5 Essential Metrics to Track in This Crypto Bull Market for Smarter Trades

With the crypto market entering another electrifying bull cycle, traders must navigate high volatility while capitalizing on profitable opportunities. Identifying the right signals can be the difference between maximizing returns and being caught off guard by corrections. Below, we explore four critical metrics to track during this bull market, providing detailed insights to help you make informed trading decisions.

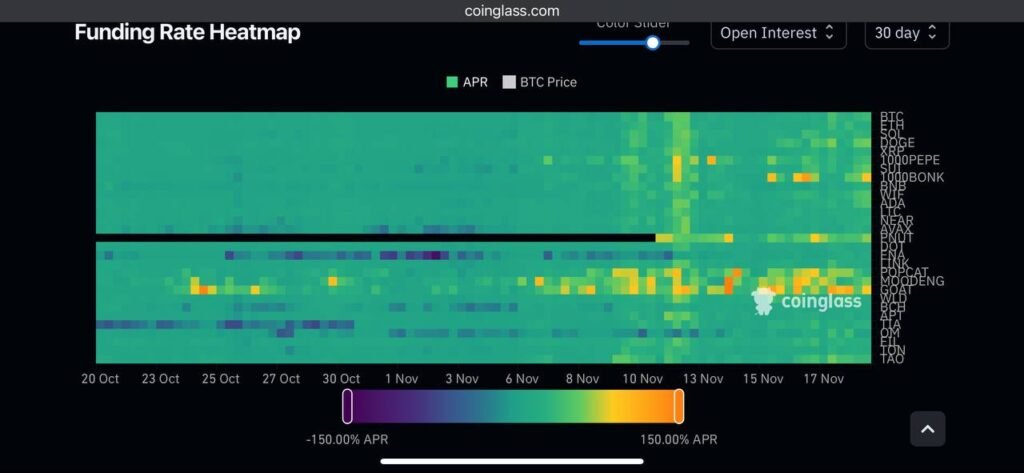

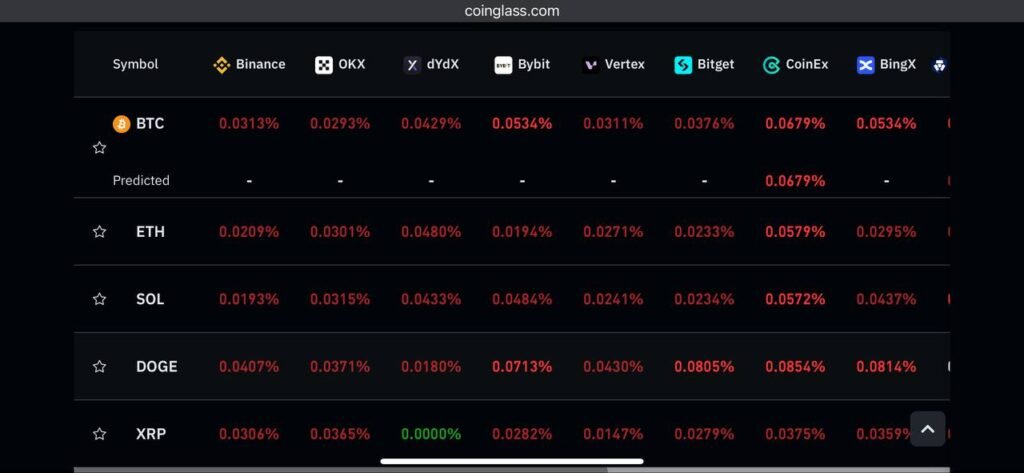

1. Funding Rate: Measuring Market Sentiment and Momentum

Definition:

The funding rate is a periodic fee exchanged between long and short traders in perpetual futures markets. When the funding rate is positive, traders holding long positions are paying those in short positions, reflecting a bullish market. A negative funding rate indicates bearish sentiment as shorts pay longs.

Why It’s Important:

- Overheating Indicator: Extremely high funding rates suggest excessive leverage and exuberance among buyers, often signaling an overheated market.

- Contrarian Signal: Negative funding rates can indicate pessimism and a potential market bottom.

How to Monitor:

- Use platforms like CoinGlass or Binance Futures to track funding rates across various cryptocurrencies.

- Look for consistent or spiking funding rates, especially for major assets like Bitcoin or Ethereum.

