Trump’s Crypto Advisory Council to Focus on Building a Strategic Bitcoin Reserve

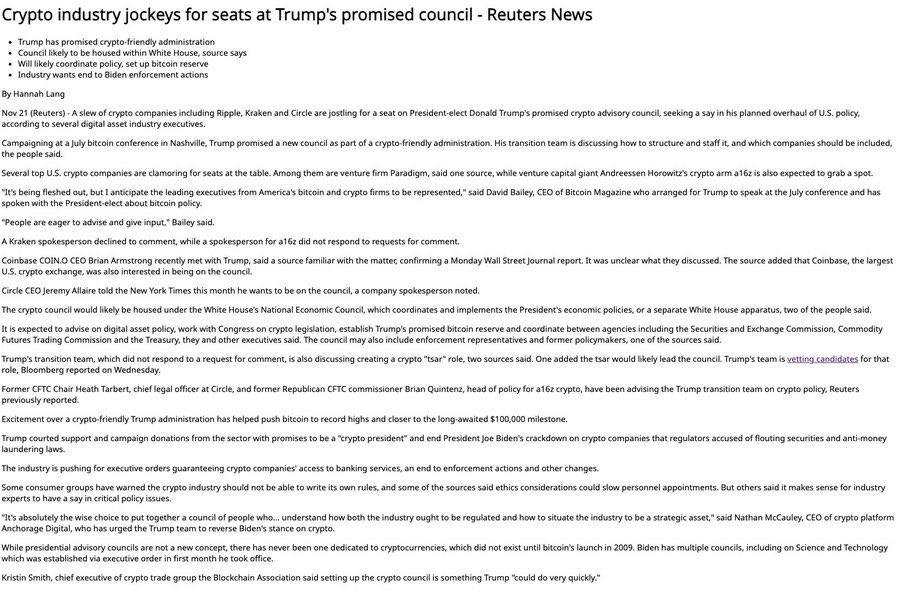

In a groundbreaking development, former U.S. President Donald Trump’s Crypto Advisory Council has reportedly outlined plans to focus on creating a Strategic Bitcoin Reserve for the United States. According to a Reuters report, this initiative is expected to position Bitcoin as a key element in national financial strategy, signaling a significant policy shift in how the U.S. government views cryptocurrencies.

A New Era for Crypto in U.S. Politics

The move comes as Trump, the leading candidate for the Republican Party in the 2024 presidential race, has adopted a more favorable stance toward cryptocurrencies. While previously critical of digital assets, Trump appears to be embracing Bitcoin as a strategic asset in the face of global economic uncertainties and competition.

His Crypto Advisory Council, reportedly composed of blockchain experts, economists, and pro-Bitcoin advocates, aims to develop policies that integrate Bitcoin into the country’s economic strategy.

What is a Strategic Bitcoin Reserve?

A Strategic Bitcoin Reserve would function similarly to national gold reserves, where a portion of the country’s wealth is held in Bitcoin to diversify assets and hedge against economic risks. The reserve could serve multiple purposes:

- Economic Security: Protecting the U.S. economy from inflationary pressures and currency devaluation.

- Global Influence: Strengthening the U.S. dollar’s position by complementing it with Bitcoin as a store of value.

