AZA Finance Secures Payment Services Provider (PSSP) License from the Central Bank of Nigeria

AZA Finance, a pioneer in fintech and foreign exchange services across Africa, has achieved a significant milestone by obtaining a Payment Services Provider (PSSP) license from the Central Bank of Nigeria (CBN). This license enables the company to directly offer payments and collections services in Nigeria, eliminating the need for intermediaries and making transactions faster and more cost-effective for Nigerian businesses and consumers.

Empowering Financial Inclusion and Innovation

Elizabeth Rossiello, the CEO and founder of AZA Finance, expressed the company’s enthusiasm for this new chapter:

“We’ve had the privilege of collaborating with many exceptional fintechs in Nigeria over the years and are excited to join their ranks as a licensed payments service provider.”

Rossiello emphasized the strategic importance of Nigeria to AZA Finance’s operations, stating:

“We are certain that this country and its currency will continue to be in demand worldwide as more organizations and enterprises expand to the continent. We look forward to being a part of that growth and deepening our presence and commitment to Nigeria.”

The license solidifies AZA Finance’s ability to drive financial innovation and support Nigeria’s growing fintech ecosystem, which has become one of the most vibrant and competitive in Africa.

From Crypto Roots to Fintech Powerhouse

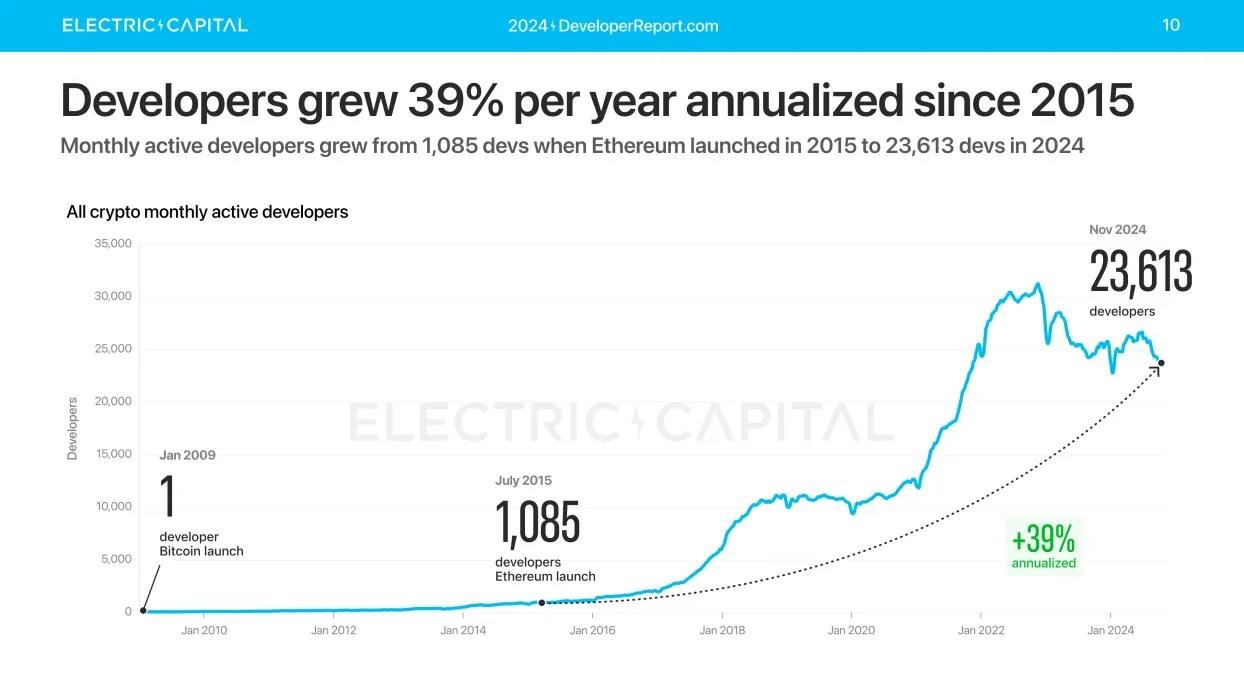

AZA Finance was originally founded in 2013 as BitPesa, a cryptocurrency startup aimed at facilitating cross-border payments using blockchain technology. Over the years, the company has evolved into a comprehensive fintech platform offering:

- Foreign Exchange (FX) Services: Seamless access to major African and G20 currencies.

- Payments Solutions: Direct payment and collection services, now enabled by the CBN license.

- Proprietary Fintech Platforms: Cutting-edge technology solutions designed to power global businesses and drive financial inclusion.

Despite its diversification, AZA Finance continues to leverage digital currencies for transaction settlement, combining blockchain technology with traditional financial services to optimize speed, cost, and reliability.

Impact on Nigerian Businesses and Consumers

The PSSP license positions AZA Finance to directly support Nigeria’s financial ecosystem in several ways:

- Cost-Effective Transactions: By bypassing third-party service providers, AZA Finance can offer lower fees for payments and collections.

- Enhanced Efficiency: Businesses and individuals in Nigeria can now enjoy faster payment processing times, reducing delays common with legacy systems.

- Access to Global Markets: AZA Finance’s expertise in foreign exchange and international payments enables Nigerian businesses to trade seamlessly across borders, further integrating the country into the global economy.

- Support for SMEs: The company’s services cater to small and medium-sized enterprises (SMEs), empowering them with affordable, efficient payment and FX solutions critical for scaling operations.

Strengthening Nigeria’s Fintech Ecosystem

Nigeria’s fintech sector has grown exponentially in recent years, driven by a young population, high smartphone penetration, and increasing demand for financial inclusion. By entering the market as a licensed PSSP, AZA Finance joins a growing list of players committed to transforming the country’s payments infrastructure.

The company’s decision to deepen its commitment to Nigeria aligns with broader trends in Africa, where fintech innovation is playing a crucial role in bridging gaps in financial access and enabling cross-border trade.

The Future of AZA Finance in Nigeria

The acquisition of the PSSP license marks a new era for AZA Finance as it transitions from working through local partners to providing direct services. This move positions the company to capture a larger share of Nigeria’s dynamic payments market while continuing to innovate with digital currency-based solutions.

As Nigeria seeks to strengthen its regulatory framework and enhance financial inclusion, AZA Finance is poised to play a pivotal role in shaping the future of payments in the country and across Africa.

Stay tuned to TawkCrypto for more updates on fintech and blockchain innovation across Africa.