- Combine with open interest data to identify whether traders are doubling down or exiting positions.

Pro Tip:

When funding rates are excessively positive for an extended period, consider reducing exposure or placing stop-loss orders. During negative funding periods, cautiously accumulate if other indicators align.

2. USDT Minting: Tracking Liquidity and Market Momentum

Definition:

USDT (Tether) is the most widely used stablecoin, acting as a bridge for fiat currency entering the crypto market. Increased USDT minting often correlates with heightened market activity and liquidity.

Why It’s Important:

- Liquidity Signal: More USDT in circulation suggests traders are gearing up to deploy fresh capital into crypto assets.

- Momentum Confirmation: Rising USDT supply during bull markets often indicates sustained buying pressure.

How to Monitor:

- Check Tether’s transparency report for updates on circulating supply.

- Use analytics platforms like Glassnode or CryptoQuant to track USDT inflows into exchanges.

- Look for significant USDT minting on the Ethereum, Tron, or Solana blockchains.

Key Insight:

If USDT supply growth slows or reverses, it may signal a cooling market or capital outflows. Conversely, consistent minting during rallies reflects strong demand and buying momentum.

3. Bitcoin Dominance: Gauging Market Cycles and Risk Appetite

Definition:

Bitcoin dominance measures the percentage of the total cryptocurrency market capitalization that Bitcoin accounts for. It provides insights into market phases and the relative strength of altcoins versus Bitcoin.

Why It’s Important:

- Market Leader: Bitcoin typically leads market rallies, and its dominance rises during periods of risk aversion or institutional focus.

- Altcoin Seasons: When Bitcoin dominance declines in a bull market, funds often flow into altcoins, leading to speculative “altcoin seasons.”

How to Monitor:

- Use tools like TradingView or CoinMarketCap to track Bitcoin dominance trends.

- Look for dominance crossing key levels (e.g., 50%) to assess shifts between Bitcoin and altcoin performance.

Key Strategies:

- Rising Dominance: Favor Bitcoin during periods of increasing dominance, as it often signals safer, institution-led rallies.

- Falling Dominance: Allocate cautiously to altcoins, but stay alert for signs of speculative excess.

4. Bitcoin ETFs: Institutional Adoption and Market Sentiment

Definition:

Bitcoin Exchange-Traded Funds (ETFs), particularly spot ETFs, allow traditional investors to gain Bitcoin exposure without directly holding the asset. Their approval or rejection often drives significant market movements.

Why It’s Important:

- Institutional Capital: Spot Bitcoin ETFs signal increasing acceptance by regulators and traditional investors, bringing fresh liquidity into the market.

- Market Confidence: Approval typically triggers bullish sentiment, while delays or rejections can cause corrections.

How to Monitor:

- Track the performance of approved Bitcoin ETFs, blackrock etc

- Monitor institutional inflows using data from firms like CoinShares, Coinglass or Arcane Research.

Pro Insight:

Bitcoin ETF approval news can serve as a macro sentiment driver. Even without approval, consistent institutional applications indicate strong long-term confidence.

5. Crypto App Rankings: Retail FOMO in Action

Definition:

The ranking of crypto trading apps like Coinbase, Binance, or Crypto.com in app stores can be a barometer for retail interest in the market. Historically, these apps climbing into Top 10 rankings correlates with retail FOMO-driven phases.

Why It’s Important:

- Retail Indicator: High app rankings often signal the entry of retail traders, who typically buy during the later stages of a rally.

- Cautionary Signal: Retail-driven peaks may coincide with overbought markets, increasing correction risks.

How to Monitor:

- Check app store rankings regularly using tools like App Annie or by directly searching the Google Play Store and Apple App Store.

- Compare rankings during bull cycles to past market tops for context.

Key Takeaway:

While rising app rankings indicate growing retail participation, they should prompt caution as markets may be approaching unsustainable euphoria.

Conclusion

Trading in a crypto bull market requires vigilance and strategy. By monitoring these five critical metrics—funding rates, USDT minting, Bitcoin dominance, Bitcoin ETFs, and app rankings—you can gain a well-rounded understanding of market trends and make more informed decisions.

As always, combine these indicators with technical analysis and sound risk management to optimize your trades.

Stay informed with TawkCrypto for more insights into navigating the crypto market. Let’s ride this bull market wisely and profitably!