insights

This exploration of strategic reserves reveals a transformative shift in how nations and institutions manage their wealth. Traditional reserves like oil and gold have long been the bedrock of national security and economic stability, backed by centuries of regulation and proven operational frameworks. However, the rise of digital assets—exemplified by Bitcoin and other cryptocurrencies—introduces both unprecedented opportunities and challenges. While digital assets offer benefits such as ease of transfer, divisibility, and resistance to censorship, they also bring volatility and require sophisticated digital security measures. Emerging regulatory frameworks for cryptocurrencies, such as MiCA in Europe and evolving U.S. guidelines, are critical to ensuring these assets can serve as reliable components of modern reserve strategies.

The Future of Strategic Reserves in a Digital Age

The future likely lies in a hybrid approach that integrates traditional and digital assets into national reserves. As technological innovations continue and regulatory frameworks mature, we may see a convergence where the stability of commodities like oil and gold is complemented by the flexibility and innovation of cryptocurrencies. This integrated model can provide a more resilient strategy to hedge against diverse risks—from physical supply chain disruptions to cyber threats and regulatory changes. Institutions such as MicroStrategy and recent governmental initiatives, like President Trump’s crypto strategic reserve announcement, demonstrate that the fusion of old and new is not only possible but increasingly necessary.

Final Thoughts and Recommendations

For policymakers and investors, the key takeaway is clear: diversification is paramount in an increasingly uncertain global landscape. Embracing both conventional commodities and digital assets can offer a more adaptive and resilient reserve strategy. As governments and institutions navigate this evolving terrain, robust, clear, and internationally harmonized regulations will be essential. In the meantime, stakeholders are encouraged to monitor technological advances and regulatory updates closely, ensuring that their reserve strategies remain both secure and forward-looking. The future of strategic reserves is poised to be a dynamic blend of tradition and innovation—one that could redefine global economic power in the digital age.

By understanding and balancing the intricacies of both traditional and digital assets, nations can build a foundation that not only preserves value during turbulent times but also leverages cutting-edge technology for long-term economic prosperity.

Read also: Decentralized Social Networks: How Web3 is Transforming Online Communities