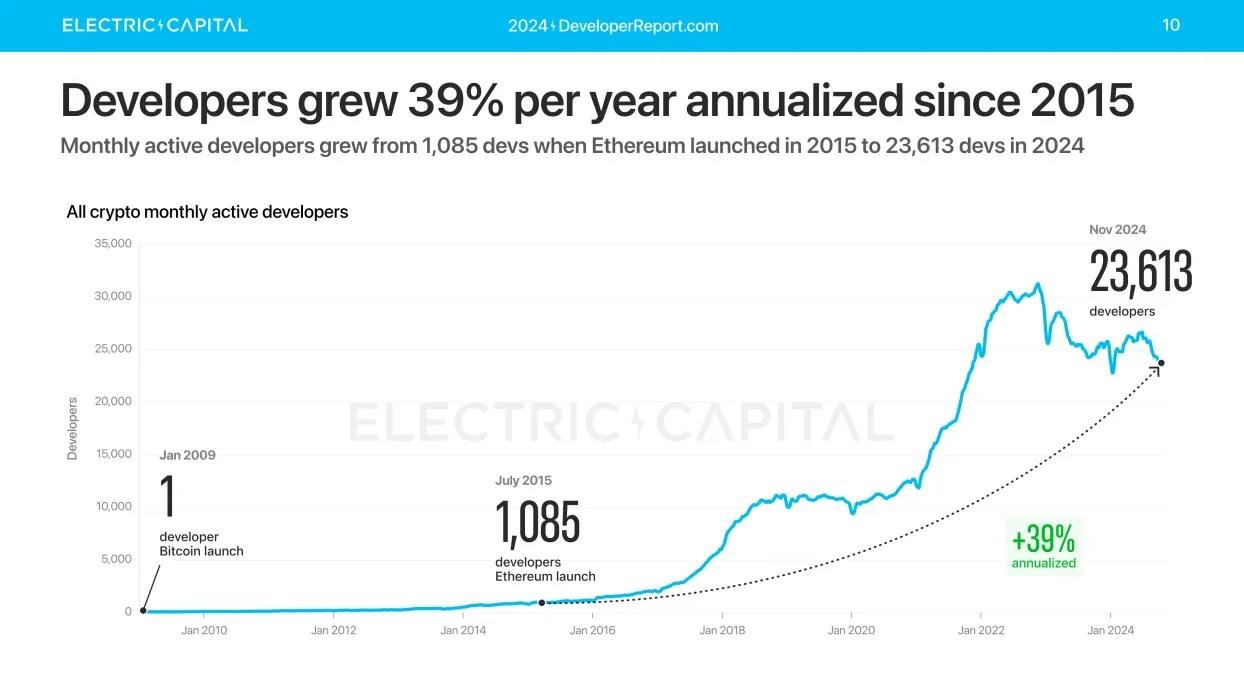

- Technological Leadership: Establishing the U.S. as a global leader in blockchain technology and digital asset adoption.

Council’s Vision and Objectives

The Crypto Advisory Council reportedly has several key objectives for the proposed reserve:

- Accumulation of Bitcoin Assets: Explore avenues for acquiring Bitcoin through mining partnerships, strategic market purchases, and incentives for private holders to sell to the government.

- Secure Storage Infrastructure: Develop robust custodial solutions to safeguard Bitcoin reserves against cyber threats and potential losses.

