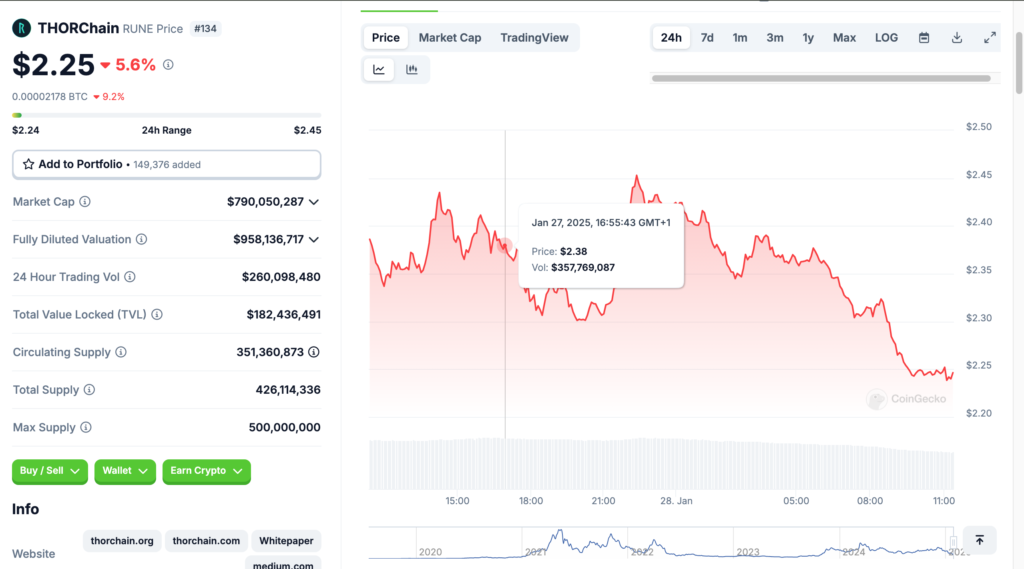

ThorChain ($RUNE) – The Risks, the Restructuring, and the Road Ahead

Thorchain has been the cornerstone of innovation in decentralized finance (DeFi), showcasing the power of permissionless cross-chain liquidity. Despite its incredible potential and notable successes, the protocol is facing a pivotal moment. Let’s break down everything you need to know about Thorchain, its native token RUNE, the challenges it’s tackling, and its future direction. Whether you’re new to Thorchain or a seasoned investor, we’ll unpack the situation step by step.

What Is Thorchain and Why Does It Matter?

Thorchain is a decentralized liquidity protocol that allows users to swap assets across different blockchains without relying on centralized exchanges (CEXs). It’s like a universal currency exchange, but for crypto. Want to swap Bitcoin for Ethereum? Thorchain makes it happen, directly and securely.

The protocol uses a multi-chain infrastructure powered by its native token, RUNE, to ensure liquidity across networks. Liquidity providers (LPs) deposit assets into pools and earn fees from swaps. The protocol’s standout feature? You maintain full custody of your assets while trading—no need to trust a middleman.

Thorchain has grown to become a top 5 fee-generating protocol in crypto, handling over $50 billion in yearly trading volume and generating between $200,000 and $400,000 in daily fees for its pools. It’s integrated with major wallets like Trust Wallet and Coinbase, making it accessible and functional for a global audience.

How RUNE Works

RUNE is the native token that powers Thorchain’s ecosystem. It serves three main purposes:

- Liquidity: RUNE is paired with every asset in Thorchain’s liquidity pools. For instance, there’s a BTC-RUNE pool and an ETH-RUNE pool.

- Security: Node operators must bond RUNE to validate transactions, aligning their incentives with the network’s success.

- Governance: RUNE holders can vote on protocol upgrades and changes.

Thorchain’s design ensures that RUNE is deeply tied to the protocol’s health and growth. When adoption increases, demand for RUNE typically rises.

