Binance Official Accuses Nigerian Lawmakers of Demanding $150 Million Bribe

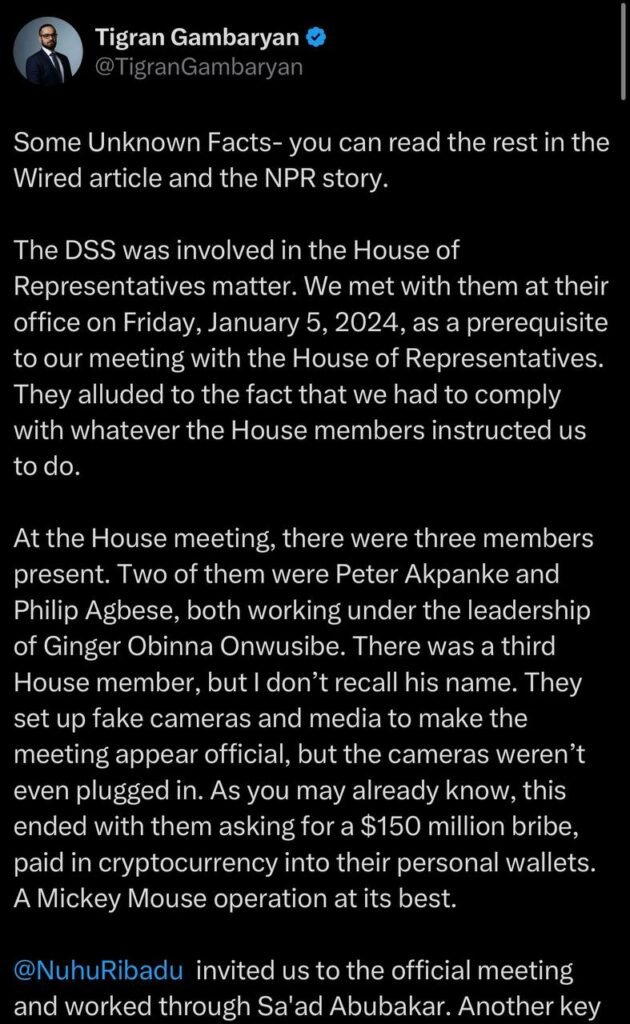

In a startling revelation that has sent shockwaves through the crypto community, Tigran Gambaryan—Binance’s head of financial crime—has accused three Nigerian lawmakers of demanding a $150 million bribe during his detention in Nigeria. According to Gambaryan’s post on X (formerly Twitter), the alleged bribe was solicited as a condition to stave off his arrest and prosecution during a highly controversial meeting.

Background and Detention Scandal

Gambaryan, who was detained in Nigeria along with another Binance official amid allegations that the firm was involved in money laundering and facilitating criminality, claims he was held for several months before being released. His detention came under heavy scrutiny when the Nigerian government, following intense pressure from domestic authorities, accused Binance of illicit activities in the country. However, after intervention from the US government led to the charges being dropped, Gambaryan was finally freed.

During his detention, Gambaryan alleges that certain members of the Nigerian House of Representatives orchestrated a clandestine meeting where they demanded a staggering $150 million bribe, to be paid in cryptocurrency directly into their personal wallets. He identified the lawmakers as Peter Akpanke, Philip Agbese, and Ginger Obinna Onwusibe—the latter paradoxically serving as the head of the House’s Committee on Anti-Corruption. Agbese, who is the deputy spokesperson for the House, and Akpanke were reportedly acting under Onwusibe’s leadership.

The Alleged Bribe Meeting

According to Gambaryan’s detailed account, the meeting took place on Friday, January 5, 2024, with the involvement of the Department of State Services (DSS) as a precondition for the session. He describes how the DSS briefed him that he had to comply with whatever the House members instructed to avoid further legal consequences. Gambaryan further alleges that the meeting was staged with fake cameras and media setups—apparently to lend an air of legitimacy to the proceedings—though he noted that the cameras were never even plugged in. In his words, the operation was “a Mickey Mouse operation at its best.”

The Fallout: A Diplomatic Crisis

The bribery scandal has had far-reaching consequences, both domestically and internationally. Gambaryan revealed that the Nigerian government’s handling of the situation led to a diplomatic rift with the United States.

He claimed that Nuhu Ribadu’s actions embarrassed Nigeria in front of U.S. National Security Advisor Jake Sullivan, leading to visa restrictions for Nigerian officials and a refusal by President Biden to meet with Nigerian President Bola Tinubu until the situation was resolved.

Binance’s Defense: Setting the Record Straight

Gambaryan used his post to debunk several claims made by Nigerian authorities. He clarified that the $26 billion figure often cited as “mystery money” escaping Nigeria was simply cumulative trade data for Nigerians on Binance’s platform. He emphasized that this money did not leave the country but represented the total volume of crypto transactions by Nigerian users.

He also dismissed allegations that Binance was manipulating the naira’s exchange rate, attributing the currency’s devaluation to President Tinubu’s monetary policies, which depegged the naira from the dollar.

Claims and Controversy

Gambaryan’s revelations have added a new dimension to the ongoing controversies surrounding crypto regulation in Nigeria. While he provided specific names and conditions of the alleged bribe, he has not released any documentary evidence to substantiate his claims. PREMIUM TIMES and other investigative outlets have reached out for comment, but efforts to secure statements from the implicated lawmakers have so far been unsuccessful. Historically, the Nigerian House of Representatives has denied any involvement in such bribery schemes.

The allegations come at a time when crypto firms like Binance face increasing regulatory pressure worldwide. Nigeria, in particular, has been a focal point of intense scrutiny due to its vibrant crypto market and persistent challenges with corruption. These claims—if verified—could further complicate Nigeria’s efforts to regulate digital assets while also undermining public trust in both political institutions and crypto enterprises operating in the country.

Broader Implications

For the crypto industry, this case underscores the risks and complexities of operating in jurisdictions where political corruption and regulatory unpredictability are pervasive. Binance’s experience, as narrated by Gambaryan, illustrates how political actors may attempt to leverage state power for personal gain—even targeting high-profile global firms. The incident also raises questions about the integrity of local law enforcement and the effectiveness of regulatory oversight in safeguarding the interests of both investors and crypto businesses.

As this story develops, stakeholders within the crypto ecosystem—and policymakers alike—will be watching closely. The case serves as a stark reminder of the challenges facing cryptocurrency companies in emerging markets, where the interplay between state actors, law enforcement, and corporate entities can be fraught with ethical and legal pitfalls.

TawkCrypto will continue to monitor this developing story and bring you updates as more information becomes available. The allegations, if proven, could prompt deeper investigations by both Nigerian authorities and international regulatory bodies, potentially reshaping the landscape for crypto operations in the region.