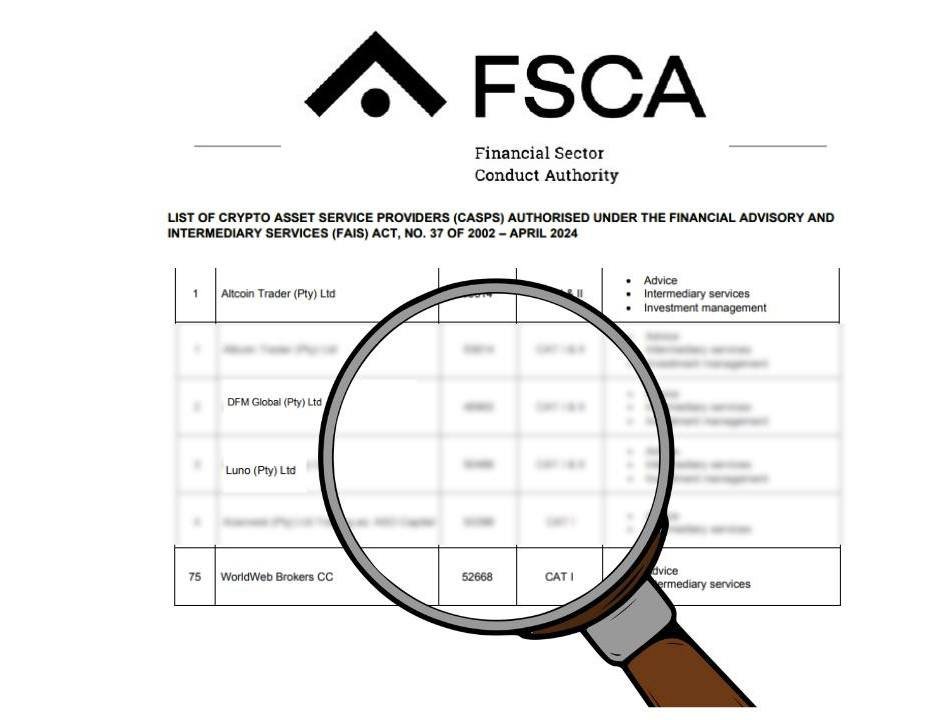

- Legal and Regulatory Frameworks: Introduce regulations that provide clarity for Bitcoin transactions, mining, and ownership, fostering greater public trust in digital assets.

- International Collaboration: Work with allied nations to encourage Bitcoin adoption and reduce reliance on traditional reserve assets like gold.

Why Bitcoin, and Why Now?

The push for a Strategic Bitcoin Reserve reflects growing recognition of Bitcoin as a global asset. With its capped supply of 21 million coins, Bitcoin is increasingly viewed as “digital gold” capable of holding value over time.

This initiative may also be driven by geopolitical factors:

- De-dollarization: With several countries exploring alternatives to the U.S. dollar in global trade, Bitcoin offers an apolitical, decentralized reserve asset.

- Financial Competition: Nations like El Salvador and Russia have already begun integrating Bitcoin into their economies, pushing the U.S. to act strategically.

Implications for the Crypto Ecosystem

The council’s initiative is expected to have a profound impact on the cryptocurrency market and the broader economy:

- Market Boost: A formalized effort by the U.S. government to accumulate Bitcoin could significantly increase demand and drive up Bitcoin prices.

- Mainstream Legitimacy: The plan could shift public and institutional perceptions, leading to greater adoption of Bitcoin as a legitimate financial instrument.

- Policy Precedents: It may pave the way for other countries to adopt similar strategies, accelerating the global race for digital asset reserves.

Industry Reactions

The crypto community has reacted with cautious optimism:

- Pro-Bitcoin Advocates: Leaders in the crypto industry, such as Michael Saylor of MicroStrategy, have welcomed the proposal, calling it a “historic recognition of Bitcoin’s value.”

- Skeptics: Critics argue that government intervention could undermine Bitcoin’s decentralized ethos, making it a tool for political leverage.

- Regulatory Concerns: Some warn that a U.S. Bitcoin reserve might invite stricter regulations on private crypto holdings to facilitate government accumulation.

Challenges Ahead

While the idea of a Strategic Bitcoin Reserve is ambitious, it faces significant hurdles:

- Volatility: Bitcoin’s price fluctuations could pose risks to its effectiveness as a reserve asset.

- Public Backlash: Skepticism toward government involvement in crypto markets could trigger resistance from privacy-focused users.

- Implementation Costs: Setting up secure storage and infrastructure for a Bitcoin reserve requires substantial investment and technological expertise.

Trump’s Crypto Pivot: A Calculated Strategy?

Trump’s evolving stance on crypto aligns with a broader effort to appeal to younger, tech-savvy voters while positioning the U.S. as a leader in blockchain innovation. His support for a Bitcoin reserve suggests a strategic pivot aimed at leveraging digital assets to enhance national security and economic resilience.

The Road Ahead

As details of the initiative unfold, the Crypto Advisory Council’s plan will likely dominate discussions in both the crypto community and political circles. Whether the U.S. succeeds in creating a Strategic Bitcoin Reserve remains to be seen, but the move underscores the growing importance of Bitcoin in shaping the future of global finance.

Stay tuned to TawkCrypto for in-depth analysis and updates on how this development will influence the crypto landscape and its potential to redefine America’s financial strategy.