What Happened? ThorFi’s Design Flaws

ThorChain’s core purpose is to facilitate permissionless cross-chain liquidity pools using multi-party computation (MPC). Since its inception, it has delivered exceptional utility, generating $200K to $400K in daily fees and managing over $50 billion in annual trading volume. These stats make it one of the top five fee-generating protocols in crypto.

However, trouble emerged when ThorChain introduced experimental features like Lending and Savers, collectively referred to as ThorFi. These features were fundamentally flawed:

- Shorting Bitcoin and ETH:

- The protocol’s lending model accepted collateral in Bitcoin (BTC) and Ethereum (ETH), swapping it for $RUNE. This essentially created a short position on BTC and ETH.

- While the strategy worked during $RUNE’s bull runs, it became a ticking time bomb when BTC and ETH outperformed $RUNE.

- As a result, the protocol became technically insolvent, with $100M in net liabilities.

- Leverage Risks:

- Lending and savings products added leverage-like dynamics to ThorChain’s base layer.

- Unlike other DeFi experiments that confine such risks to application layers, ThorChain’s integration at the base layer amplified potential damage.

Today, Thorchain is technically insolvent, with over $100 million in liabilities from these programs. The misstep here wasn’t the idea of lending or savings but the decision to implement these risky features directly at the base layer of the protocol.

The Fallout: What Happens Next?

To address the situation, node operators recently voted to pause Lending and Savers withdrawals. Deposits into these programs had already been halted a year ago. This pause gives the community 90 days to come up with a viable restructuring plan.

Two options are on the table:

- Let the protocol go bankrupt:

- This would mean liquidating assets, leaving debt holders with nothing, and shutting down a groundbreaking protocol.

- Restructure the debt:

- Under this plan, debt holders would receive a recovery rights token, which would entitle them to a percentage of Thorchain’s revenue until the debt (plus interest) is fully repaid. Such tokens could be traded on secondary markets, gaining value as the protocol generates more revenue.

A similar approach was used by Bitfinex after a major hack in 2016. Bitfinex successfully repaid its debt, and investors who took the risk saw significant upside.

Given Thorchain’s status as a highly profitable protocol, restructuring seems to be the most likely path forward.

Key Takeaways: Lessons for DeFi

The ThorChain debacle offers crucial lessons for DeFi protocols:

- Don’t Experiment on the Base Layer:

- Risky features like Lending and Savers should be confined to application layers. This ensures that failures do not compromise the protocol’s core functionality.

- Adversarial Thinking is Essential:

- ThorChain’s core DEX protocol excelled due to its emphasis on security and resilience. Unfortunately, this discipline wasn’t carried into ThorFi.

- Leverage is a Double-Edged Sword:

- While leverage can boost profits during bull markets, it magnifies losses during downturns. ThorChain’s community now understands the importance of mitigating leverage risks.

What’s Still Working? The Core Protocol

Amid the turmoil, ThorChain’s core functionality remains intact:

- DEX Operations Unaffected:

- Swaps, liquidity provision, and withdrawals continue to operate smoothly.

- Fee Generation:

- ThorChain remains one of the most profitable protocols in crypto, generating daily fees of $200K to $400K.

- LP Stability:

- Liquidity providers are not exiting in abnormal numbers, a testament to the protocol’s enduring utility.

- Adoption and Integrations:

- ThorChain is integrated with major platforms like Trust Wallet and Coinbase, showcasing its relevance in the broader crypto ecosystem.

Why Some Investors Are Bullish on RUNE

Despite the current turmoil, many believe that Thorchain is poised for a comeback. Here’s why:

1. Strong Fundamentals:

Thorchain’s core protocol remains fully operational, and this is a key reason why many investors remain optimistic.

- Uninterrupted Functionality: Users can still seamlessly trade assets, and the protocol’s liquidity pools are functioning without disruption.

- Confidence Among Liquidity Providers (LPs): Data shows that LPs are not exiting in large numbers, which is a strong signal of confidence in the protocol’s long-term viability. Historically, such stability is rare during periods of turmoil for DeFi projects.

For context, the pools hold 44 million RUNE tokens, and outflows have been minimal, even during the current crisis. This underscores the resilience of Thorchain’s ecosystem.

