Tether Report: Almost Half of 2024 USDT Transactions Originated in Emerging Markets

In its Q4 2024 report, Tether, the issuer of the USDT stablecoin, revealed that nearly half of all USDT transactions this year originated from emerging markets. This underscores the growing reliance on stablecoins as a tool for financial inclusion and stability in regions where traditional banking systems often fall short.

USDT Adoption Reaches Record Highs

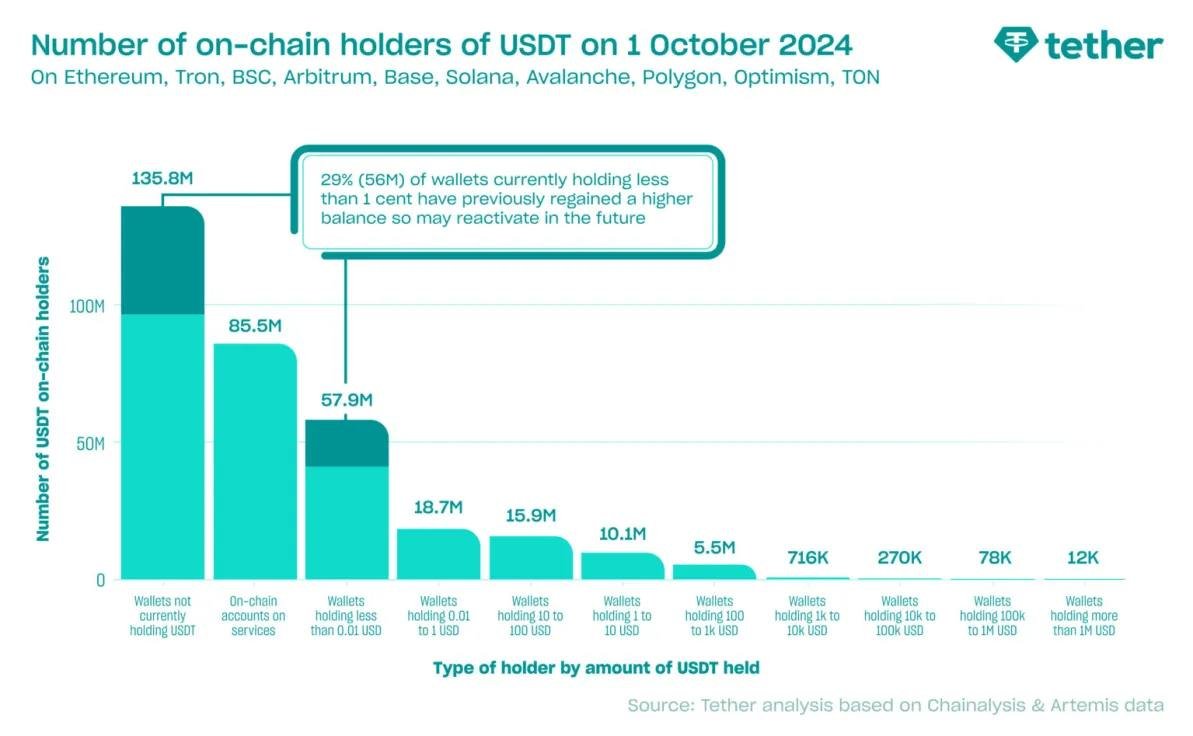

As of Q4 2024, a staggering 109 million on-chain wallets hold USDT, solidifying its status as one of the most widely held digital assets globally. This figure represents more than double the number of wallets holding Bitcoin and is approaching the 128 million wallets holding Ethereum.

USDT wallet growth has been phenomenal, increasing by 71% over the past year and 129% over the last two years. Much of this growth stems from retail adoption in emerging markets, where smaller wallet balances dominate.

Wallet data from Tether highlights this trend:

- 18.7 million wallets hold balances of less than $1.

- 31.5 million wallets hold between $1 and $1,000.

- Just over a million wallets manage balances exceeding $1,000, with two-thirds of these holding between $1,000 and $10,000.

This distribution showcases USDT’s appeal to users with limited financial resources, offering them a stable, accessible, and reliable digital currency option.

Emerging Markets Drive USDT Demand

Tether’s report attributes 46% of centralized platform visits for USDT-related activities to users from emerging markets. These platforms—cryptocurrency exchanges and other centralized services—have played a crucial role in USDT’s adoption, hosting 86 million accounts that have received on-chain USDT deposits.

Centralized exchanges attracted 4.5 billion web visits during the first three quarters of 2024, with nearly half coming from emerging markets. For many users in these regions, USDT serves as a lifeline for saving, transacting, and managing economic challenges.

“We know from our partners that many users of exchanges in emerging markets buy, hold, and send USDT entirely within the platform,” Tether noted. These off-chain activities, which occur exclusively within exchanges, add to the stablecoin’s widespread usage, though exact balances on such platforms remain known only to the exchanges.

Why Emerging Markets Turn to USDT

USDT’s rise in emerging markets can be attributed to several key factors:

- Stability in Volatile Economies: With many emerging markets grappling with inflation, currency devaluation, and economic instability, USDT offers a secure and dependable alternative for savings and transactions.

- Accessibility: The low barriers to entry make USDT an attractive option for retail users. Wallet data demonstrates that the majority of USDT holders manage modest balances, catering to those with limited financial means.

- Platform Integration: The widespread availability of USDT on centralized platforms ensures easy access for users, even those without technical expertise or experience with decentralized wallets.

Dominance in the Stablecoin Space

USDT continues to outpace its competitors in the stablecoin market, with four times more wallets than all other stablecoins combined. This dominance is indicative of its strong foothold in both retail and institutional markets.

The report highlights USDT’s accessibility as a critical driver of its popularity. Its ability to serve a diverse range of users—from those holding less than $1 to large-scale institutional investors—positions it as a versatile and inclusive financial tool.

Looking Ahead

Tether’s findings emphasize the transformative role of stablecoins in emerging markets, where access to traditional financial services remains limited. By providing a stable and secure medium for saving and transacting, USDT has become a vital resource for millions of users navigating economic uncertainty.

As stablecoin adoption continues to rise, Tether’s focus on accessibility and reliability ensures that USDT remains a leader in the global digital asset ecosystem, particularly in regions where financial innovation has the potential to drive economic empowerment.