2. Revenue Potential:

Even with the suspension of lending and savings features, Thorchain is proving to be a significant revenue generator:

- Daily Fee Generation: The protocol brings in between $200,000 and $400,000 in fees daily, making it one of the most profitable DeFi protocols.

- Sustained Volume: Thorchain boasts $50 billion+ in annual trading volume, a testament to its strong product-market fit.

Without the liability of ThorFi dragging it down, the protocol’s revenue demonstrates a robust ability to service debt and maintain operations.

3. Simplified Design:

One of the major lessons from this crisis is the importance of focusing on a protocol’s core strengths. Thorchain’s community and developers are now taking active steps to simplify its design:

- Eliminating High-Risk Features: The pause and eventual removal of the ThorFi features (lending and savers) is a pivotal step toward mitigating systemic risks.

- Refined Focus: The community plans to emphasize Thorchain’s core offering as a decentralized, cross-chain liquidity protocol. This pivot aligns with best practices seen in other DeFi ecosystems.

The shift toward simplicity not only reduces future risks but also positions Thorchain for sustainable growth by doubling down on what it does best.

4. Market Position:

Thorchain has a solid foothold in the crypto ecosystem, with integrations that amplify its utility and accessibility:

- Wallet Integrations: Thorchain is integrated with major wallets like Trust Wallet and platforms like Coinbase, ensuring easy access for users globally.

- Established Product-Market Fit: As a permissionless cross-chain liquidity protocol, Thorchain stands out as one of the most innovative solutions in DeFi. Its ability to facilitate swaps across different blockchain ecosystems is a critical value proposition in the market.

These integrations highlight the protocol’s potential to grow its user base as DeFi adoption continues to rise.

5. A History of Recovery:

History shows that protocols can rebound from crises, and many believe Thorchain could follow a similar trajectory:

Restructuring Plans: Thorchain’s proposed “recovery rights token” could offer debt holders a path to recover funds over time while keeping the protocol operational. This type of creative financial restructuring has precedent in crypto and could restore confidence in the ecosystem.

Learning from Bitfinex’s Recovery: In 2017, Bitfinex faced a significant hack, leaving it with a massive debt burden. The company issued recovery tokens to affected users and repaid its debt over time. By 2018, Bitfinex had fully recovered, emerging as one of the most respected exchanges in the crypto industry.

6. Early Signs of Accumulation

Some savvy investors are already taking calculated risks by accumulating $RUNE, anticipating a recovery.

- No Death Spiral Risk: With ThorFi features paused, the risk of a downward spiral has been mitigated. This reassures investors that the protocol is not at immediate risk of collapse.

- High Upside Potential: As one prominent investor pointed out, without the leverage from ThorFi weighing it down, Thorchain has the potential to grow 10x bigger.

- Fee Generating Giant: It remains a top 5 fee-generating protocol in the crypto space, an indication of its enduring market relevance.

Investors see this moment as an opportunity to position themselves before the protocol restructures and sentiment turns bullish again.

What’s Next for Thorchain?

The next 90 days are shaping up to be pivotal for Thorchain’s future. During this period, the community, developers, and validators will come together to address pressing challenges and redefine the protocol’s direction. Here’s a detailed look at what lies ahead:

1. Finalizing a Restructuring Plan

At the heart of Thorchain’s recovery is a robust restructuring plan aimed at stabilizing the protocol and rebuilding trust. Key elements of this plan include:

- Debt Management: The introduction of recovery rights tokens (or a similar mechanism) to ensure debt holders have a clear path to recuperating their funds over time. This solution mirrors successful strategies like Bitfinex’s recovery from its 2017 hack, which allowed the platform to fully repay its debt and regain user trust.

- Community Governance: Thorchain has always prided itself on being community-driven, and this period will likely see proposals and votes on the specifics of the restructuring plan. Transparent communication between the core team, validators, and the broader community will be essential.

- Operational Funding: Ensuring the protocol has enough liquidity to continue operations during this period of uncertainty will be a priority. Revenue from fees, currently ranging between $200,000 and $400,000 daily, provides a strong financial cushion to weather this phase.

2. Refocusing on Thorchain’s Core Technology

One of the biggest takeaways from the recent crisis is the need to return to the fundamentals that made Thorchain successful.

- Streamlined Core Functionality: The team will prioritize Thorchain’s core purpose as a decentralized cross-chain liquidity protocol. This involves doubling down on its ability to facilitate seamless swaps across major blockchain ecosystems like Bitcoin, Ethereum, Binance Chain, and others.

- Innovation at the Protocol Level: Instead of experimental, high-risk features, Thorchain will focus on enhancing its core infrastructure to ensure security, scalability, and reliability. For instance, the launch of streaming swaps has already proven to be a massive success, driving significant fee revenue and trading volume.

This back-to-basics approach is expected to rebuild confidence among users and investors alike.

3. ThorFi’s Permanent Removal or Redesign

ThorFi’s lending and saving features, which played a significant role in the current challenges, are officially paused, but the protocol’s long-term plan involves their complete removal or a fundamental redesign.

- Permanent Removal: High-risk features like leveraged lending and savings that led to systemic risks will likely be retired permanently.

- Safer, App-Layer Redesigns: Instead of operating these features at the protocol level, the community is exploring the possibility of reintroducing them as app-layer products. This approach would isolate risks to individual applications rather than the protocol itself, ensuring greater stability.

Thorchain’s experience serves as a cautionary tale for other DeFi projects experimenting with protocol-level features that could introduce systemic vulnerabilities.

4. Strengthening Community and Ecosystem Trust

Thorchain’s community has always been its backbone, and the next 90 days will be crucial for rebuilding trust among users, liquidity providers, and validators.

- Transparent Communication: Regular updates from the core team and validators will help maintain transparency, keeping the community informed about progress, decisions, and any challenges that arise.

- Validator Commitment: Thorchain validators, who have millions of dollars at stake, continue to support the protocol. Their alignment with the community’s goals is critical for Thorchain’s stability and long-term success.

5. Potential Outcomes if Restructuring Succeeds

If the restructuring process is successful, Thorchain has a genuine chance to regain its position as a leading decentralized finance (DeFi) protocol. Here’s what success could look like:

- Renewed Growth: With ThorFi’s risky features removed, Thorchain’s design will be simpler, safer, and more attractive to institutional and retail investors. The protocol’s strong fundamentals—daily fee generation, high trading volume, and wallet integrations—position it well for future growth.

- Improved User Confidence: A focus on transparency and stability could bring back users and liquidity providers who may have been deterred by recent events.

- Reclaiming Market Leadership: Thorchain already generates more fees than many top DeFi protocols, even during its current challenges. By focusing on its strengths, it could reclaim its spot as a top-10 protocol in terms of both revenue and user adoption.

- Setting an Example: Thorchain’s ability to navigate this crisis could serve as a blueprint for other DeFi projects facing similar challenges, solidifying its reputation as an industry pioneer.

The Road Ahead

The next three months will test Thorchain’s resilience, but the protocol has already proven its capacity to innovate and adapt. By addressing its current challenges head-on and refocusing on its core strengths, Thorchain could not only survive but thrive.

For investors and users, the coming weeks will reveal whether the community’s efforts to stabilize and rebuild Thorchain can lead to a stronger, more resilient protocol. If successful, Thorchain’s comeback could serve as a powerful reminder of the importance of fundamentals and the strength of decentralized communities.eFi protocol, delivering massive value to users and investors alike.

Should You Buy $RUNE?

nvesting in $RUNE at this moment is not for the faint-hearted. It represents a classic high-risk, high-reward opportunity that requires careful consideration of potential scenarios. Let’s break it down into two key possibilities:

Scenario 1: Restructuring Fails

This is the doomsday scenario for Thorchain. If the community and developers fail to resolve the $100M in liabilities, the consequences could be catastrophic.

- Bankruptcy Risks: The protocol’s inability to repay its debts would likely result in a loss of confidence from both users and liquidity providers. This could trigger a mass exodus of capital, pushing Thorchain into insolvency.

- Market Fallout: $RUNE’s price could spiral further downward as panic selling accelerates. In a worst-case scenario, $RUNE might lose most, if not all, of its value.

- Community Impact: Thorchain’s vibrant community, which has been a cornerstone of its success, could disband as users move to other, more stable DeFi protocols.

In this scenario, any investment in $RUNE would likely result in a total loss, making it an extremely high-risk bet.

Scenario 2: Successful Restructuring

If the restructuring plan is executed effectively, Thorchain has the potential to bounce back and emerge as a stronger protocol. Here’s how this could play out:

- Debt Management: The issuance of Recovery Rights Tokens (RRTs) could provide a structured path for debt holders to recover their funds over time. This would alleviate immediate financial pressure while showcasing the protocol’s commitment to resolving its liabilities.

- Fee Generation: With the risky ThorFi features removed, Thorchain has already proven its ability to generate $200,000 to $400,000 in daily fees. This revenue stream not only sustains operations but also strengthens the protocol’s financial foundation.

- Market Sentiment: Successful restructuring would likely restore investor confidence. As one large investor mentioned, “We hold a big position in $RUNE and are not selling. We’re not buying more either, but only because we already have large exposure.” This cautious optimism reflects the potential for $RUNE to regain traction if key issues are resolved.

- Upside Potential: Thorchain’s integrations with major platforms like Coinbase and Trust Wallet, coupled with its strong product-market fit, position it for significant growth once stability is achieved. A return to focus on its core functionality as a cross-chain liquidity protocol could drive adoption and increase $RUNE’s value substantially.

The Case for High Reward

If Thorchain successfully navigates this crisis, $RUNE could deliver exceptional returns. Consider these factors:

- Proven Revenue Model: Thorchain is already one of the top fee-generating protocols in DeFi, with over $50 billion in annualized trading volume. Few protocols can boast such consistent revenue generation.

- Simplified, Safer Design: By eliminating ThorFi’s risky features, Thorchain is poised to become a more stable and attractive option for both users and institutional investors.

- Market Position: Thorchain’s integration with major wallets and platforms provides a significant edge, making it easier for new users to onboard and participate in the ecosystem.

- Bullish Sentiment: Some investors see the removal of leverage as a turning point. As one noted, “Without ThorFi’s leverage, this could easily grow 10x bigger.” This sentiment highlights the belief that Thorchain’s streamlined design will unlock substantial growth opportunities.

The Case for High Risk

On the flip side, there are undeniable risks:

- Execution Challenges: Successfully restructuring $100M in liabilities requires flawless execution, transparent governance, and strong community support. Any misstep could derail the recovery efforts.

- Market Volatility: Even with a successful restructuring, $RUNE’s price is likely to remain highly volatile in the short term. This could test the patience and confidence of investors.

- Competition: DeFi is an increasingly crowded space, and Thorchain will need to prove its value proposition to stand out among competitors.

The decision to buy $RUNE ultimately depends on your risk appetite and confidence in Thorchain’s recovery plan. If you believe in the protocol’s ability to restructure and refocus, now could represent a rare buying opportunity at distressed prices. However, the risks are real, and the path forward is far from guaranteed.

For those who choose to invest, proceed cautiously, do your own research, and consider the possibility of both significant upside and total loss. As Thorchain works through its challenges, one thing is certain: the next few months will be critical in determining its future—and the fate of $RUNE.

Final Thoughts

ThorChain’s current crisis underscores the importance of careful risk management in DeFi. However, the protocol’s resilience and profitability provide a strong foundation for recovery. If the community can successfully restructure its liabilities, $RUNE might emerge stronger than ever, serving as a cautionary tale and a beacon of hope for the DeFi ecosystem.

Check out our piece on Fundamentals vs. Pumpamentals: Mastering Short-Term Crypto Trading

So what do you think? Are you willing to take the risk on $RUNE, or are you staying on the sidelines? Let us know in the comments below!